SharpLink Gaming, the second-largest corporate holder of Ethereum, has increased its Ethereum (ETH) treasury significantly, now totaling 740,760 ETH. This marks an addition of 11,956 ETH in just four days. The company’s acquisition included a notable purchase of 143,593 tokens last week at an average price of $4,648.

Source: X

At the time of writing, the price of ETH is above $4,100, and as such, the holdings of SharpLink are worth more than $3 billion. This rise secures its position as a big player in the Ethereum treasury companies, second only to BitMine Immersion, which controls over 1.5 million ETH.

SharpLink's ETH accumulation follows recent financing breakthroughs. The company raised $146.5 million through an At-the-Market facility and another $390 million through a registered direct offering, which closed on August 11. These proceeds of SharpLink are expected to make it a larger player in the sale of Ethereum.

The firm reports having over $84 million cash on hand. With this huge pile of cash, SharpLink can go out and buy much more ETH in the days to come. This build-up looks to be part of a larger objective by SharpLink to establish a larger footprint in the burgeoning Ethereum ecosystem.

Meanwhile, a well-known investor, James Wynn, opened a 25x leverage long position in the biggest-ever confidence exercise on the part of any investor for the future appreciation of the cryptocurrency. At the time Wynn entered, the sale price was $4,227.5, with the position staring at $4,239.5.

In comparison to the possible profits, the risk taken by Wynn is significantly great, since a market going down could produce unworthy irrecoverable losses to him. At present, the position is in a loss of $1,342.53, lending testimony to the volatility of the price of the altcoin. These developments underscore the risks that come with high-leverage trading in a fluctuating market.

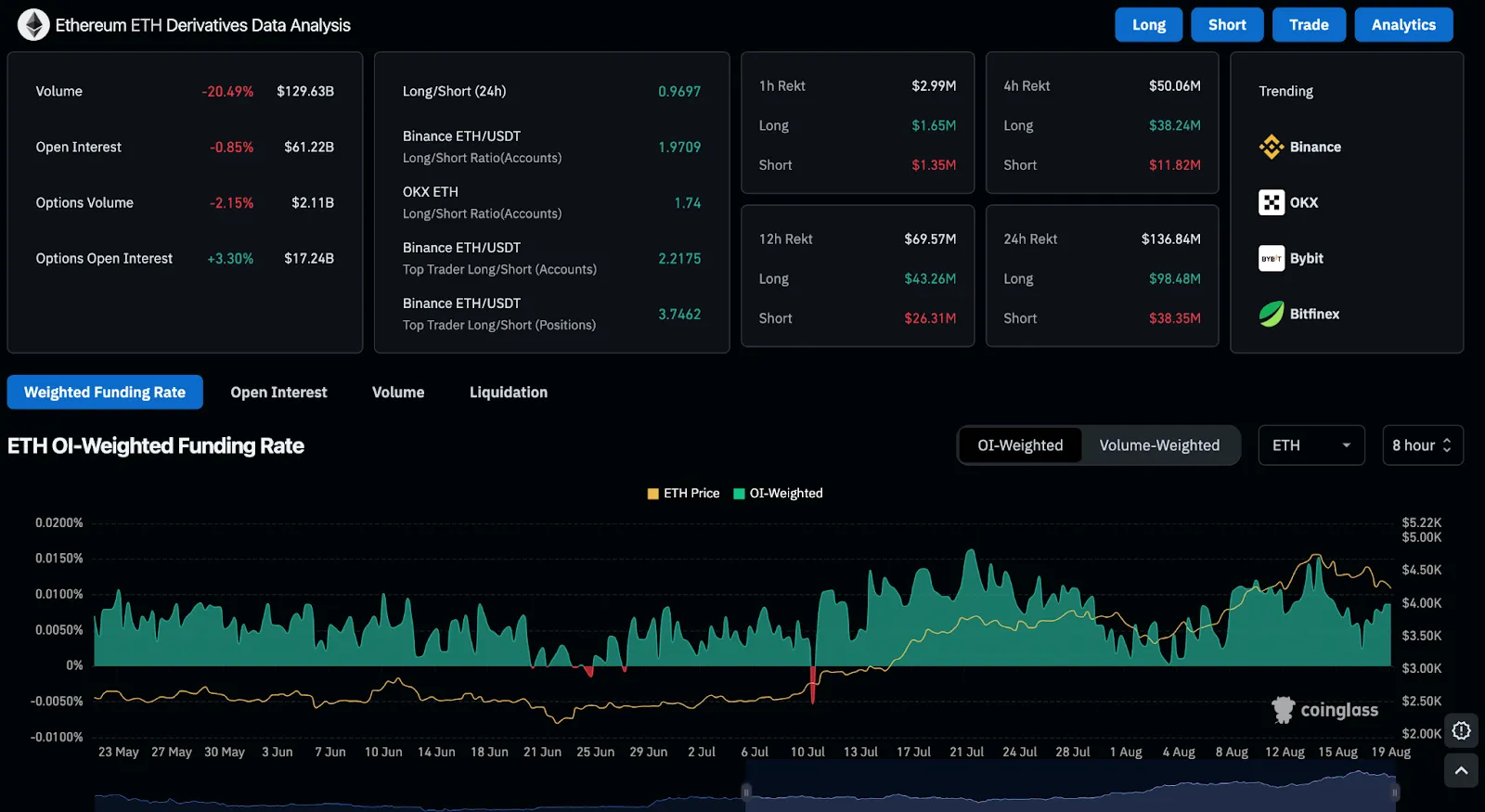

From CoinGlass data, it becomes evident what the overall sentiment in altcoin's derivatives market is neutral. There has been around 20.49% decline in volume, touching $129.63 billion. Along with this, open interest saw a slight drop of about 0.85% to $61.22 billion.

Source: Coinglass

This suggests that we are entering a period that has seen diminished market participation, possibly a sign of cautious sentiment from traders. Yet, there is still a growing interest in longer-term speculative positions, as seen by a 3.30% rise in altcoin's open interest in options. This indicates that while short-term volatility may pose a concern, long-term notions toward the altcoin remain bullish.

In the past months, there have been fluctuations in funding rates for the altcoin's futures contracts, with positive spikes appearing around mid-July. These positively charged readings began to temper and became fairly neutral throughout August, reflecting an equilibrium between long and short traders in the market.

Being long dominated on major exchanges like Binance and OKX, particularly for periods of 1 hour to 12 hours, further supports a scenario where majority of traders are expecting upward movement for Ethereum. However, short-term volatility floats heavily as a contender in return.

Kelvin Munene is an experienced crypto and finance journalist with over five years in the industry, known for delivering detailed market insights and expert analysis. Holding a Bachelor’s degree in Journalism and Actuarial Science from Mount Kenya University, he is recognized for his thorough research and strong writing abilities, especially in cryptocurrency, blockchain, and financial markets. Kelvin consistently offers timely, accurate updates and data-driven perspectives, helping readers navigate the complex world of digital assets. His work focuses on identifying emerging trends, analyzing market cycles, exploring technological advancements, and monitoring regulatory changes that influence the crypto sector. Outside of journalism, Kelvin enjoys chess, traveling, and embracing new adventures.