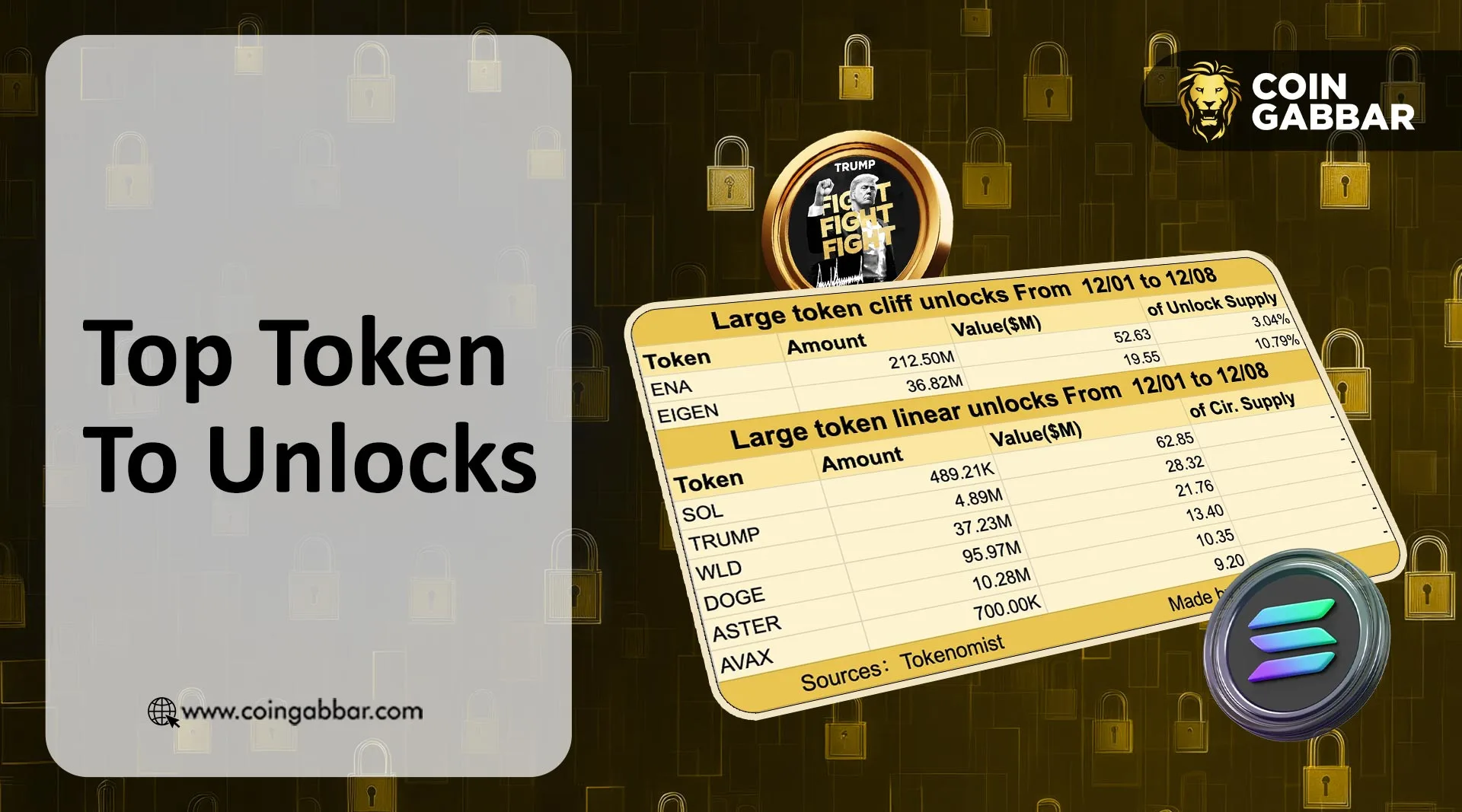

As per the data from Tokenomist’s panel, the crypto landscape is preparing for an extended grip of token unlocks in the next seven days. This huge one time release and high value linear emissions are projected to infuse more than $218 million worth of tokens into circulation, potentially influencing price action across several major digital assets.

Source: X

Tokenomist highlights two major cliff scheduled within the next week – Ethena (ENA) and Eigencloud (EIGEN)

ENA is set for a $52.63 million release, representing 3.04% of its circulating supply.

EIGEN will also follow with a $19.55 million unlock, amounting to token supply of 10.79%.

Other cliff unleash in this row include minor yet notable releases from Momentum (MMT), Redstone (RED), and Staika (STIK), though these down fall below the $5M limit.

These one time unlocks often grab market attention due to their potential to trigger short term fluctuation, especially when a large section of vested tokens become available to teams,ecosystem funds or early investors.

In addition to this, several major cryptocurrencies are going significant daily linear releases, each exceeding $1 million per day.

Key assets include:

BTC - $39.01M per day

Solana (SOL) - $8.89M per day

ETH - $7.57M per day

Trump - $4.01M per day

Worldcoin (WLD) - part of a combined multimillion daily release

Combined with other scheduled releases, today’s linear emissions surpass $82.60 million, widening the supply available to the landscape and adding another layer of liquidity pressure during periods of uncertainty.

The dashboard shows several tokens, including ENA, BMEX, SPEC and HONEY, experiencing sharp 24 hour price movement as a significantly unlocked event approach. Latest Upcoming emissions for the next seven days emphasize dollars releases for tokens like SPEC and ENA, showing potential fluctuation for traders watching the token unleash scenario.

The surrounding sector is already displaying signs of activity. ENA, for instance, swung over 17% in the last 24 hours, while EIGEN slipped downward by 12%, signaling a cautious environment for users waiting for additional supply to hit the market.

Other leading tokens, among such currencies include Monad (MON), sui (SUI), and Hyperliquid (HYPE), are also trading down as crypto sentiments adjust to the upcoming unlock cycle.

Tokenomists dashboard further suggests that the total emission value across the crypto market this week exceeds $786.71 million. This figure includes linear unlocks, scheduled cliff unlocks, and ongoing vesting distributions across many projects.

Such huge token unlock activity mainly raises questions about liquidity inflows, price dynamics, and investor positioning especially during volatile trading conditions.

With this week setting up to be an exciting one in the crypto market with unlocks exceeding $218 million led by ENA, EIGEN, WLD, SOL, TRUMP, and others, the crypto market is getting set for an eventful period. While unlocks do not necessarily cause an immediate sell off, they do have an impact on factors like trading volume, market emotions, and short term price behavior. User confidence, liquidity conditions, and broader macro trends will determine the manner in which the market absorbs this latest unlocked supply.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.