Newton Protocol is developing a secure layer of automation for decentralized finance (DeFi). It enables users to outsource complicated tasks to AI agents, like trading or cross-chain operations, with the assurance that each step adheres to user-specified rules with cryptographic checks.

Newton Protocol combines automated trading, secure rollups, and an AI marketplace, with aspirations of being a fundamental tool for both developers and DeFi users.

Binance is set to list Newton Protocol (NEWT) on June 24 at 14:00 UTC, bringing a fresh and innovative AI-driven crypto project into the spotlight. It will be available for trading with the pair of USDT, USDC, BNB, TRY, and FDUSD. It is launching on Binance Alpha, before the Binance Spot.

Source: Wu Blockchain

Total Token Supply: 1 Billion

Circulating Supply at Listing: 215 Million (21.5%)

HODLer Airdrop Allocation: 12,500,000 NEWT (1.25%)

Marketing Allocation: 12,500,000 NEWT (to be used 6 months after listing).

The smart contracts will be available on the BNB chain and Ethereum Networks. There is no listing fees. Maximum BNB holding cap for Airdrop is 4% for every user.

Users who BNB-subscribed to Simple Earn or On-Chain Yields between June 14 and June 17 are qualified for the HODLer Airdrop. These users will be credited with NEWT into their Spot Wallets, at least one hour prior to trading begins.

Moreover, special rewards will also be given to early participants and engaged Kaito community members, with 0.9% of the NEWT total supply reserved for them.

Binance will also publish a research report on Newton Protocol within 48 hours of announcement of listing.

Token Name / Ticker: NEWT

Contract Address: 0xd0ec028a3d21533fdd200838f39c85b03679285d

Blockchain: Ethereum

Token Standard: ERC-20

Total Supply: 1,000,000,000 NEWT

Source: CoinMarketCap

Initial Airdrop (10%): It is a type of Community Rewards

Magic Lab (5%): Allocated towards the community.

Liquidity Support (4%): To increase community access to the token and enhance transparency.

Onchain Ecosystem Growth Fund (15.50%): This is available for immediate deployment towards the foundation.

Network Rewards (8.50%): To reward network supporters.

Onchain Ecosystem Development Fund (12.50%): This is also available for immediate deployment towards the development of foundation.

Early Backers (16.50%): This much will be allocated for initial supporters.

Onchain Foundation Treasury (9.50%): This is also available for immediate allocation.

Core Contributors (18.50%): Allocated to the major contributors.

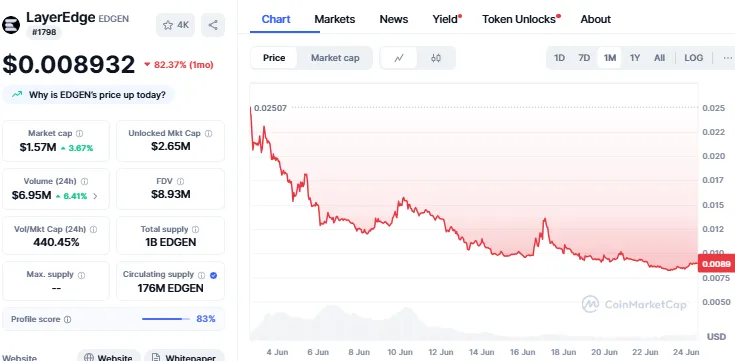

The actual price of the Newton Protocol token will be there at the time of launch, but price can be estimated by comparing it with the Layeredge token, as it also has a similar token supply of 1 Billion.

Layeredge listed on 2nd June, its initial price was $0.02, however due to heavy selling it dropped by 82%, currently trading at $0.008950.

Source: CoinMarketCap

The price of NEWT is also estimated to go $0.02 to $0.04 initially when the trading opens. It might further go up after getting listed for Binance Spot. It has a community support of 722k followers on

Before the main listing, Newton Protocol will appear on Binance Alpha, allowing early access. Once spot trading opens, it will be removed from Alpha, but users can still view and transfer their tokens. Platform will automatically transfer any remaining tokens in Alpha Accounts to Spot Wallets within 24 hours.

This process gives early users a sneak peek and helps the platform test market reactions.

NEWT is not another token listing. It is one of the most important advances in AI in DeFi, which provides actual applications of automation and security combined. This is all the hype and the traders will keep their eyes on how recipients of the airdrops will behave, will they sell, will they hold or will they wait towards a dip?

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.