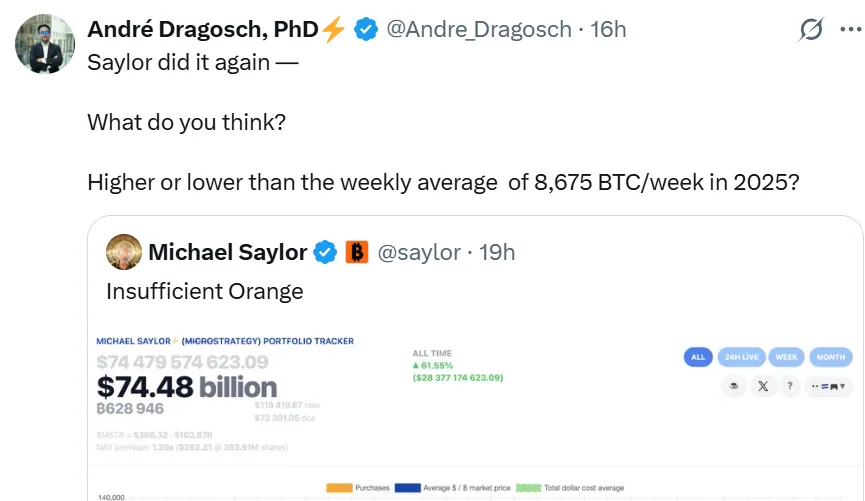

The former CEO of Strategy known for his aggressive and public acquisition of digital gold, once again left the market in new speculation with the news of Michael Saylor hints bitcoin purchase. He shared a chart of his company’s holding on his X profile and hinted that additional holding data may be disclosed next week, stating: “Insufficient Orange.”

Source : X

The chart shows the company now holds 628,946 BTC worth of $74.48 billion making it the largest corporate BTC holder. In the past also, Michael Saylor hints bitcoin purchase before Strategy's additional coin acquisitions. At an average buying price of $73,301 (as reported in tracker chart), the company's entire profit margin is above 60%, which translates into more than $28 billion in unrealized profits.

The company started accumulating the digital gold in September 2020 with 16,796 tokens worth $175,000,000. Since then the accumulation continues with the recent buy on August 11 of 155 BTC worth $18,000,000 when BTC is breaking its all time high records.

Source : X

Michael Saylor hints bitcoin purchase and his position demonstrates an unwavering belief in the long-term viability of coin. Devoted holders would continue to stack more even in the face of sharp price declines. According to his recent interviews and coverage, the company would not be liquidated if the token reached $1.

Michael Saylor hints bitcoin purchase has once again made headlines in the cryptocurrency space with his aggressive BTC accumulation strategy. According to Andre Dragosch's recent tweet on August 17, 2025, he 'did it again,' prompting a discussion on whether its digital gold purchases will exceed or fall below the average of 8,675 BTC per week in 2025.

Source: Andre Dragosch X profile

This statement has created chaos among the crypto currency market and is following the trend. The treasury firm is a major institutional player in the crypto market and always influencing price dynamics and trader sentiment.

It gives you information about possible price changes, implications for trading opportunities in coin, and correlations with stock market trends, with an emphasis on data-driven insights to help you make trade decisions.

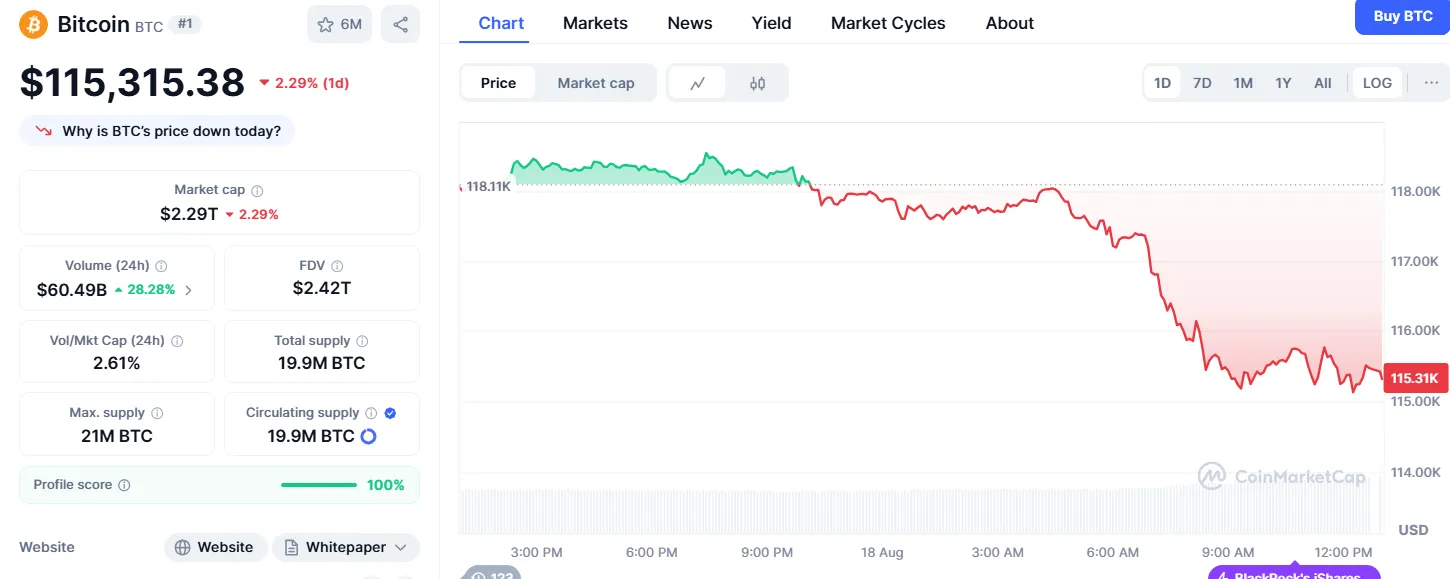

As the token is underperforming from the last seven days after hitting ATH. Short -term traders and institutes gained profit by selling off as it reached above $124k.

Source : Coinmarketcap

As per past records Michael Saylor hints bitcoin purchase news boosted the trading volume of coin by 20-30%. At present the 24hr trading volume has increased by 28% and the coin is trading at $115,315. The 2.29% dip represents bearish sentiments among traders. Also it has increased the confidence in corporate institutions to make a buy when in dip. That's why Michael Saylor hints bitcoin purchase and Strategy is betting on. More stacking tomorrow could fuel the next big move.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.