Why would a company that loves Bitcoin suddenly focus on holding cash? This is the big question many crypto investors are asking after Strategy (formerly MicroStrategy) announced a major increase in its Strategy USD Reserve.

On December 22, 2025, the firm confirmed that it added $748 million to its cash reserves. The move saw the total Strategy USD Reserve climb to $2.19 billion even as the firm continues to hold a huge amount of the cryptocurrency.

Michael Saylor’s firm is known for its conviction in the largest cryptocurrency and buying frequently, no matter the price. This time, the company took a brief break in accumulating the crypto asset as prices fell sharply.

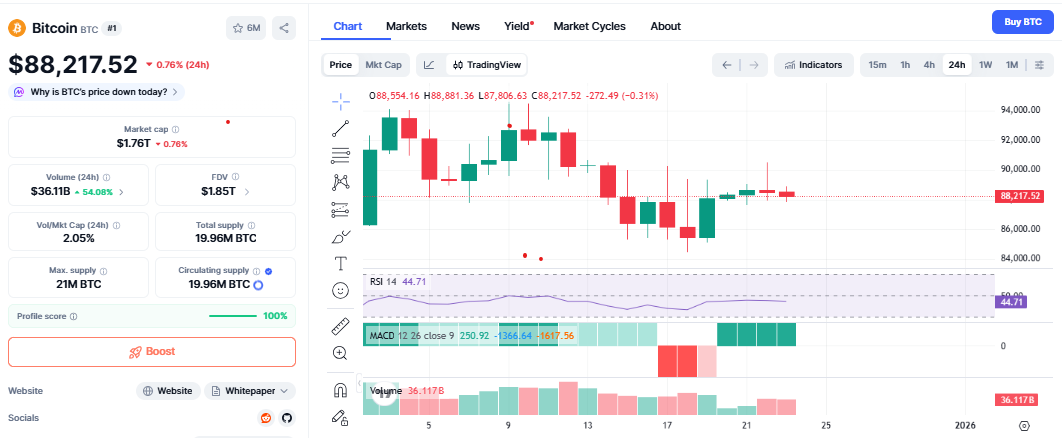

As per the Coinmarketcap, the currency is now trading near $88,000, down almost 30% from its recent high. During this fall, the organisation did not sell any amount of the cryptocurrency. It went on to increase the USD Reserve, strengthening the overall balance sheet.

Source: CMC

This then shows that the cash reserve is put in place for a safety buffer. In essence, the company wants to have enough cash to pay dividends against its preferred stock and interest costs without having to sell coins in a weak market.

The company is holding an immense stash even after halting purchases. The company holds 671,268 BTC worth close to $60 billion at current prices.

This makes them the world's largest corporate holder. So, while for some quarters the cash build-up reflects caution, others see it as smart planning.

BTC maximalists hailed the move, stating this shows long-term confidence. Critics, among them Peter Schiff questioned Strategy why chose dollars instead of gold. Most analysts still believe liquidity is essential during such uncertain times.

The digital asset is down 0.63% in the last 24 hours and has continued a broader decline seen for the past two months.

There are three reasons of this weakness:

New money entering in this cryptocurrency has slowed down.

Strong selling pressure around the $93,000 level

Investors remain cautious, despite long-term interest in ETFs

Technical signals are mixed, pointing at a struggling market, which might see further selling if prices fall below $86,000.

Even with short-term weakness, big institutions have not turned their backs. BlackRock recently highlighted Bitcoin as a key investment theme for 2025.

Source: X (formerly Twitter)

Its BTC ETF, the IBIT, still maintains more than 777,000 BTC, indicating large investors still believe in it's future, even if they're cautious for the time being.

Bullish: If it remains above $86,000, it could slowly recover toward a range of $92,000–$93,000.

Bearish: If it falls below that support level, it might force prices closer to $81,000.

Thus, in this uncertain phase, the Strategy USD Reserve gives flexibility to the company to wait, stay calm, and buy this digital currency again when it may feel the time is right.

The increased Strategy USD Reserve to $2.19 billion does not mean that Michael Saylor’s firm is stepping away from the digital asset; rather, it shows balance. With large cash reserves and a huge BTC treasury, the organisation is preparing for both the near-term pressure and long-term opportunity. In a volatile market, that might just turn out to be its biggest strength.

Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing in crypto markets.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.