Key Highlights:

The crypto market cap dropped by 2.3% to 2.99 trillion globally due to the extreme fear sentiment.

Bitcoin fell, Ethereum fluctuated; altcoins were unstable.

Sentiment was affected by regulatory changes, sluggish Bitcoin activity, and exchange growth.

Overall Crypto Market Update: 18 December 2025: The cryptocurrency industry fell drastically as fear set in as the favorite Bitcoin dropped, Ethereum was split, altcoins were volatile, and significant regulatory, liquidity, and institutional events influenced short-term prospects.

Source: Forex Factory

The global cryptocurrency market today reached a capitalization of $2.99 trillion, reflecting a 2.3% sharp dip over the last 24 hours. Total trading volume across all cryptocurrencies was $127.4 billion, showing steady crypto activity.

Bitcoin (BTC) remains the largest crypto, commanding 57.3% dominance, while Ethereum (ETH) holds 11.4%. Currently, 19,144 cryptocurrencies are being tracked, with Polkadot and XRP Ledger tokens showing the strongest gains in the past day.

Bitcoin (BTC) and Ethereum (ETH) Price:

Bitcoin (BTC) price today is trading at $85,995.56, down 1.97% in the last 24 hours, with a trading volume of $43.6 billion and a market cap of $1.71 trillion.

Ethereum (ETH) is priced at $2,826.47, rising 4.78% in 24 hours with a trading volume of $26 billion and a market cap of $341 billion.

(Note: BTC and ETH are often viewed as less volatile historically, but still risky.)

Top 5 Trending Coins in 24 Hours

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

Bitcoin trades at $85,992.98, down 1.92%, with a trading activity of $43.66 billion.

Ethereum stands at $2,826.42, falling 4.48%, while recording $25.93 billion in volume.

AI Cyclone is priced at $0.0002127, surging 80.02%, with $70.61 in trading activity.

Yooldo Esports trades at $0.4094, up 0.39%, backed by $1.12 billion in volume.

Solana is valued at $123.45, down 4.62%, with a trading volume (TV) of $5.38B.

Top 3 Gainers in 24 hours

(Ranked by 24-hour percentage gain)

Canton (CC) is trading at $0.07677, gaining 7.78%, with a TV of about $20.02 million.

Midnight (NIGHT) is priced at $0.06285, up 4.24%, recording a heavy TV of around $1.10 billion.

MemeCore (M) stands at $1.67, rising 2.43%, with TV close to $15.49 million.

Top 3 Losers in 24 hours

(Ranked by 24-hour percentage decline.)

UNUS SED LEO (LEO) is trading at $7.30, down 20.25%, with a daily trading activity of $5 million.

Pump.fun (PUMP) is priced at $0.002051, recording a 12.04% decline, while trading volume stands near $117 million.

SPX6900 (SPX) trades at $0.4793, slipping 11.36%, with a trading volume of $20.3 million.

Stablecoins and Defi Update

Stablecoins recorded a 0.1% negative change in the past 24 hours, with a market cap of $313.8 billion and trading volume of $97.8 billion.

The Decentralized Finance (DeFi) market steeply dips 4.9% in the last 24 hours, reaching a market cap of $101 billion, while total value locked (TVL) stands at $5.89 billion.

(TVL refers to the total crypto assets locked in DeFi protocols.)

