The U.S. Securities and Exchange Commission has formally sanctioned ProShares Trust to list a number of XRP futures ETFs. The new ETFs will begin trading on April 30, 2025. The SEC, however, still hasn't granted approval for spot XRP ETFs yet.

ProShares, which already has Bitcoin ETFs on the market, is introducing three new products linked to futures. These include:

ProShares Ultra XRP ETF (2x leverage)

ProShares Short XRP ETF (-1x inverse leverage)

ProShares UltraShort XRP ETF (-2x inverse leverage)

These are designed to give investors a way to bet on coin's price movement without directly buying the cryptocurrency. The products will track the price through an index referred to as the Ripple Index.

ProShares initially sought to launch these fun on January 17, 2025, shortly after Donald Trump, who is famously pro-crypto, was elected President. The SEC has since considered the request and has now approved it.

It should be noted that ProShares also submitted an application for a spot category, but that remains pending. Unlike futures, spot ETFs would directly follow the actual market price of coin.

ProShares isn't the first company to bring to investors. Teucrium launched it earlier this month on April 8, trading on the New York Stock Exchange.

Internationally, Hashdex recently brought a spot Ripple ETF in Brazil which is the first in the world. This event showcases that other countries are going forward than the U.S. in approving crypto spot products.

Concurrently, the CME Group disclosed plans to introduce Ripple futures contracts starting from May 19 as part of its endeavor to address increasing demands for crypto options outside of Ethereum and Bitcoin.

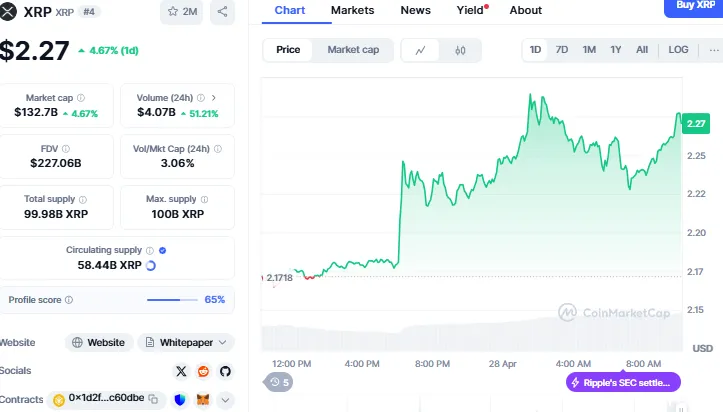

Post this approval the coin's prices increased by 4.67% in one day. It is currently trading at $2.26 as per the reports of CoinMarketCap.

Source: CoinMarketCap

The approval of ProShares' futures is a significant advance for the cryptocurrency sector. It is a way for traders and investors to earn money from the price fluctuations of the currency without necessarily holding the token.

Analysts think that increased ETF choices, particularly for widely popular altcoins such as Ripple Coin and Solana, may bring bigger institutional investors to the crypto space. Initial indications are that there is already increased attention, as both these coins experienced increased institutional demand since the new products were introduced.

Futures-based exchange-traded funds provide an easier and more secure way for investors to trade risky crypto assets without exposing themselves to the dangers of holding them directly, like hacking or private key loss.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.