According to the recent information, a decentralized exchange (DEX), Meteora, is based on the Solana blockchain. It becomes the most popular Solana trading platform because of the Kenya West YZY token launch. As per DefiLlama data, Meteora achieved an astonishing trading volume of $1.183 billion in the last 24 hours, outpacing Raydium.

The run is an indicator of a retail speculation cycle, as fueled by the hype around the YZY token. According to analysts, when tokens are launched by famous people, it is typical that they cause a momentary surge in trading volumes, and Meteora seems to be no exception.

Source: Wu Blockchain X

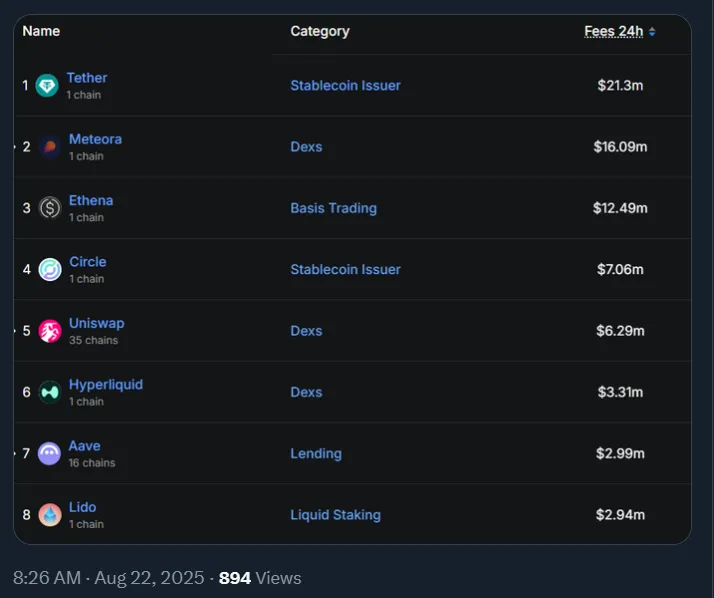

The trading fee-related revenue was also high on the platform. Meteora earned 16.09 million in fees in the same 24-hour period, second only to stablecoin issuer Tether, which earned 21.3 million in fees. This shows the high demand for trading and liquidity on the platform, especially during times of high speculation.

Tether, the most popular stablecoin issuer, remains one of the key players in DeFi. Tether still acts as a settlement layer to most of the decentralized platforms, with a reported 70% market share. Its hegemony is unquestionable, but previous research, including a Whale Alert report published in 2022, demonstrates that Tether printing activities are frequently accompanied by the rising prices of Bitcoin, which indicates the power of the platform over the entire crypto market.

The unexpected spike in the trading volume of Meteora emphasizes the larger role of stablecoins and celebrity-based tokens in influencing the DeFi activity. Studies published in the Journal of Financial Economics have indicated that volume peaks created by stablecoins are sometimes related to market manipulation risks. Although the Yeezy Money meme coin is now generating hype, analysts warn that such a high rate of inflow might not always be possible.

Although Meteora is the most active Solana DEX, there are other platforms that are also doing well. As of the DeFiLlama data:

Basis: Basis trading platform, charges $12.49 million in fees

Circle: Stablecoin issuer, $7.06 million fees

Uniswap: Cross-chain AMM, $6.29 million in fees

Hyperliquid: DEX, $3.31m in fees

Lending platform, Lending fees $2.99 million

Lido: liquid staking protocol, $2.94 million in fees

These platforms represent the variety of the DeFi space, including the issuance of stablecoins to lending, and staking.

Kanye West has now officially announced the Yeezy money (YZY) token, a memecoin based on the Solana blockchain. The token received enormous attention almost instantly after its launch, with much of the hype being driven by celebrities. The traders and fans rushed in to buy it, and its market cap rose to over $3 billion in a few hours and then plunged. The hype surrounding YZY is a part of the rising popularity of celebrity-endorsed digital assets.

However, the Current YZY token Price has experienced a significant decline in value. At the time of writing, YZY is down 53.1% over the past 24 hours, trading at $0.8066, with a market cap of $104 million and a trading volume of $320 million. This sudden crash exemplifies the unpredictability and volatility of memecoins. Alongside, it is a lesson that hype-driven assets can experience sharp declines over a short time.

Source: CoinGecko

Meteora is a recent example of how social influence and viral token launches can be used to succeed in the cryptocurrency market. Although the YZY meme coin token (Yeezy Money) has generated a lot of buzz, analysts stress that the crypto market is very volatile. Investors should take such high-volume trading periods with caution and with the risks and rewards in mind.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.