PayPal has stated that it would launch its stablecoin, PayPal USD (PYUSD), using the Stellar blockchain. This is a big step forward for Fiat-backed token in 2025.

The announcement was made on June 11, 2025 in a press release and in a post from this fintech firm's CEO Alex Chriss discussing this blockchain as a method of making real-world payments that are fast, low-cost and straightforward.

Source: Stellar X Account

This decision will make PayPal PYUSD on Stellar upon acceptance from the New York State Department of Financial Services, a valuable resource for merchants, users, and development teams in over 170 countries.

The blockchain is optimized for low-cost, fast, and scalable payments—a perfect fit for these fintech giants' stablecoin goals. By rolling out PYUSD on this chain, the firm is making a play for use cases beyond speculation. Namely:

1. International transfers/cross-border payments

2. Business financing/working capital accessibility

3. Every day purchases/digital commerce

4. Remittances for folks in developing economies

With platofrm's comprehensive access to on and off ramps, the company users will now interact with PYUSD through local cash systems as well as digital wallets. This gives the fiat-backed coin expansion more reach and practical use than ever before.

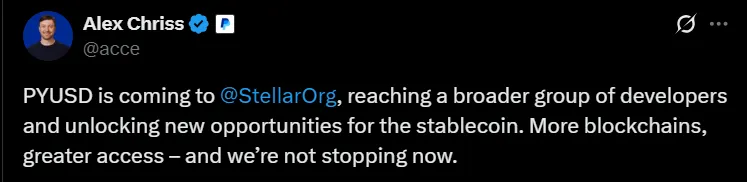

Alex Chriss, President and CEO of PayPal, shared on X (formerly Twitter):

“PYUSD is coming to StellarOrg, reaching a broader group of developers and unlocking new opportunities for the stablecoin.”

Source: Alex Chriss Official Account

Denelle Dixon, CEO of the Stellar Development Foundation, added:

“We are bringing stable digital currency to small businesses and individuals in emerging markets all over the globe.”

The integration of this Fiat-backed token on this blockchain also opens the door for “PayFi”—short for Payment Financing. Small businesses now can receive instant working capital in PYUSD, enabling them to manage operates such as:

Supplier payments

Inventory restocking

Operational cash flow

Because of chain's instant settlement, this capital became available without the traditional banking delays, further proving the utility of the fintech firm's stablecoin crypto news in action.

It also highlighted potential risks users should be aware of:

This Fiat-backed coin is not insured by FDIC or SIPC

Pegged cryptocurrency value could fluctuate if not redeemed through PayPal or Paxos

Regulatory environments may change

Digital wallets carry security risks, and transactions are irreversible

These warnings are key for anyone looking to adopt stablecoins in 2025—especially as the digital finance ecosystem continues to evolve.

With PayPal PYUSD on Stellar, stablecoin usage moves further into the real world. This partnership strengthens the idea that crypto payments can be both trusted and practical, especially in countries where traditional banking is limited.

The launch of this stablecoin on Stellar blockchain is much more than an another crypto update, it is an indication that the adoption of stablecoin in 2025 will become mainstream. Blockchain payments combine fast transaction speeds, global offering, and real world usage to be the backbone behind digital money for a new generation.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.