Chief Legal Officer of Ripple, Mr. Stuart Alderoty, recently wrote to the U.S. SEC asking for more clear guidance, about how the crypto tokens should be treated under the law. He said that major crypto assets traded on secondary markets, like exchanges, should not be covered under the classification of securities. His letter took reference from the recent court ruling, legal research, and the current regulatory discussions. He is escalating for more clear and fair regulations that aligns with the current crypto market scenario. The last update from the Ripple vs SEC case was that they have agreed to settle on a $50 million penalty.

Alderoty cited Judge Torres' decision in the current Ripple case, in which the court decided that XRP tokens traded on secondary markets were not securities. This is in contrast to XRP's previous institutional sales, which the court did hold constituted investment contracts. The decision serves to distinguish between initial sales and subsequent trading on an exchange.

He also referred to a legal article by Lewis Cohen which illustrates that an investment agreement must have a definite legal relationship between seller and buyer. As this relationship generally doesn't exist in secondary market exchanges, most tokens exchanged there cannot be viewed as securities. This makes it clearer when digital assets are under the securities law and when they are not.

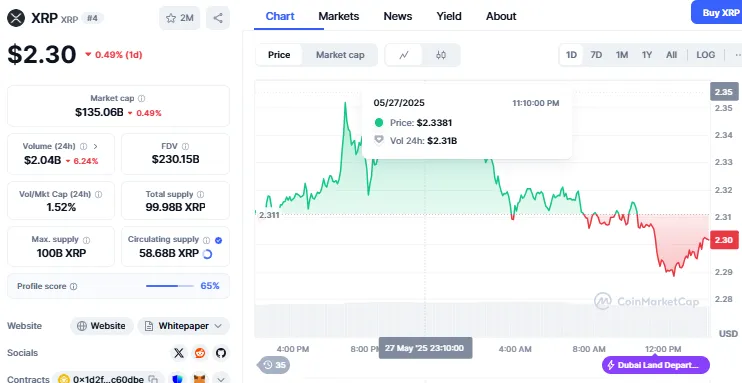

Alderoty suggested a new legal approach to decide when tokens are distinct from the initial investment contracts. If the issuer has satisfied the material commitments given at the initial sale and if the holders who sell on secondary markets no longer enjoy enforceable rights against the issuer, then the tokens must be treated as distinct and not securities. The XRP token is currently trading at $2.30 with a slight decrease of 0.49% within a day as per the CoinMarketCap.

Source: CoinMarketCap

Alderoty emphasized that new laws for cryptocurrency must come from Congress, not regulators acting alone. He found that U.S. regulators like the SEC are not authorized to make new regulations for digital assets. He thought clear directives based on present laws could keep confusion at bay and ensure equality.

He believes the responsibility for filling those gaps in crypto law belongs to lawmakers instead of regulators taking matters into their own hands.

According to Ripple, questioning whether a network is mature enough could decide when tokens stop being securities. One would look at how old the project is, how spread out its network is and how much input the creators still have.

A token should only be considered a security if two conditions are met: the original promises by the issuer have not been fulfilled, and current holders have legal rights to those promises. In all other cases, the tokens should be recognized as distinct from the initial contract for investing.

Ripple’s letter follows calls from the Blockchain Association and other groups urging the SEC to stop applying traditional finance rules to crypto. The SEC’s Crypto Task Force, led by Commissioner Hester Peirce, is working to bridge gaps between traditional markets and digital assets. Huge organisations like BlackRock have interacted with this task force. It demonstrates robust influence towards more clear cryptocurrency rules. Letter by Ripple encourages the efforts by providing legal reasoning and proposals which are practical. That would clear the path for new products like XRP ETFs.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.