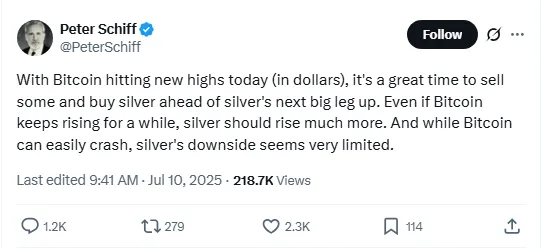

As (BTC) continues to soar, recently crossing at $116,000 mark, long-time critic Peter is doubling down on his belief that XAG/USD–noot crypto– is the better bet. In the ongoing debate of Peter Schiff Bitcoin vs Silver, the veteran economist is urging investors to consider rotating out into while the metal remains undervalued.

“With reaching new record highs today, now might be the perfect time to take some profits and move before its next major rally. Even if it climbs further, has even more room to run– and while remains vulnerable to sharp drops, risk appears far more limited.”

Source:X

BTC has had a blockbuster year in 2025, rising over 21.5%, fueled by ETF inflows, institutional interest, and rate cut optimism. But XAG/USD has quietly outperformed, with the iShares Trust (SLV) rising about 25% YTD.

In the lens of Peter Schiff Bitcoin vs Silver, Peter sees not just as a hedge, but as a better value play. While this is riding a wave of momentum, he believes real-world utility and lower downside make it a smarter, safer bet-especially for investors looking beyond speculation.

The core of the Peter Schiff Bitcoin vs Silver argument revolves around risk. He warns that meteoric rise could just as quickly turn into a steep fall. In contrast, anchored by industrial demand– offers a more stable growth path.

He sees XAG/USD as both a defensive asset and a growth opportunity. For those worried about an overheated crypto market, could be the safer play to weather any volatility ahead .

Interestingly, the Peter Schiff Bitcoin vs Silver message is resonating with some in the crypto community. It whales who have made significant gains are starting to rotate a portion of their profits into other precious metals.

They’re not abandoning entirely– but they are following logic, take profits when the market is hot, and reinvest in assets with fundamental value and lower volatility.

In the debate of Peter Schiff Bitcoin vs Silver, the question arises: can traditional assets still outperform in the age of crypto?

He argues yes– and points to growing relevance in green energy, electronics and tech manufacturing. Unlike which is depends heavily on investor sentiment, has practical applications, making it a strong contender even in the modern economy.

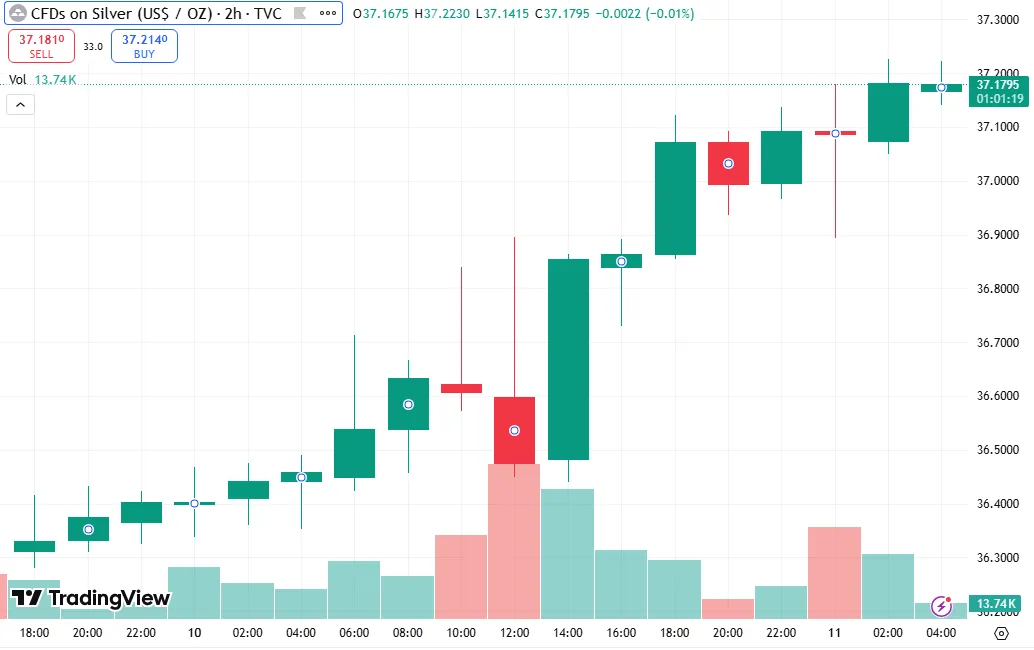

Source: TradingView

The recent chart shows a steady uptrend with prices climbing above $37.18 and supported by strong buying volume. A breakout candle suggests rising momentum, with most candles turning green over the past sessions. This slow, stable climb contrast with volatility moves, reinforcing Peter Schiff Bitcoin vs Silver argument that offers a safer more reliable upside with limited downside.

If this is right corrects soon, his bet could make a significant turning point for investors. The Peter Schiff Bitcoin vs Silver discussion isn’t about dismissing crypto– it’s about timing, balance, and recognizing when an asset has overhead.

As it continues to set new highs, voice grows louder. He’s not anti-crypto: he’s pro-reality. And in his view, it is ready for its own breakout–it just starts looking overextended.

While BTC and gold are hovering near all-time highs,it remains nearly 25% below its previous peak, making it one of the few undervalued major assets in 2025.

This gap is central to the Peter Schiff Bitcoin vs Silver argument. Schiff views underperformance not as a weakness, but as an opportunity, believing it has more room to run compared to BTC, which may be nearing exhaustion.

Source: TradingView

Source: TradingView

For investors looking out to overheated markets into undervalued assets with industrial demand and limited downside, offers an appealing risk reward profile.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.