The big day for the Spur Protocol listing date has been moved. Instead of launching on December 19, 2025, the new date will be in January 2026.

This $SON coin news has sparked multiple questions in the crypto community regarding why the token was delayed, what’s the potential impact on the market, and what will happen in 2026?

In this article, we will explain everything from the $SON listing delay reasons to what next.

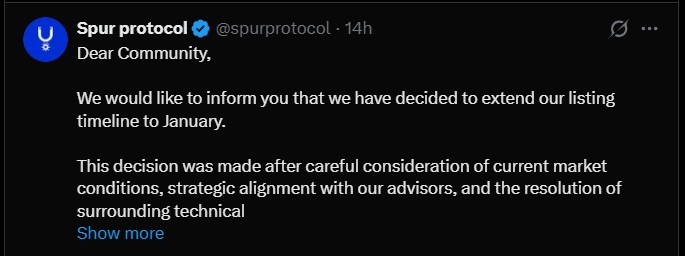

The team behind Spur Protocol shared on X that they are pushing back the launch date to January, 2026. As per the team, the decision to push the debut was made after careful considerations of the following things:

The current crypto crash and weak market sentiment.

Taking guidance from advisors to stay aligned with long-term goals.

Fixing and finalizing any remaining technical issues.

Important note for the community: “They are also keeping the "community fundraising" open until January so more people can join in before the new Spur Protocol listing date announcement.

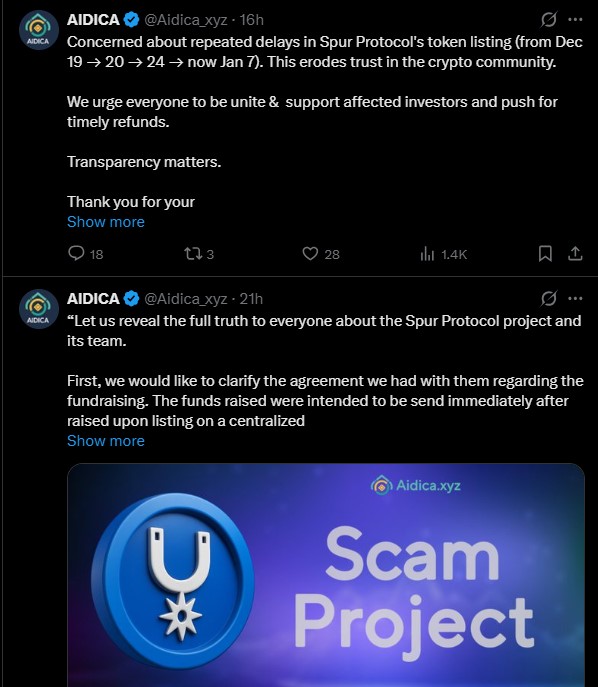

A big Spur Protocol listing date delay reason is a falling out with their partner, AIDICA. The team says AIDICA didn’t fully understand how the project worked, and there were issues with their contract.

Because of these problems, they stopped working together. Things got messy when AIDICA official X post called it a “scam project,” which made people question if Spur Protocol is legit.

Even after the new $SON launch date January 2026, many are wondering if the upcoming month’s debut will be postponed yet again. As per Coingabbar’s market research, there are a few things that could affect this decision. Let’s take a look at them:

1. Current Market Condition: Right now, the crypto market cap is around $2.98 trillion, with a 2% rise in the past 24 hours. However, Arthur Hayes, co-founder of BitMex, recently said that Bitcoin could trade between $80,000 and $100,000 in the near future.

If BTC $80K prediction turns real, this will cause a major crypto market crash, which may cause $SON to reassess its debut plans.

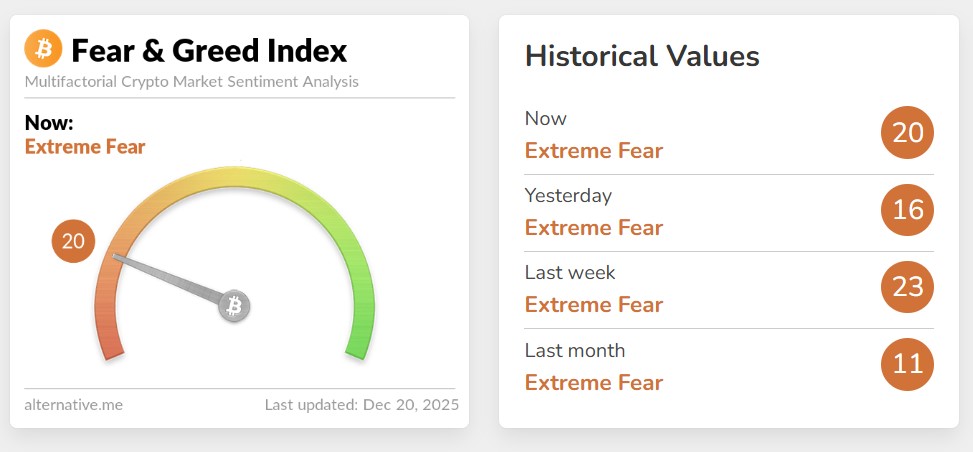

2. Crypto Fear Index on Rise: The Crypto Fear and Greed Index has been in the “Fear zone” for seven weeks, says Ted a well known analyst.

As seen in the above chart right now, it is at 20 (Extreme Fear). When people are scared, they don't buy new coins. If this doesn't change, the new Spur Protocol listing date could be delayed again.

3. Talk of a Market Bloodbath: Some big investors (called "whales") are betting that prices will drop soon. OxNobler, an insider whale tracker, revealed a whale opened a $90 million short position on Bitcoin ahead of Trump's upcoming announcement.

If a "flash crash" happens, the team might decide that January is still too risky for the $SON token launch.

The Spur Protocol listing date delay is a big deal, but it might help the project in the long run. The AIDICA partnership fallout and ongoing market volatility are factors that cannot be ignored.

Whether the $SON January 2026 launch becomes the official month or more delays arrive, the team’s transparency and long-term success will be key in determining the projects’ future.

Disclaimer: This article is just for information. It is not financial advice. Crypto is risky, so please take expert’s help and do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.