In a major win for the crypto industry of the United States, the Senate has passed the GENIUS Act. It is a revolutionary bill that frames the prior official rules for stablecoins. It gets 68-30 votes, with significant support from Republicans as well as a group of Democrats. The bill now heads to the House of Representatives, which is already working on a similar version.

The GENIUS Act could bring a wave of innovation at the global level. It offers strict but clear guidelines for payment stablecoins, digital tokens backed 1:1 by U.S. dollars. Under the new law, stablecoin issuers must hold full reserves, publish monthly audits, and obtain either federal or state licenses. It also restricts risky practices like misappropriating funds or creating algorithmic currencies. Most importantly, compliant stablecoins will officially not be considered as securities which mean that they will not be under the governance of SEC. The current market cap of the first largest stablecoin USDT by Tether is $155.15 Billion.

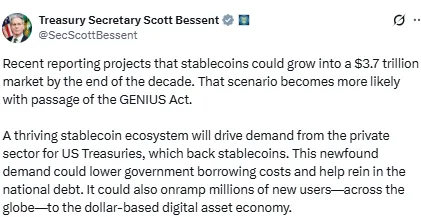

U.S. Treasury Secretary Scott Bessent appreciated the Senate vote. He threw light on the long-term impact of the Genius Act. In a post on X (formerly Twitter), he estimated the stablecoin market could reach $3.7 trillion by 2030, a scenario now far more likely thanks to this new legislation.

Source: Treasury Secretary Scott Bessent X Handle

Bessent said that an evolving stablecoin market would bring huge demand for the U.S. Treasuries, which are used to back these digital assets. That private-sector demand could help lower the government’s borrowing costs and slow the growth of the national debt. At the same time, it could connect millions of people, especially in developing countries, to the dollar-based digital economy.

“It’s a win-win-win,” Bessent wrote.

For the private sector

For the Treasury

For consumers

“These are the results of smart, pro-innovation legislation,” he further added.

Supporters of the GENIUS Act believe it could help the U.S. dollar stay dominant in a digital world. By giving stablecoins legal clarity and safety, the bill makes the digital dollar easier to use globally, for savings, remittances, and business payments. The biggest supporter of this Act, Coinbase CEO, Brian Armstrong has also shared the news through his X post calling it a milestone bill.

Senator Bill Hagerty, who introduced the draft, called it a turning point for United States. financial leadership. “This bill will cement U.S. dollar dominance, protect customers, and drive demand for U.S. treasuries,” he said.

The new rules also have a ripple effect beyond stablecoins. Since these currencies are often used to buy Bitcoin and other crypto, a stronger stablecoin system could boost wider crypto adoption. It could also improve the way people send money across borders, making transactions faster and cheaper.

If the House approves this Stablecoin Bill, tbe Genius Act, the Unite States will lead the way in setting global crypto standards. It would be a landmark moment for both the digital economy and U.S. financial power in the 21st century.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.