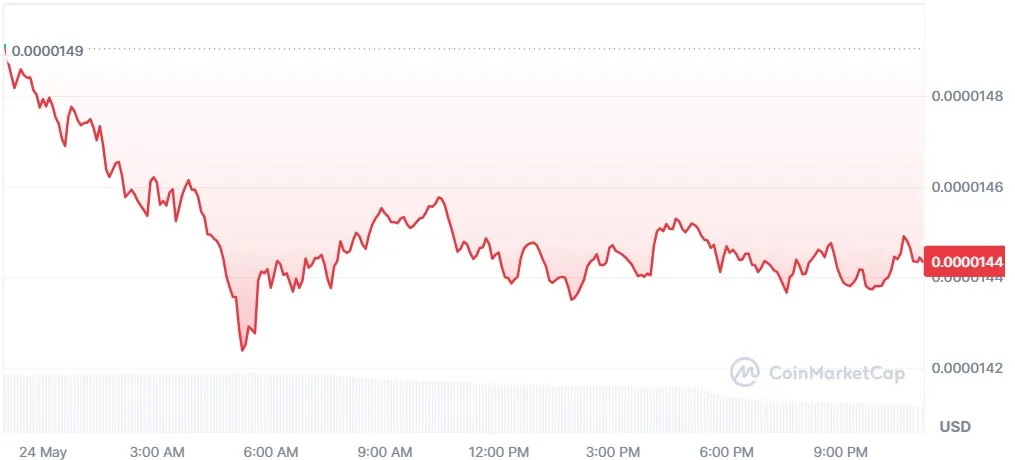

Even after burning over 14 million SHIB tokens in the last 24 hours, the Shiba Inu coin price crashed hard around 2.92% to $0.00001442, according to CoinMarketCap’s live data.

Source: CoinMarketCap

Trading volume also dropped to $220 million, showing that interest among retail traders may be cooling off.

This comes as no surprise to those following Shiba Inu news today, where the community continues discussing the effectiveness of burn tokens. With the total burned supply now around 410.7 trillion tokens, the recent burn made little impact because the circulating supply still remains close to 999 trillion coins.

Even with this much burn every day, the market reacted badly, creating a lot of questions about why Shiba Inu is falling today and if the coin has peaked. The actual burn rate also fell by 39%, an indication that one of the project's main support strategies is causing a slowdown.

The rationale for token burns is straightforward: supply down, demand up, potentially price up. However, with an overall supply that is so high, burning 14 million SHIB barely puts a dent in the supply.

As a result, traders are now asking why it is going down, when it has an actively functional burn mechanism in place. Clearly, the token price drop today wasn’t just a function of burn numbers; it was also a function of broader market moves.

One possible silver lining is its close connection to Ethereum. Since SHIB runs on the Ethereum blockchain, analysts of Coingabbar have pointed out that it often mirrors ETH’s performance. If Ethereum manages to push up to $4,000, then its price prediction could see some upside as well.

In his analysis, shared across trading communities, he highlighted that this coin is currently above its 50-day moving average, and forming a Golden Cross—both signs that could support a bullish run. If $ETH makes the move, this coin could follow and reverse the ongoing crash into a recovery.

Bullish scenario: It may reach $0.00001945 or even $0.0000221 if ETH climbs higher.

Bearish outlook: If this cryptocurrency dips below $0.000012, we could see a drop back to $0.00001080, the lowest point of this year.

These levels reflect the current sentiment behind the price prediction discussions, which are getting more cautious. Long-term holders still believe in a bigger move later, looking ahead to price forecast 2025, but near-term momentum remains shaky.

So, will more token burns help push the price up? Maybe someday—but not just yet. The amount burned needs to be much higher to truly affect market supply. For now, the project’s fate seems tied more to Ethereum than to its own actions.

Investors wondering why it is going down should consider both on-chain actions and the broader market. While the latest Shiba Inu coin price crash is frustrating, all eyes now turn to ETH. If Ethereum rallies, SHIB could bounce—but without that push, short-term gains may remain limited.

Always do your own research before investing, especially in meme coins like $SHIB, which remain highly volatile and sentiment-driven.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.