Standard Chartered has been potentially bullish on $SOL, raising its long-term Solana price target to $2,000 by 2030, despite reducing the short-term outlook of 2026-end to $250 from $310 looking at current broader volatility.

Source: X Official

The London-based global bank, which manages around $800 billion in assets, believes Sol’s dominance in micropayments, stablecoins, and real-world applications gives it a major edge over other powerful blockchains.

The report, released around February 3, 2026, was authored by Global Head of Digital Assets Research, Geoffrey Kendrick, at Standard Chartered.

Here’s how the asset expert defined the long-term roadmap of Solana price prediction:

$250 by end-2026 (down from previous target of $310)

$400 by end-2027

$700 by end-2028

$1,200 by end-2029

$2,000 by end-2030

From current levels near $97, the 2030 target implies nearly 1,900% upside, assuming continued adoption of the network and its utilization.

Standard Chartered’s confidence is rooted in real network usage. The bank highlighted the platform's low fees, high speed, and scalability, which make it ideal for everyday payments and large stablecoin transfers.

Low Cost: In 2025 alone, Solana processed more than $1 trillion in stablecoin volume. It became possible because of the network’s very low transaction fees, ideal for micropayments instead of spending extra on other expensive chains.

Fast Speed: The network can support up to 65,000 transactions per second (TPS), and on a regular-basis, it consistently handles 1,000–4,000 TPS. Daily transactions recently hit 109.5 million, a two-year high, while weekly totals have reached 1 billion transactions.

Network Upgrades: On the technology side, Solana is preparing major upgrades. The Alpenglow consensus upgrade, expected in early 2026, aims to cut block finality from 12 seconds to just 150 milliseconds. This follows the Firedancer client rollout, which improved network stability and validator diversity.

The increasing trend in the Solana-based memecoin also potentially supports its market status as they alone contribute around $4.7 to $5 billion in $37.8 billion total memcoin market value as per DefiLlama. On the other SOL-ETFs, DEX activities, and stablecoin, all empower its significance which ultimately support long-term price predictions.

While the long-term outlook is bullish, Standard Chartered reduced its end-of-2026 $SOL price target to $250, down from $310. This adjustment reflects current market conditions rather than weakness in the network’s fundamentals.

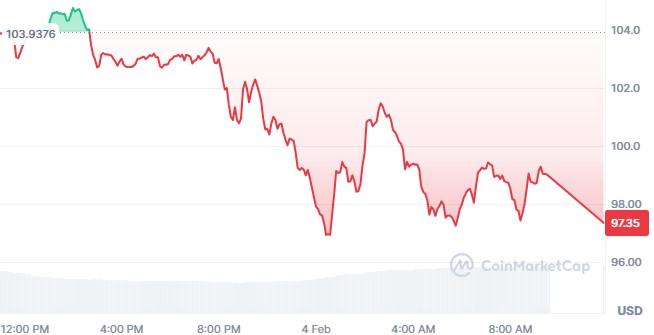

$SOL has recently fallen below the key resistance level of $100 to $97.30, down 6.15% in 24-hour, extending its 22% weekly down. Moreover, the asset lost more than 50% of its value in Feb 2025 comparison. The situation is similar for many major crypto tokens, like BTC, ETH, who are also suffering to catch up the momentum after the October 2025 market collapse.

Source: CoinMarketCap Data

Despite the price decline, its on-chain activity continues to grow. Daily active addresses recently surged to 5 million, nearly doubling from early January levels. DEX activity is also strong, with Total Value Locked (TVL) around $7.3–$7.6 billion, near all-time highs.

These figures further reinforce the bank’s view that Solana’s usage is expanding even during bearish phases.

Standard Chartered’s Solana forecast highlights a clear contrast: short-term price weakness versus strong long-term fundamentals.

While market fear, technical breakdowns, and risk-off sentiment are pressuring SOL today, real network usage continues to grow. With rising stablecoin volumes, record transactions, upgrades, Solana remains one of the strongest long-term blockchain bets, according to one of the world’s largest financial institutions.

In the end, as always, these are forecasts – not guarantees, and investors should watch key support levels, on-chain data, and regulatory developments closely.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.