Canadian company Sol Strategies has applied to list its shares on the Nasdaq exchange, a significant move that indicates its increased emphasis on the Solana blockchain. The firm is already listed on the Canadian Securities Exchange (CSE) under the ticker symbol "HODL" but now seeks more global scope by making an entry in the U.S. market under the ticker "STKE."

The company submitted a Form 40-F to the United States SEC, a requirement for Canadian companies that want to trade on U.S. stock markets. This filing was made public recently, and not long after, the company’s stock price jumped over 4% on the CSE. The move to the Nasdaq, as it is the world’s second-largest stock exchange by market cap, will assist the organisation obtain visibility. It will also attract more investors, specifically from the United States.

Source: Securities and Exchange Commission

What makes this organisation different is its huge emphasis on the SOL token. It is one of the biggest blockchain networks known for high speed and low fees. The organisation is developing its treasury with more than 420,000 SOL tokens, worth about $61.3 million as of early June. The organisation also operates several Solana validators that will ensure securing the network.

In the month of April, the organisation issued $500 million for convertible notes. That money was used to buy and stake SOL, showing how confident the company is in the long-term value of this altcoin. Then in May, the company also filed a prospectus with Canadian regulators, aiming to raise up to $1 billion to invest even more into the Solana ecosystem.

The timing of this Nasdaq move is interesting because this crypto is gaining more attention from big financial firms. Companies like Fidelity, VanEck, and Franklin Templeton have recently filed proposals with the SEC to launch spot Solana ETFs (exchange-traded funds). These Exchange Traded Funds will enable investors to purchase into SOL token without the requirement to hold the actual crypto.

VanEck has already listed its "VSOL" ETF on the DTCC (Depository Trust & Clearing Corporation), which is a major move toward approval. If approved, this digital currency would become only the third crypto after Bitcoin and Ethereum to get a spot ETF in the U.S. market.

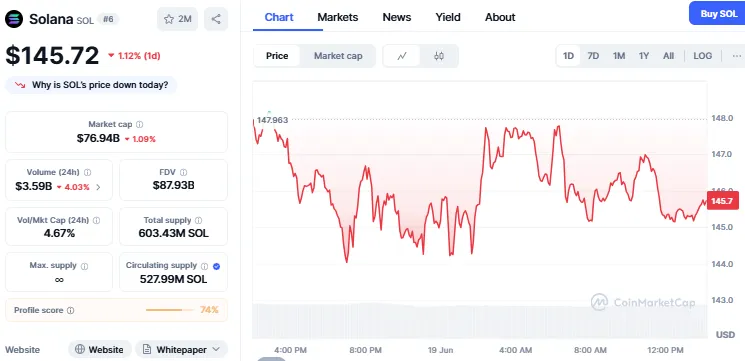

While Solana’s price hasn't moved much after the announcement, due to the current weak market trend, the long-term outlook appears promising. The currency is now trading at $145.72 with a decrease of 1.12% in the last 24 hours. The trading volume has also decreased by 4.03% depicts less movement.

Source: CoinMarketCap

Financial analysts, including those from Cantor Fitzgerald, believe that firms investing in Solana may benefit from the blockchain’s growing use in tokenized assets and finance apps.

By going to Nasdaq, Sol Strategies isn't simply pursuing publicity, it's becoming a market leader in the Solana-centered investment sector. With both a healthy SOL treasury and fresh capital incoming, the firm has the potential to be a giant in the world of crypto investment.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.