What if one country could control the value of one of the top altcoins? That’s the question Ripple holders are now asking as shocking data reveals how South Korea’s XRP control is pulling headlines in the latest XRP news today. While global exchanges play their role, a surprising amount of power may rest in the hands of traders from just one platform—Upbit.

Let’s dive into what really happened, what experts like Dom are warning, and what this means for the token’s future.

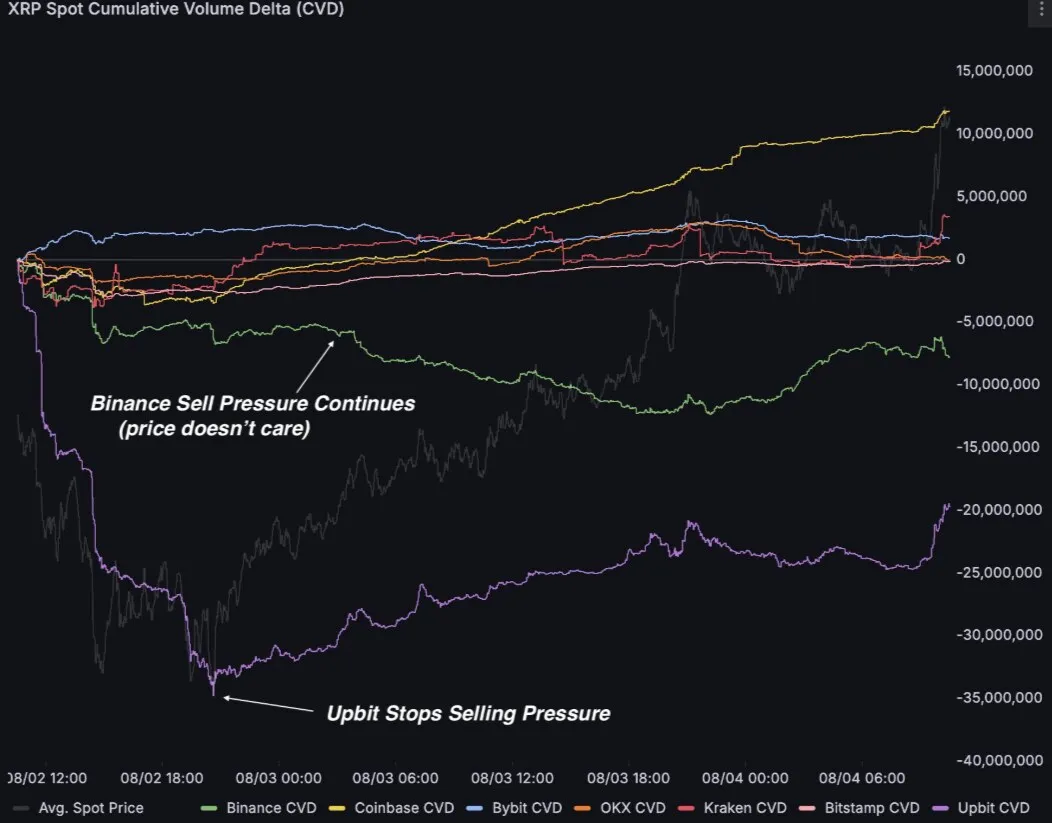

On August 1, something unusual happened in the altcoin market. Traders from Seoul-based market largest crypto exchange, Upbit, suddenly sold 40 million tokens within 24 hours.

This massive selloff wasn’t just large—it was bigger than all net ripple sales from other global exchanges combined. This unexpected move led to a steep market level drop. The token fell from its yearly high of $3.66 to a low of $2.73.

Many believed it was just a normal market correction, but as per my analysis being a crypto observer, this selloff tells a deeper story—one that shows possible South Korea news today hidden action.

The community was celebrating a 64% rally earlier on July 18, only to be met with a sharp XRP price manipulation. Dom, a leading crypto analyst, highlighted when Korean whales on Upbit started selling, the price dropped quickly.

Source: Dom’s X Post August 3, 2025

Yet, as their selling cooled off, the coin quickly bounced back toward the $3 mark despite Binance traders continuing to exit. This shows how one group of users, from one exchange, can play a major role in moving a token’s value.

Crypto analyst Dom took a closer look at the charts and trading volume. He pointed out a never-before-seen pattern that the digital asset had broken out of a long 7-month range against crude oil (USOIL). But the breakout didn’t last. By August 1, this cryptocurrency was back to testing old support levels.

If the token goes back fully into that old trading range, the bullish setup could break down. His analysis strongly hints that South Korea XRP control is a key factor behind this pattern.

Right now, the Ripple token price today is hovering near $3.05. The top analyst says the most important level to watch is $3.12 resistance level. If it can close above this level, the market might flip back to bullish mode.

Here’s a quick look at the technical picture from a TradingView chart study:

Current Support: $2.90

Immediate Resistance: $3.12

RSI Level: Around 54 – showing neutral-to-positive momentum

Breaking $3.12 could push the XRP price prediction surge to the $3.35–$3.50 range. But if it fails, the value may fall back to $2.75 or lower.

Will Ripple’s fate really lie in Seoul’s hands? Watch $3.12 like a hawk. Well, It all depends on what happens next. Whether you are an investor or just watching from the sidelines, this is a moment to pay attention. If buying interest increases, and the Korean whales don’t start selling again, the asset has a chance to climb higher.

But if Upbit users begin another wave of selling, the asset price could slide again. The South Korea xrp control discussion is no longer just theory—it’s being supported by real data and trading range action.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.