The pump fun token launch finally went live across major exchanges, making a big entrance into the crypto world. But despite the massive rollout and hype, the crypto price has dropped sharply—leaving traders wondering if this is a quick sell-off or something more serious.

Source: PumpFun X Account

Let’s break down the listings, the price drop, and what might come next.

The listing happened all at once—one of the most aggressive launches in 2025. Here’s where it’s now trading:

Kraken: Enabled both spot and margin trades

KuCoin: Deposits open for Solana SPL wallets with USDT pairs

MEXC: Listed under both USDT and USDC

Gate.io: Went live at 17:00 UTC with a CandyDrop campaign

OKX: Launched perpetual futures at 17:30 UTC

Bitget: Added full support for deposits and spot trading

This exchange-wide debut aimed to pull in global volume from day one—and it worked.

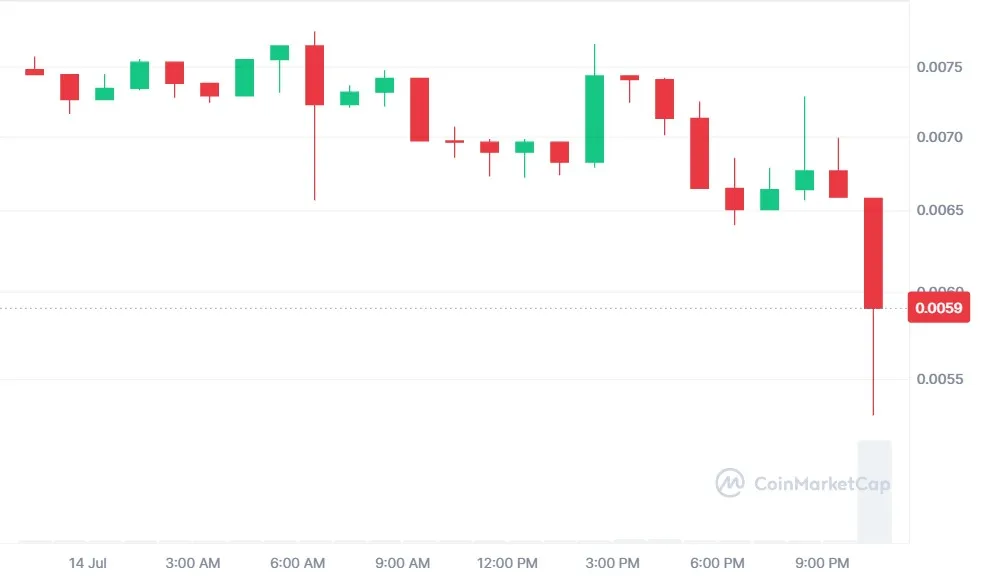

Despite listing success, the pump fun price fell fast. At one point, it dropped 21.16%, trading near $0.005902 as per CoinMarketCap. That’s a steep fall from its launch highs, and people online started asking: “why is the coin crashing?”

The answer seems simple. Early buyers from the coin launch are now cashing out. Pumpfun Public sale unlocks allowed users to dump their holdings immediately after launch, creating massive sell pressure. This isn't unusual for big listings—it’s part of the cryptocurrency lifecycle.

While the price fell, trading volume went in the other direction. In just one day, it reached $163.08 million—a rise of over 2567%. The asset's volume clearly shows people are still very active.

It market cap is holding near $2.08 billion, and a lot of the action came from new futures markets like OKX, which let traders bet on price moves in both directions.

As a crypto analyst, my chart readings and observations indicate to three possible pricing situations moving forward:

The price might test support near $0.005 or lower. But if it stays above $0.0048, it could bounce to $0.0064 as futures interest increases.

Mid-Term (2–4 Weeks):

If campaigns like Bybit rewards and Gate.io’s CandyDrop keep the energy up, we could see a recovery to around $0.007–$0.008.

Long-Term (3–6 Months):

If the launch leads to continued user growth on the platform, and big exchanges like Binance step in, the coin could hit $0.010–$0.012. Still, competition and memecoin fatigue are risks.

Yes, the pump crypto price took a hit—but this isn’t rare. After a big launch like the pump fun token launch, some people sell fast. But the strong volume, high exchange support, and community buzz tell a different story.

It’s too early to call it a failure. With promotions, futures activity, and more users coming in, this may just be a retest phase—before the next run starts. For now, one thing is clear: The coin is on the radar, and the market is still watching closely.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

3 months ago

Good