This stablecoin has just sent a shockwave through the crypto market, breaking out of its tight range, hitting a local high near $0.348, and recording a 180% surge in 24-hour trading volume.

In the latest $TRX news today, this bullish volume spike often signals whale activity or institutional inflows, especially when paired with strong on-chain fundamentals, fueling Tron price breakout analysis near $1.

A powerful green candle pushed the coin above its consolidation range as per CoinMarketCap chart analysis. After touching $0.348, it’s now consolidating around $0.336, forming a healthy pause — not a rejection.

Key Support: $0.333–$0.335

Immediate Resistance: $0.355–$0.36

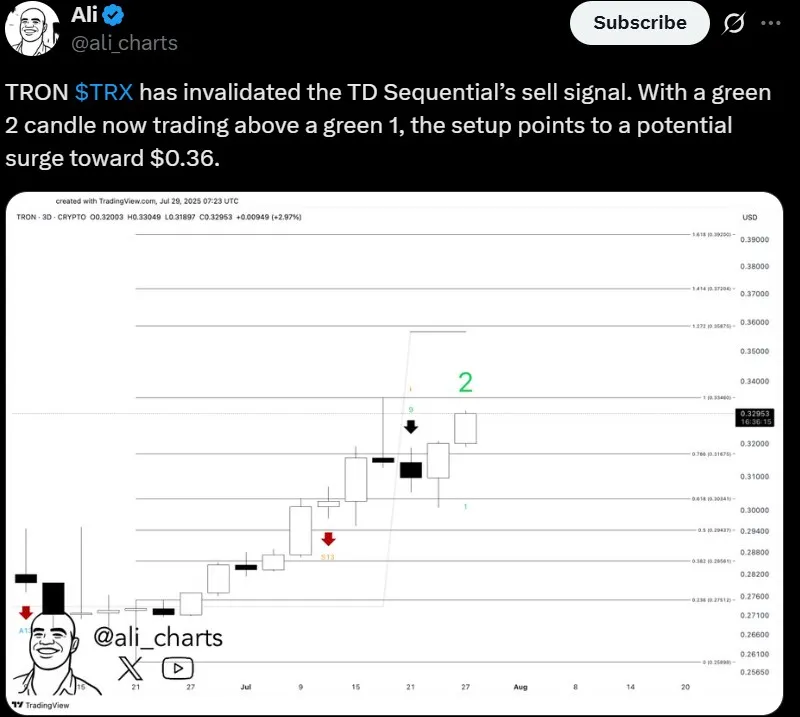

TD Sequential: Ali Charts confirms bullish continuation — green 2 candle trading above green 1

If crypto price surge holds above $0.333, a retest of $0.36 is likely. And if broken? The $0.40 comes into play.

The cryptocurrency has now crossed 320 million total users, second only to Ethereum’s 329M. If the pace continues, it could become the most-used blockchain by user count before the year ends.

Recent Network Growth (QoQ):

Daily transactions up 12.6% → 8.6M

Daily active addresses up 5.9% → 2.5M

New addresses up 16.6% → 199K/day

8%+ of wallets are new users — indicating mass onboarding

According to Tron news today, the coin made a bold leap by becoming the first-ever blockchain mainnet to ring the Nasdaq opening bell. This happened via a reverse merger with SRM Entertainment. This moment isn’t just symbolic—it opens the gates for Wall Street capital to flow directly into the blockchain’s ecosystem.

As per my research being a crypto analyst, In the past 30 days alone, its network generated $362M in on-chain revenue, more than many traditional fintech companies. So it’s no longer just a blockchain, instead an economic engine.

Short-Term Target: $0.345–$0.355

Scenario: If support above $0.333 holds, $0.36 could be retested and broken.

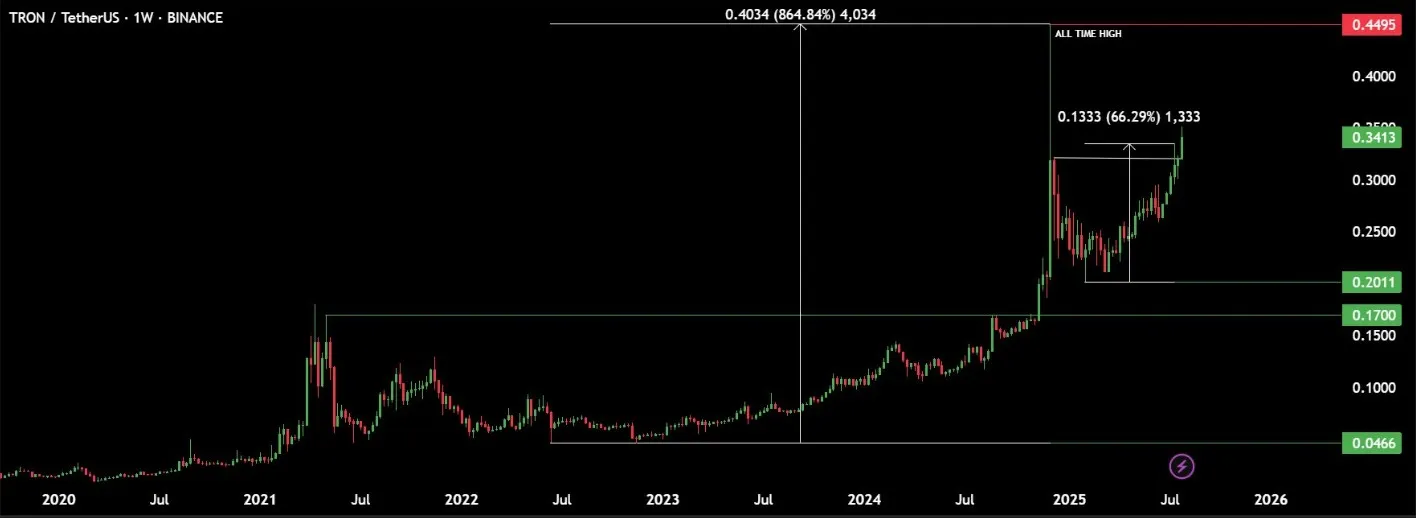

Mid-Term Target: $0.30–$0.50

Scenario: Sustained user growth and institutional inflows could push TRX back to earlier 2024 highs.

Long-Term Target: $0.60–$1.00

Scenario: In a full bull cycle, with Fed rate cuts and altcoin rotation, it could test $1 — especially if it overtakes Ethereum in user count. Even crypto analyst Lau confirmed, It has given a return of 864% to investors since July 2022.

It may not beat Ethereum on tech or decentralization, but on mass usage and stablecoin flow, it’s already closing in fast. If $TRX price breaks above its resistance level with sustained volume, the next target is $0.40–$0.50. And beyond that?

The Tron price breakout $1 dream becomes a reality, especially with Wall Street backing, Nasdaq buzz, and 320M+ users behind it.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.