Imagine waiting for a landmark moment in cryptocurrency investing—then the rules suddenly change mid-game. That’s exactly what’s happening in the U.S. SEC crypto ETF news market this week.

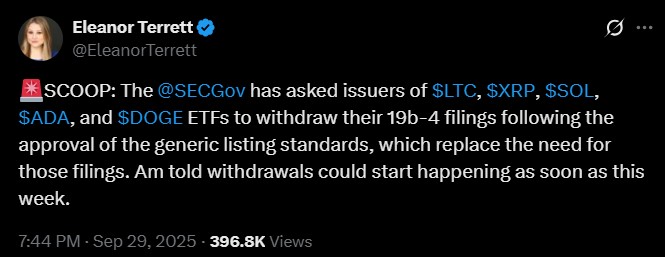

Investors and analysts were expecting decisions on 16 highly anticipated spot exchange traded funds, Eleanor Terett latest X post has added a twist, as SEC crypto ETF filings 19b-4 withdrawal has been requested from the issuers, but why?

Here’s everything you need to know for LTC, XRP, SOL, ADA, and DOGE ETFs.

As per latest Eleanor Terrett crypto comment on X, a well-known analyst, confirmed that the Security exchange commission has asked issuers of spot ETFs for LTC, XRP, SOL, ADA, and DOGE to withdraw their 19b-4 filings. At first glance, this may sound alarming.

But here’s the key takeaway: This Filings 19b-4 Withdrawal is not a setback. According to her, this is a procedural update following the Federal Securities Authority’s new generic listing standards.

Investors asking whether SEC crypto etf approve or delay should understand that it's not delayed; they are simply moving to a more streamlined approval process.

Two weeks ago, they approved generic listing standards, a rule that simplifies how crypto ETF filings can get listed. Traditionally, each traded fund required a 19b-4 filing—a complex and time-consuming process.

Under the new rules:

Exchanges no longer need individual security entry approval for each token

Tokens that meet commission's criteria can be approved through a simple S-1 filing.

The commission can approve any listed fund at any time, even if previous deadlines are approaching.

Analysts say this rule is a game-changer for the cryptocurrency industry and new exchange traded fund launches and demonstrates that the securities regulator board approval process can now be faster and more efficient.

Before the generic listing standards, as per Onur a famous analyst’s X post, investors were tracking 16 SEC crypto ETF October deadline:

Canary’s Litecoin Traded Fund: October 2

Grayscale’s Solana & Litecoin Trusts: October 10

WisdomTree’s XRP fund: October 24

Thanks to the 19b-4 filings withdrawal and the new generic listing framework, these deadlines are no longer restrictive.

Faster Approval – Listed funds can now launch without waiting for lengthy 19b-4 filings.

Reduced Uncertainty – Investors no longer worry about procedural delays.

Market Flexibility – The regulatory body can act on any token meeting the criteria, enabling timely and efficient decisions.

Analysts like Nate Geraci called October an “enormous” month for cryptocurrency exchange traded funds, and this update confirms the market is moving toward a faster and more efficient system.

The SEC Crypto ETF Filings 19b-4 Withdrawal is a procedural shift, not a setback. Generic listing standards are reshaping the investment funds landscape, making approvals faster and more flexible.

If you’re watching Litecoin, XRP, Solana, ADA, or DOGE this month, this is a moment to stay ready for the upcoming approvals because the security commission isn’t slowing down the cryptocurrency listed fund revolution—it’s actually accelerating it.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.