Bitcoin is heating up in the crypto space once again, and this time there are significant events taking place. MicroStrategy just made another major BTC purchase, institutional investors are dumping money into Bitcoin ETFs, whales are transferring coins to cold wallets, and high leverage traders are placing big bets on price moves.

All of these signals are pointing in the same direction—It could be gearing up for a strong push toward the $115K mark. Here’s a full update on what’s happening and why it matters.

MicroStrategy, the biggest corporate holder of Bitcoin , has once again added to its stack. On May 25, the company bought 4,020 BTC at an average price of $106,237, spending roughly $427.1 million. This latest Michael Saylor Bitcoin purchase brings their total to 580,250 coins, acquired at a cost of $40.61 billion, or an average of $69,979 per coin, as per Michael Saylor X Account

Source: X

This isn’t just another piece of press; it’s a sign of serious long-term conviction. Strategy's total return this year for 2025 is 16.8%, indicating their HODL is successful. This type of consistent buying also sends a message to the overall market: strong hands are still present.

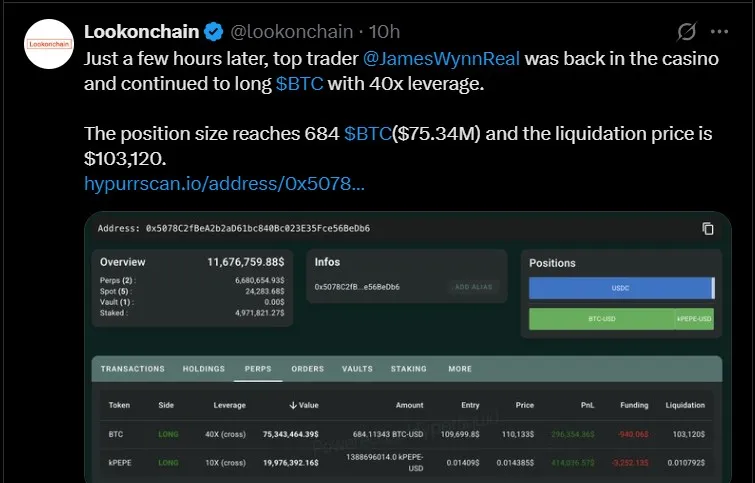

It wasn’t long before traders got in on the bullish trend. Just hours after this announcement, well-known crypto trader James Wynn opened a massive leveraged position.

He opened a long position of 684 BTC valued at about $75.34 million at 40x leverage. This shows how much confidence he had in the bullish price trend. His position will only be liquidated if this largest cryptocurrency drops below $103,120.

Source: Lookonchain on X, May 25, 2025

This type of move shows that traders are not only watching what institutions are doing—but are also acting on it. When big buys happen, retail and professional traders often expect short-term rallies, and Wynn’s position reflects that exact sentiment.

The bullish activity doesn’t stop at individual traders. On May 26, data revealed that ten Bitcoin ETFs saw a combined net inflow of 3,686 BTC, equal to $405.78 million. BlackRock’s iShares ETF alone pulled in 3,954 BTC, or $435.3 million in value. Their total holdings now stand at 655,571 coins, worth over $72.18 billion.

Such strong inflows mean one thing—institutions are still buying. The more they lock up Bitcoin into ETFs, the less there is in the open market. That limited supply often creates pressure on price to move upward, especially when demand stays high.

On-chain data added another layer of bullish news. Whale Alert reported that 895 tokens—worth about $98 million—was moved from Kraken exchange to a private wallet.

These kinds of movements are often interpreted as signs of long-term holding. When whales pull their BTC off exchanges, it usually means they don’t plan to sell anytime soon.

That’s important because fewer coins on exchanges mean less risk of sudden dumps, helping support the current price and letting momentum build

At the time of writing, Bitcoin is trading at $109,444.21, showing a 2% increase in the last 24 hours. The total crypto market cap stands at $2.17 trillion, and even though daily trading volume dropped slightly to $45.87 billion, Bitcoin has gained around 4% in the last seven days.

Source: CoinMarketCap

With strong fundamentals, increasing demand from both institutions and retail, and fewer coins floating around on exchanges, all eyes are now on Bitcoin price prediction, whether $BTC can break past the $115,000 barrier. If the momentum holds, that level may come into view sooner than expected.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decision.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.