In an interview recently, Paul Atkins, Chairman of America's Securities and Exchange Commission (SEC) stated that the SEC is "mobilising" to establish the U.S. as the crypto capital of the world.

Source: X (Previously Twitter)

He has introduced a significant initiative termed Project Crypto that may transform America's position in global finance.

The action follows President Donald Trump's signing of an executive order opening the $9 trillion U.S. retirement market to crypto, private equity, and real estate investment.

Both of such strategies could transform the way millions of Americans save and make investments for the future.

Central to Paul Atkins' vision is Project Crypto. It is an ambitious plan to upgrade rules and regulations for digital currencies. Investors and business organisations have long complained about vague digital assets regulations that held back the innovation.

This project promises certainty, clarity, and a safe environment for investors and business organisations alike.

Major aspects of Project are:

Tokenization of RWAs like equities, bonds, and real property.

Clear classification of securities, commodities, and NFTs.

A legal framework for token launches and airdrops.

Custody innovation for safe storage outside of "a flash drive in a drawer."

Governance-enabled Permissioned DeFi Framework.

A regulatory sandbox for startups to innovate with safety.

Comprehensive licensing for digital platforms.

By solving these issues, the SEC hopes to reduce enforcement risks and bring back firms which had already left due to ambiguous rules.

The other key area Paul Atkins highlighted is the increase in institutional interest. With new asset categories and revised custody requirements, large-scale investors are now able to enter into cryptocurrencies without worrying about legal uncertainty.

This should push Bitcoin, spot ETFs, and decentralized finance (DeFi) initiatives. Experts see it also as a way to provide confidence to legacy financial institutions.

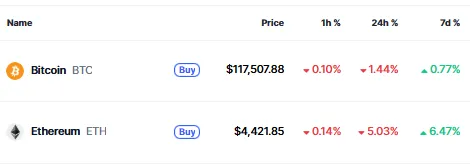

Currently the crypto market cap stands at $3.97 Trillion. Bitcoin is trading at $117,507 with a decrease of 1.44%, while Ethereum is trading at $4,421 with a decrease of 5% in the last one day as per the CoinMarketcap.

Source: CoinMarketCap

Already, Twitter sentiment is trending more optimistically, with initial enthusiasm for this policy change.

In his discussion,

Digital Assets Bills: Paul Atkins also referred to new bills such as the Clarity and Genius Act, aimed at steering policies and regulations.

Cryptocurrency Payments: The SEC is investigating safer custody alternatives for broker-dealers and advisors and supporting other payment systems via crypto.

Atkins described that blockchain payments would deliver immediate and transparent settlements, cutting market risks and enhancing day-to-day transactions.

He also made a connection of today's transformation with history. In reference to the 1792 Buttonwood Agreement that resulted in the New York Stock Exchange, Paul Atkins referred to blockchain as the "next leap" in finance.

This is an indicator that America is once again poised at a crossroads in financial history.

Paul Atkins is leading one of the largest shifts in American Digital assets policy. With Project Crypto reforms, Trump's retirement market order, and increasing institutional demand, America is poised to become the world cryptocurrency hub.

These actions not only redefine U.S. markets but also dictate the tone for the rest of the world to potentially follow.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.