History was just made on the Arbitrum blockchain. On December 17, 2025, the company made a huge move by putting 500 Robinhood stock tokens on a blockchain called Arbitrum.

This transfer marks the highest single-day deployment on record for Arbitrum, a scaling solution for Ethereum. Investors around the community are now asking: Will this impact shares price, and what will be the $HOOD price target 2026 after this historic activity.

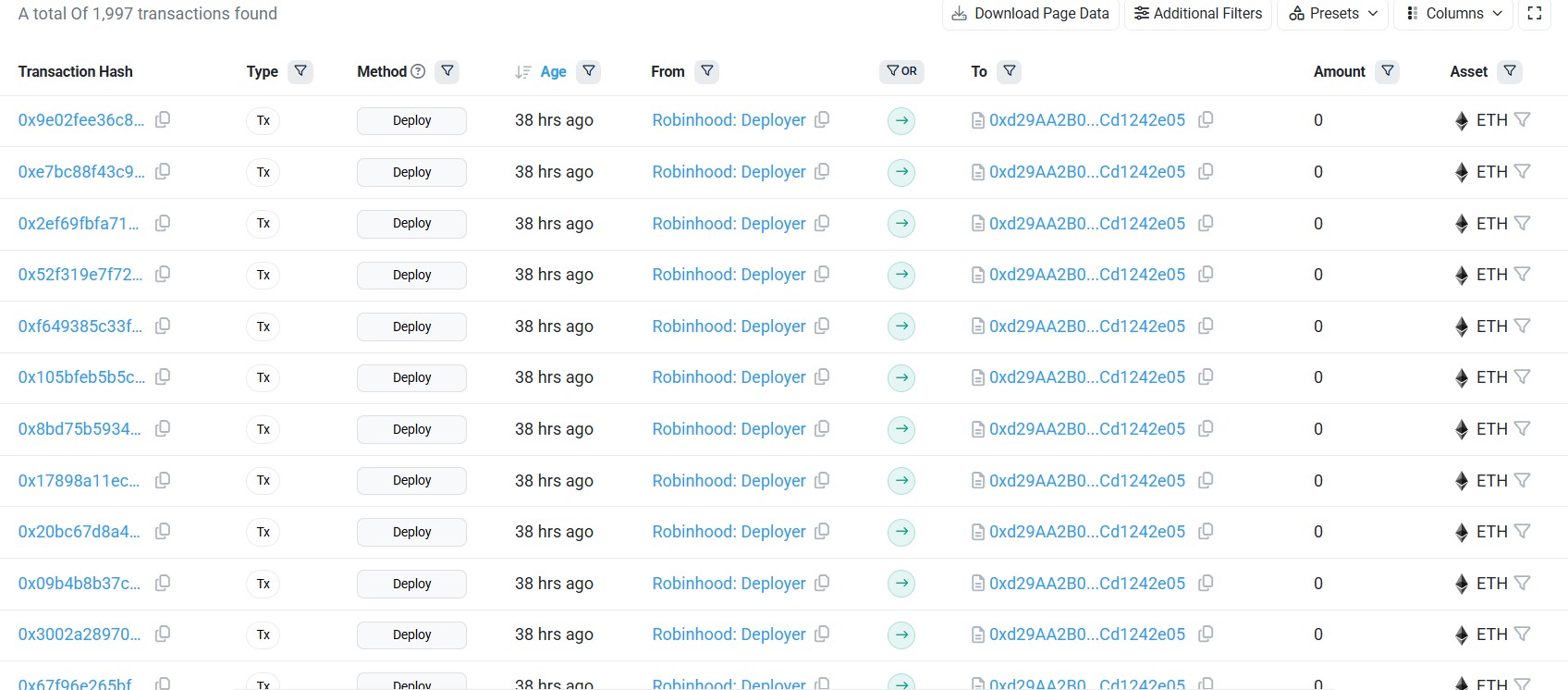

Source: Arbiscan Official Website

The firm wants to connect regular money (like shares) with the world of cryptocurrency. Arbitrum’s growing activity is one of the main reasons why the firm may have chosen this chain for deploying stock assets.

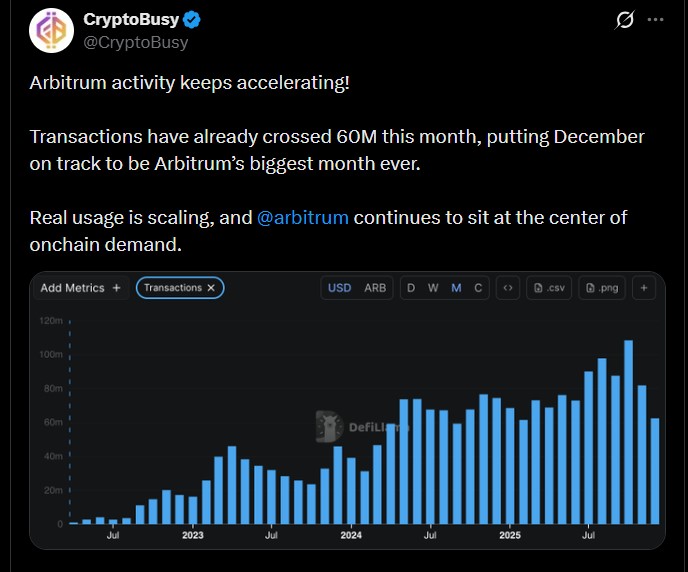

“As per CryptoBusy, a popular market analyst, recently highlighted that its transaction volume has already exceeded 60 million transactions this month.”

December 2025 is now on track to be Arbitrum’s biggest month ever, which indicates that real usage is growing rapidly on this layer-2 Ethereum solution. By tokenizing shares, the company wants to offer better performance to its users.

As per the official TradingView HOOD price analysis chart, the share is currently sitting at $117.17. The asset is a bit lower than its recent peak of $120, experts see a pattern called a "descending wedge." This usually means the coin is resting before a major trend reversal.

Let’s break down the key indicators:

The $120 Mark: This is a "resistance" level. If the price breaks above this, a bullish trend reversal can begin.

Support: $115 is the immediate support level. After the recent Robinhood stock news of 500 token deployment, it's important for the asset to hold this level for experts' $HOOD price target 2026 to turn real.

MACD (Moving Average Convergence Divergence): The MACD line is below the signal line, signaling negative momentum.

RSI (Relative Strength Index): With an RSI of 43.20, this equity is in the neutral zone, but it’s approaching oversold territory.

Safety Net: If the price drops, it might find a floor at $110 or $115.

Given the recent news of Robinhood deploying 500 stocks on Arbitrum, it could lead to short-term volatility, says top crypto expert. Investors might sell-off to book quick profits, before price crashes.

The Bearish Case: A fall below the $115 support zone will lead to $100 bloodbath.

The Bull Case: Coingabbar experts are feeling positive about the $HOOD price target 2026. If the asset keeps adding more tokens, the price could reach $130 to $140 by 2026. Some very optimistic analysts even think it could go as high as $153.

Expert View: According to Donald Dean, an experienced technical analyst, the $HOOD price target 2026 after breaking out of the current pattern is around $153.86, which could also challenge the previous highs.

500 Robinhood stock tokens deployment on Arbitrum blockchain is a "game-changer." Traders should note that, while the stock might be a little volatile in the next few weeks, the long-term goal of $140+ looks possible if they keep innovating. However only the upcoming updates will confirm whether the $HOOD price target 2026 turns real or crashes to $100.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please do your own research and consult a professional before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.