Federal Reserve Chair Jerome Powell’s recent speech at Jackson Hole sparked renewed speculation about the central bank's policy direction. While Powell did not make any definitive promises, he hinted at a potential interest rate cut in September.

The decision to adjust monetary policy must be taken cautiously because inflation risks are still mounting. His remarks hold impressive implications for the overall economy and the crypto market, which is sensitive to liquidity shifts and investor sentiments.

He said that because the stability in unemployment and other labor market indicators still exists, the Fed can be careful in considering possible changes to monetary policy. Powell said, however, that the central bank may decide to effect a change of stance given the "shifting balance of risks."

He reminded the audience that the Fed's policy has been actually restrictive for quite some time and acknowledged that the occasion to revisit the outlook later this month as early as the September meeting could very well be there. He emphasized that the Fed sees inflation as an important issue but is also pursuing its dual mandate of both full employment and price stability.

Notably, Powell also pointed out that inflation resulting from tariffs, particularly those introduced by former President Donald Trump, might not yet be fully reflected in economic data. Impact of these tariffs will take time to trickle down fully through the channels of the supply chain and distribution network. But regardless, Powell ensured that the Fed remained committed to ensuring that a one-time price increase does not result in a longer-term inflation challenge.

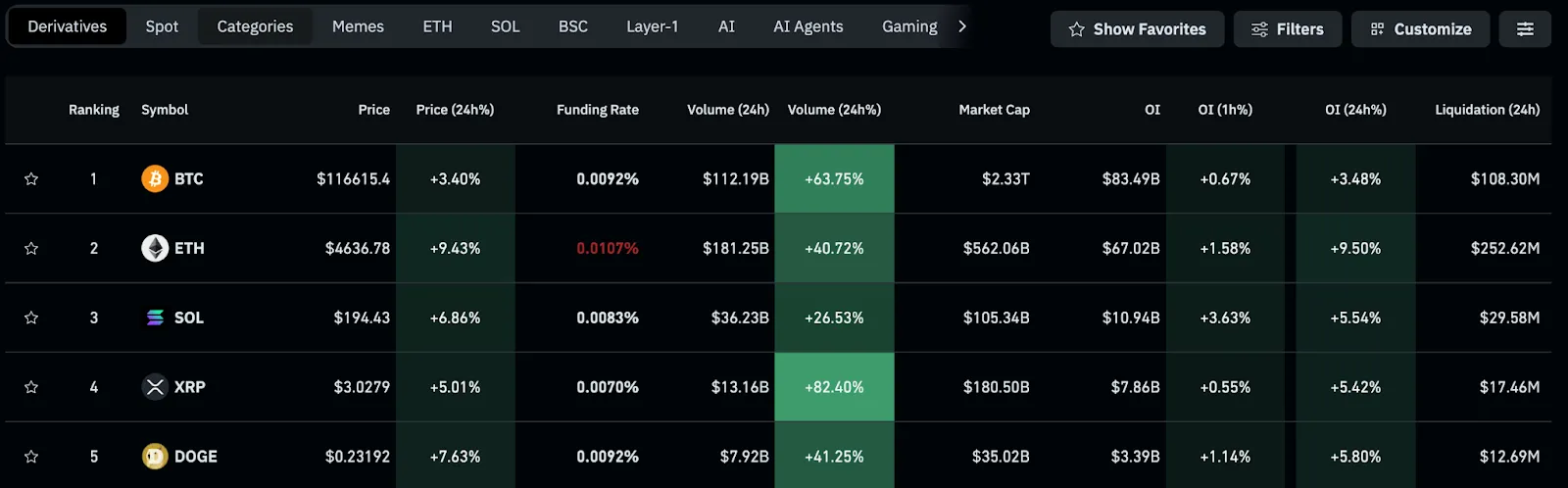

While Powell's speech was mainly centered on inflation and labor market conditions, its effects on the cryptos were also visible. After Powell's comments, Bitcoin saw a 3.43% increase in the last 24 hours, coming to a price of $116,900. Bitcoin, however, had experienced a decrease of 0.88% in the past week, which signals volatility in the markets.

Ethereum prices have been more notable in their in 24-hours, climbing by 9.02% to a price of $4,649.11. The price increase depicts a rise of 2.07% in the past week, which means that investors are growing in confidence toward the asset. XRP prices were up 4.92% over the last 24 hours but were still down by 0.89% for the week.

There is a suggestion that the Federal Reserve's cautious outlook on interest rates might cause movements for cryptos, with the major ones being Bitcoin and Ethereum. Should the Federal Reserve pursue a rate cut, there will be a consequent increase in liquidity and thus, capital flows on risk-on assets such as cryptocurrencies.

Some of the recent crypto price swings were surprisingly reinforced by large liquidation events. Bitcoin saw liquidations around $108.30 million in the past 24 hours, making it a really volatile asset.

Source: CoinGlass

For the same timeframe, Ethereum's liquidation volume stood at a higher $252.62 million. Such a surge in liquidation implies that a lot of traders had leveraged positions hit by the price changes.

Meanwhile, Solana continued its upward move with a price increase of 6.86%, but it also saw liquidations totaling $29.58 million. Although this was a comparatively low sum than that of Bitcoin and Ethereum, it still attests to the heightened volatility in the market. These liquidation figures provide insight into the risk levels that traders are navigating as they respond to shifting market conditions and potential changes in monetary policy.

Kelvin Munene is an experienced crypto and finance journalist with over five years in the industry, known for delivering detailed market insights and expert analysis. Holding a Bachelor’s degree in Journalism and Actuarial Science from Mount Kenya University, he is recognized for his thorough research and strong writing abilities, especially in cryptocurrency, blockchain, and financial markets. Kelvin consistently offers timely, accurate updates and data-driven perspectives, helping readers navigate the complex world of digital assets. His work focuses on identifying emerging trends, analyzing market cycles, exploring technological advancements, and monitoring regulatory changes that influence the crypto sector. Outside of journalism, Kelvin enjoys chess, traveling, and embracing new adventures.