On July 25, Saylor’s company Strategy announced a game-changing financial product: Stretch Perpetual Preferred Stock, also called STRC.

In the latest STRC stock news today, this security raised a surprising $2.47 billion, far more than the original $500 million plan.

Source: Michael Saylor Official X

Microstrategy STRC Stock is neither a typical bond nor a cryptocurrency—but something new that’s drawing huge attention from institutional players. Some call it a “Bitcoin T-Bill.” But what does that really mean? Let’s break it down.

It is a preferred share listed on Nasdaq, launched at $90 with a par value of $100. What makes it special is that it pays a 9% monthly dividend, which can be adjusted depending on its price action.

Source: Swan X Account

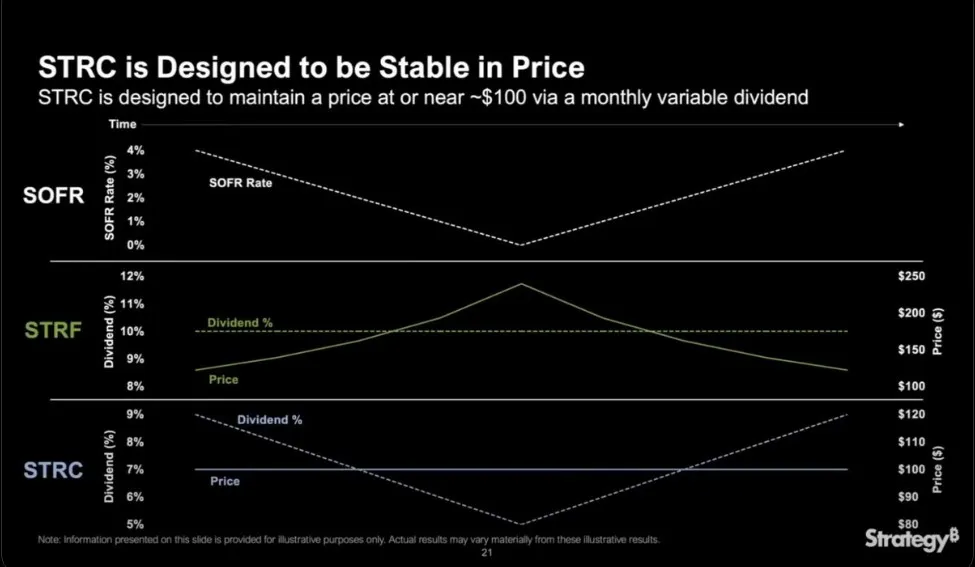

How does STRC work like a stable-asset?

If the price drops, Strategy boosts the dividend or stops issuing new shares.

If it climbs, they may reduce returns or recall some shares.

This makes the stock behave like a stable-value instrument, without being a digital coin. And this is the reason behind the equity compared with stablecoin.

It’s backed by Bitcoin (BTC) and managed like an actively stabilized fund, offering consistent returns for capital allocators.

Being a crypto analyst, I view this equity as a strategic bridge that simplifies digital asset exposure for traditional investors while reinforcing BTC adoption from the top down.

Many investors are calling this share the first “Bitcoin-backed T-bill”. Here’s why:

It’s short duration, yield producing aims to stay around a fixed value.

It has BTC backing, so it is digital.

It is a natural fit for people looking for safe returns, but no crypto direct ownership.

Compared to stable coins, it is fully regulated and traded like any stock. This hybrid model suits anyone looking for Bitcoin-backed stable yield products.

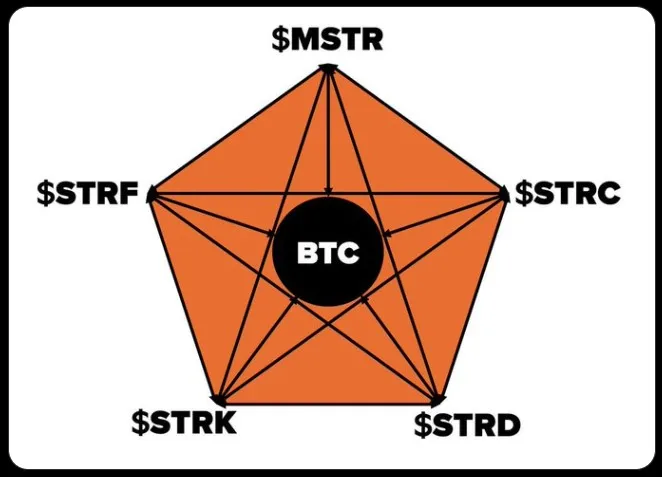

It is not a standalone project. It's part of a bigger structure called the Bitcoin credit stack, which includes four products:

Strife: Long-term senior asset

Stretch: Low-risk, near-cash layer

Strike: Medium-yield mezzanine

Stride: High-return, high-risk segment

In this structure, this new launch is positioned as the most stable and lowest-volatility product, offering a bridge between traditional finance and Bitcoin-backed income streams.

It was built with conservative investors in mind. It’s ideal for:

Cash managers looking to park idle funds

Family offices needing exposure to digital assets without volatility

Institutional players seeking yield without direct BTC risk

Note: Every dollar raised through this share is used to buy more Bitcoin, it also supports MicroStrategy’s long-term crypto strategy.

Approach? STRC demand → more proceeds → Strategy buys more BTC → BTC backing grows → Share stays safer. This makes it a strong tool for both earning yield and supporting BTC accumulation.

The launch of the Microstrategy STRC Stock represents a major shift in digital asset finance. It is the first-ever regulated equity product created to work analogy to a Bitcoin-secured Treasury instrument.

With attractive dividends, regulated trading and intraday stabilization, it clearly shows how BTC can help power real credit markets.

As interest rates shift and traditional instruments lose appeal, its unique position is attracting serious capital—and possibly reshaping how finance interacts with crypto-backed assets.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

2 months ago

good