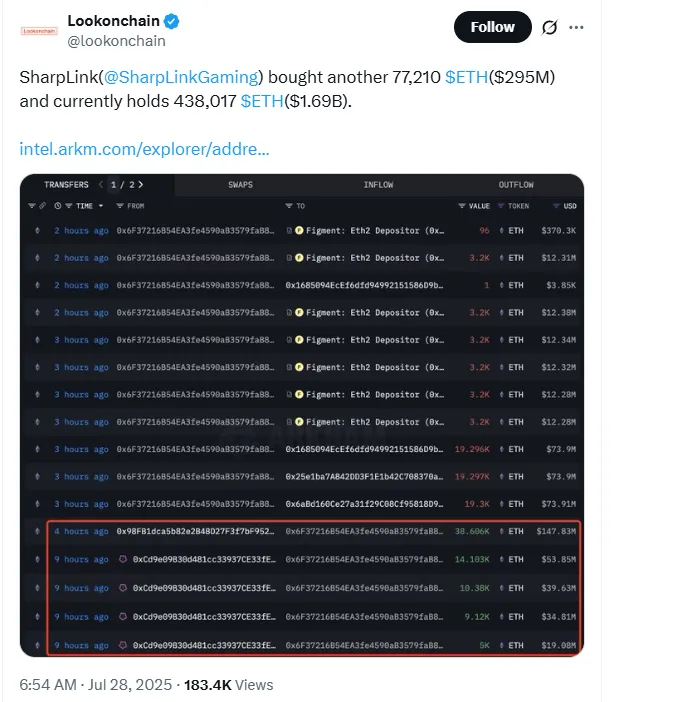

Sharplink has once again made waves in the world of crypto by buying 77,210 ETH worth $295 million on July 28, 2025. This strong move has pushed the firm’s total Ethereum holdings to 438,017 ETH worth $1.69 billion.

According to on-chain data shared by Lookonchain the purchase was made from over-the-counter(OTC) which deals through Galaxy Digital.

Source: X

Earlier this week SharpLink Ethereum had already transferred $145 million in USDC to Galaxy and hinted that the buying storm was far from over.

What’s more fascinating, this spree shows no signs of stopping. The firm appears to be shaping a full-fledged focused treasury strategy. In the month of July alone, the firm scooped up more than 16,000 ETH through similar OTC channels.

Rather than sitting idle almost all of its ETH is actively staked to generate passive yield. This dual movement of the firm to accumulate and earn shows that SharpLink sees ETH not just as an asset but as a foundational pillar of its long-term financial infrastructure.

SharpLink’s aggressive strategy is not just about holding digital coins but it is a blueprint for corporate crypto adoption.

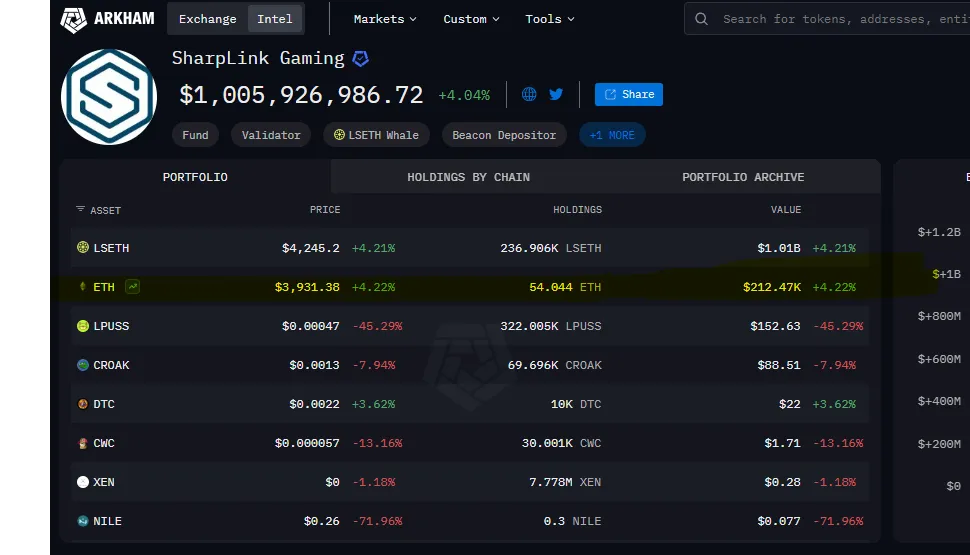

According to crypto intelligence platform Arkham, currently it has total 54.044 coins, and trading at $3,931.38( at the time of writing)

Source: Arkham

By funding its asset purchases through At-the-market equity offering the company ensures liquidity without overexposing itself to risk. This ambitious approach of SharpLink is sparking conversations in the business world about how companies can integrate crypto in their balance sheets with confidence and reward.

The firm is aggressively buying, as its asset which shows a bold move. It might be a strategy to collect more as the rise in price has been seen in the last month. On June 30,2025 it was trading at $2,519.13 and currently trading at $3,887.43 that means in just one month it raised by $1,269.25 most probably, in upcoming weeks its prices soars up to $4,500.

Source: CoinMarketCap

SharpLink’s rapid ETH accumulation , aggressive staking strategy and bullish market timing paint a clear picture that the company is in it for a long time. With every major purchase the company is not just growing its crypto portfolio but it is shaping how corporations globally could approach digital assets in the future.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.