Something big is happening in the world of digital payments—and it’s not regular Ripple XRP news. While most headlines screamed "Ripple Buys Rail $200M" and moved on, they missed the real story.

This isn't just another acquisition. This is Layer 1 chain setting the stage to reshape how stablecoins power cross-border payments, and possibly challenging the very dominance of Tether and USDC.

So what exactly is Blockchain unlocking with Rail? Let’s dig in.

According to Reuters and Wu Blockchain, Ripple confirmed on August 7 that it would acquire this crypto platform, a Toronto-based stablecoin payment platform, in a $200M deal.

The transaction is expected to close in Q4 2025, pending regulatory approval. At first glance, it looks like another Web3 expansion—but what the chain is really buying is precision-grade settlement power.

Backed by Galaxy Ventures and Accomplice, Rail crypto platform supports virtual accounts and automated payment processing. This makes blockchain’s infrastructure faster, leaner, and more robust.

With this acquisition, the firm can now process cross-border transactions that once took days in just hours.

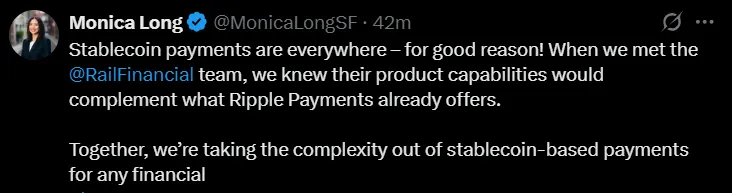

Blockchain's President Monica Long took X handle and said:

This isn’t just growth—it’s about dominance, and this acquisition is the clearest signal yet.

The strategic value of the platform lies in its global reach and automation, something fiat systems still struggle with. The cryptocurrency platform reportedly powers 10% of global stablecoin-based payment activity, a figure most payment firms dream of.

By integrating this backbone into its existing network, Ripple may finally offer a stablecoin solution that combines regulatory clarity, fast settlements, and low-cost remittances. It’s a direct challenge to legacy platforms like SWIFT, and even fintechs like Wise or Revolut.

More importantly, it aligns perfectly with Trump’s recent crypto bill, which introduces a federal regulatory framework for stablecoin regulation.

As a crypto analyst, I see this acquisition as the layer 1's attempt to gain first-mover advantage in compliant global payments. And this move could put it ahead of both Tether and USDC in institutional adoption.

They launched its dollar-backed stablecoin RLUSD last year to challenge top players like Tether and USDC.

At that time, Tether’s market cap was over $164 billion, and USDC was the top choice for regulated payments.

Now that $200M buy is official, RLUSD gets key upgrades—like virtual accounts and automated systems.

This means RLUSD can now connect easily with businesses and large financial platforms.

All this gives RLUSD a stronger position in the growing battle of RLUSD vs USDC.

One overlooked aspect of this Ripple buying Rail $200M is how it may affect XRP news today. While blockchain is legally distinct from its native token, market trends have consistently shown a correlation between blockchain's expansion and XRP price movements.

As they are now owning a system that clears stablecoin payments globally, there’s room to speculate whether XRP could once again be integrated into liquidity corridors.

That’s why this news is very important, it's more than just acquisition of stablecoins; it includes bridging regulatory gaps, and the start to a new era of flows of funds, both fiat and crypto.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.