A bold statement, in the viral post by Dr Altcoin, is that Crypto is the future of money! Nevertheless, he claims that cryptocurrency is mostly misinterpreted as a short-term profit instrument to be used in everyday trading, and its worth is actually in the long-term investment plans. He supports this further by providing historical price charts of cryptocurrencies like Bitcoin and other assets that have increased tremendously with time.

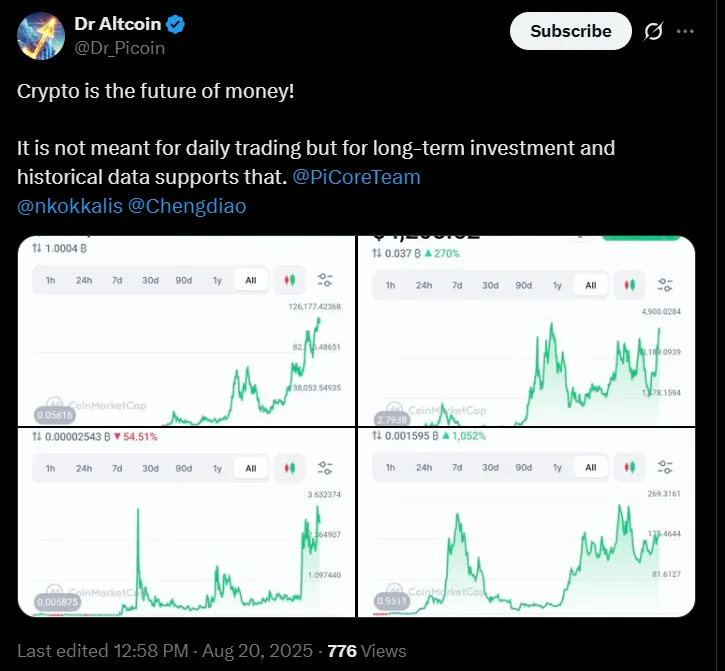

The charts show explosive growth trends of wild fluctuations followed by explosive increases. This trend confirms his assertion that long-term holding (sometimes referred to as HODLing) beats short-term speculation.

In the post and additional analysis, Bitcoin has grown to 113659 and Ethereum to 4,217 in 2025, with an enormous increase in market capitalization. According to the information cited in the July 2025 research report by ExplodingTopics, the world crypto market cap has reached a maximum of $3.8 trillion in December 2024. This influx was also associated with wider economic changes, such as U.S. trade tariffs and inflation fears globally, which are driving more institutional interest in crypto as a hedge.

Source: Dr Altcoin X

To further support, a 2023 paper published in the Journal of Risk and Financial Management discovered that 70% of diversified crypto portfolios outperform short-term trading strategies in most market cycles. This provides scholarly support of the notion that crypto is more applicable as a long-term store of value than a gamble by day-traders.

The common pictures in the post of Dr Altcoin contain several price charts with long-term upward trends. Whereas the short-term perspective (daily or weekly) may indicate volatility and sudden drops. The all-time charts (since 2012) will indicate an undeniable exponential growth, at least of Bitcoin and other early coins.

Some of the charts include:

A graph with the sudden price changes of under $0.01 to more than $126,000 on a coin (probably it is Bitcoin).

Another chart analysis with a stable growth over the years, which is also a typical feature of crypto cycles.

These graphics provide a strong case that even after market crashes and corrections, long-term investors have historically won.

Dr Altcoin has tagged the founders of the Pi Network, Nicolas Kokkalis and Chengdiao Fan, and this may be an indication that he supports the new blockchain projects with a future perspective. Nevertheless, the commentary of the article observes that Pi Network experienced delays in mainnet and high KYC barriers, which have made it lose credibility among its users. Since 2023, these concerns have been discussed by more than 176,000 Reddit users in Pi Network.

Conversely, established currencies such as Bitcoin and Ethereum have demonstrated concrete development, real liquidity, and real-world application, which makes them more secure long-term investments.

The post by Dr Altcoin only confirms one of the oldest investment facts: short-term volatility, long-term gain. The figures, graphs, and time trends are telling enough to show that investing in cryptocurrencies in the long term has been much more profitable to the investor than attempting to time the market daily.

It is unclear whether that will be the case with new projects such as Pi Network, but history has shown that patience, proper portfolio diversification, and faith in the technology are what truly make one a winner in the crypto realm.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.