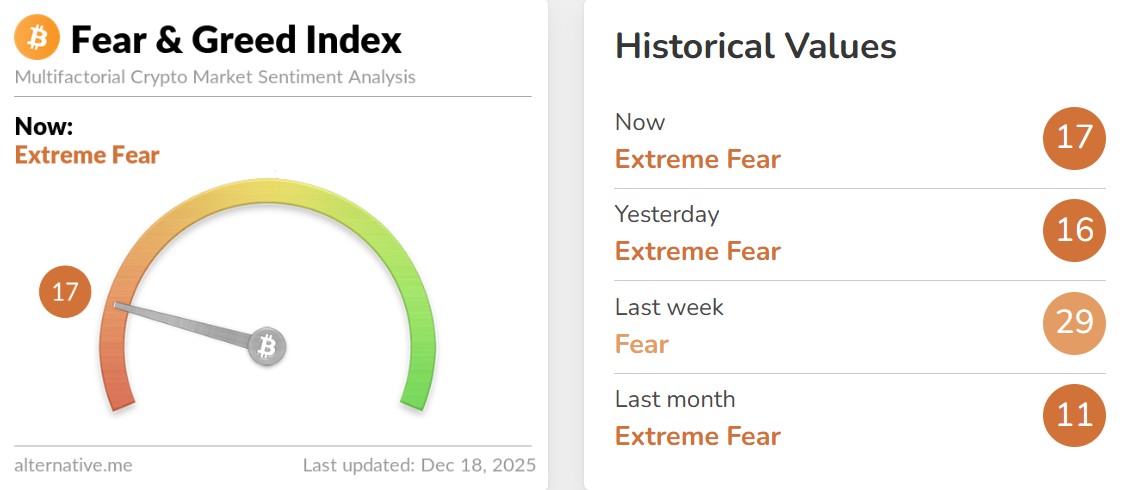

Source: Alternative Me

The current Fear and Greed Index is 17 (Extreme Fear), an improvement of 16 from the previous day. The sentiment is poor because of the volatility of prices, regulatory uncertainty, and low risk appetite. Compared to 29 last week (Fear), confidence has worsened, though it’s higher than last month’s 11, signaling mild stabilization.

1. Coinbase Broadens Trading Services.

Coinbase also said it would introduce stock trading, prediction markets, perpetual futures, Kalshi integration, and Jupiter-powered on-chain swaps, making its trading offerings not limited to crypto.

2. Fed Eases Crypto Banking Rules

According to journalist Eleanor Terrett, the US Federal Reserve withdrew 2023 guidance that limited uninsured banks’ crypto access, easing membership rules and reversing a policy that blocked Custodia Bank’s master account.

3. Dormant Bitcoin Floods Weak Market.

Studies indicate that almost $300 billion of dormant Bitcoin flowed in 2025 as long-term holders sold in large numbers, and weak ETF flows, declining derivatives markets, and softening retail demand left markets vulnerable worldwide.

4. Monero Reclaims Privacy Crown

Privacy coin Monero outperformed, reaching an $8 billion cap with over 100% yearly gains, nearing its 2021 peak, and overtaking Zcash as the top privacy asset again today.

5. Binance Considers Binance US Relaunch

Binance is weighing a Binance US relaunch, including possible recapitalization to cut CZ’s stake, easing regulatory hurdles. Talks continue, with no final decision yet.

(Note: Each of these updates impacts traders by affecting liquidity, market sentiment, and potential returns, highlighting the need for careful monitoring.)

Today is weaker in sentiment and under heavier selling pressure as compared to last week, which had more confidence. Bitcoin and Solana were down, but some of the altcoins and privacy coins, such as Monero, did better, showing that not all sectors were recovering equally.

To crypto users, the present state of affairs is an indicator of increased volatility and uncertainty. Short-term trades may be affected by falling prices, the extreme fear mood, and regulatory changes. Nevertheless, more offerings of exchanges and relaxation of banking regulations may help with the long-term adoption and better infrastructure.

Risk Context

This commentary is only informational and not for long-term conditions. It does not indicate the direction of the price or indicate an action to be taken on the investment.

The present sphere is still not safe for short-term investors since the cryptocurrency is full of fear, the prices are falling, and the liquidity is not strong. Selective opportunities can be available to long-term investors, although care is necessary. It is highly recommended to stagger the investing, risk management, and closely monitor the macro and regulatory developments.

Disclaimer

This is not financial advice. Do Your Own Research before investing. CoinGabbar is not liable for any financial loss. The crypto assets are risky,y and you may lose all your investments. Not all regions can offer some of the services or assets discussed.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.