Robert Kiyosaki on ETFs, They are Not Suitable For Real Assets

Investor and best seller author Robert Kiyosaki on ETFs has warned investors to be careful when relying on exchange traded funds for assets like Bitcoin, gold, and silver. He acknowledges that they make investing easier for the average person, he believes they don’t provide the same protection as owning physical assets.

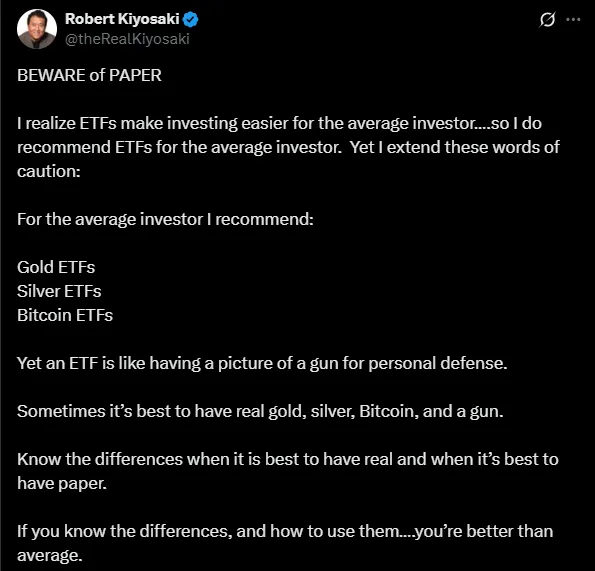

Source: X

He mentioned that “Sometimes it is best to have real gold, silver, Bitcoin, and a gun.” He compared them as having a “picture of a gun”, maybe useful in normal conditions, but useless in an emergency.

He claimed that they might be failed during times of financial disasters. His worries is that institutions managing these things could crash or run out of reserves. If that happens, their shares might become useless. That is why he had long recommended owning physical gold, silver, and self-custodian Bitcoin, which he believes provide more security.

Robert Kiyosaki also mentions how the US dollar loses its value over time and that Fiat Currency, which he denotes as a fake currency, is increasingly risky.

Despite the concerns, its markets are seeing strong inflows. On Friday, U.S. spot Bitcoin ETFs attracted $130 million in net inflows, after ending a three-day outflow trend of over $280 million on Thursday.

Leading the gains were Fidelity’s FBTC with $10.19 Million, VanEck’s HODL with $18.16 Million, and BlackRock’s IBIT with $92.83 Million. Ethereum ETFs also saw strong demand, with $452.72M inflows the same day.

Market analysts have pushed back on Rich Dad, Poor Dad's author claims. Bloomberg’s senior ETF analyst Eric Balchunas pointed out that all Exchange Traded Funds are supported one to one with the assets they represent and are lawfully required to store them with custodians.

According to him, Exchange Traded Funds offer a high level of safety, especially for the investors who are not able to keep or afford cold storage wallets. On the other hand physical assets can be stolen, he added, contradicted to Robert Kiyosaki.

Robert Kiyosaki warning highlights a growing divide in investment approaches. While many inventors endorse the ease and liquidity of the asset.

Although he put forward gold, silver, and Bitcoin ETF for beginner investors, he urges them to understand their limits. “Know your differences when it is best to have real and when it is best to have paper” he suggested.

As more firms, including Trump supported Truth Social, file to launch their own exchange traded funds, the debate between paper claims and real assets is expected to increase.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.