The recent tweet of Kobeissi Letter on X handle highlights how President made several major announcements like tariffs on Brazil and copper imports, his strong words on BRICS, talks and deals with India and China, right when the Fed revealed its interest rate decision.

The timing suggests a possible strategy to shift market focus and send strong global signals.

Source: X

It is clear that the more the Fed holds a firm interest rate, the louder Donald Tariff gets with his moves. This tug-of-war on rates and trade is disturbing the crypto market.

Crypto investors are left confused, unsure whether this dispute will bring big gains or painful losses in the ahead days.

President has imposed a 25% tariff and an added penalty on India for buying oil and arms from Russia and also links it to India’s role in BRICS.

But, this move puts financial pressure on India as the global tensions rise and dollar faces objection, might India lean further into decentralized systems like Web3, crypto and DeFi.

These tools offer more financial independence and less reliance on politically driven systems like traditional bankings. It would be great news for Indian investors if the central government shakes hands with the decentralized systems apart from only collecting 30% tax and 1% TDS over it.

This tightens regulations for making policies and pushes stronger towards the crypto framework to avoid over-reliance on the dollar based systems.

Bitcoin is riding a rollercoaster as the global tension rises. With the Fed staying quiet on rates and Donald threatening 100% tariffs on countries trading with Russia, markets are reacting fast.

Bitcoin had just reached an all time high of $121,000 but dipped to $117,000 after President's warning. Surprisingly, after Trump Tariff announcement it saw a downfall at $116,000 and then again it bounced back and is now trading at $118,436. This shows that while short-term dips may happen during political shocks the investors still trust BTC.

In a world full of taxes, wars and uncertainty the BTC continues to act like a safe haven for those looking beyond traditional finance.

Amid the global tension of tax Bitcoin Ethereum and Solana showed a downfall in its price but gained rose later. Let’s understand the change in market prices due to Trump tariffs one by one. All mentioned sources are collected from CoinMarketCap

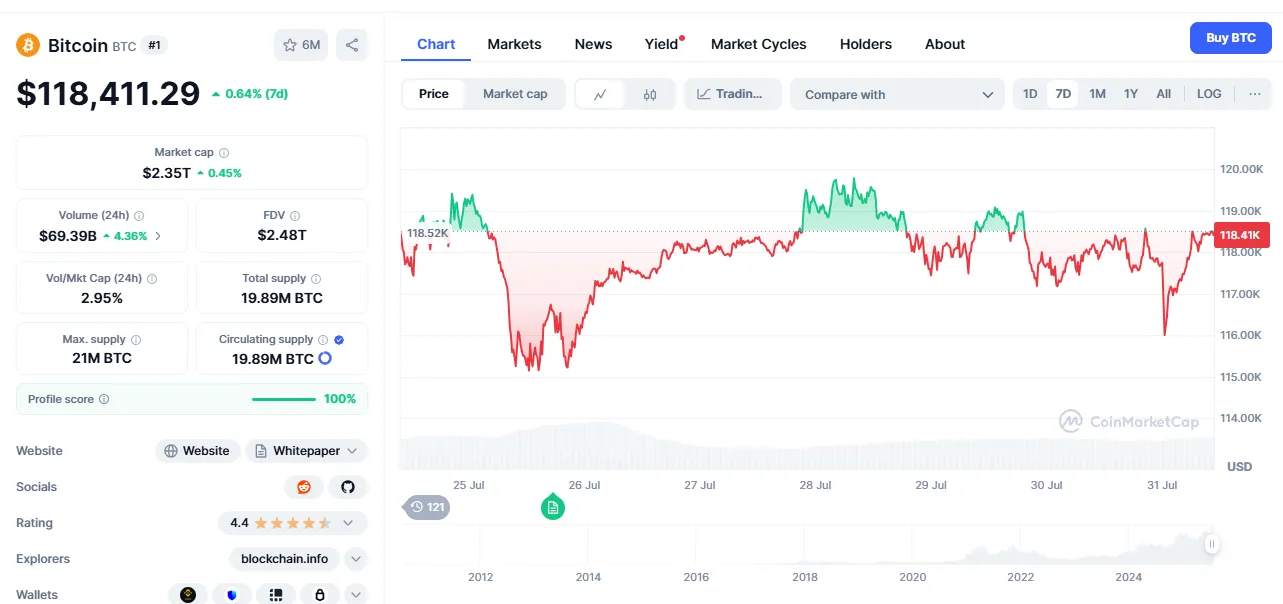

Bitcoin

Currently trading at: $118,436.12

At the time of announcement: $116,000.56

Price fall by : $2,435.56

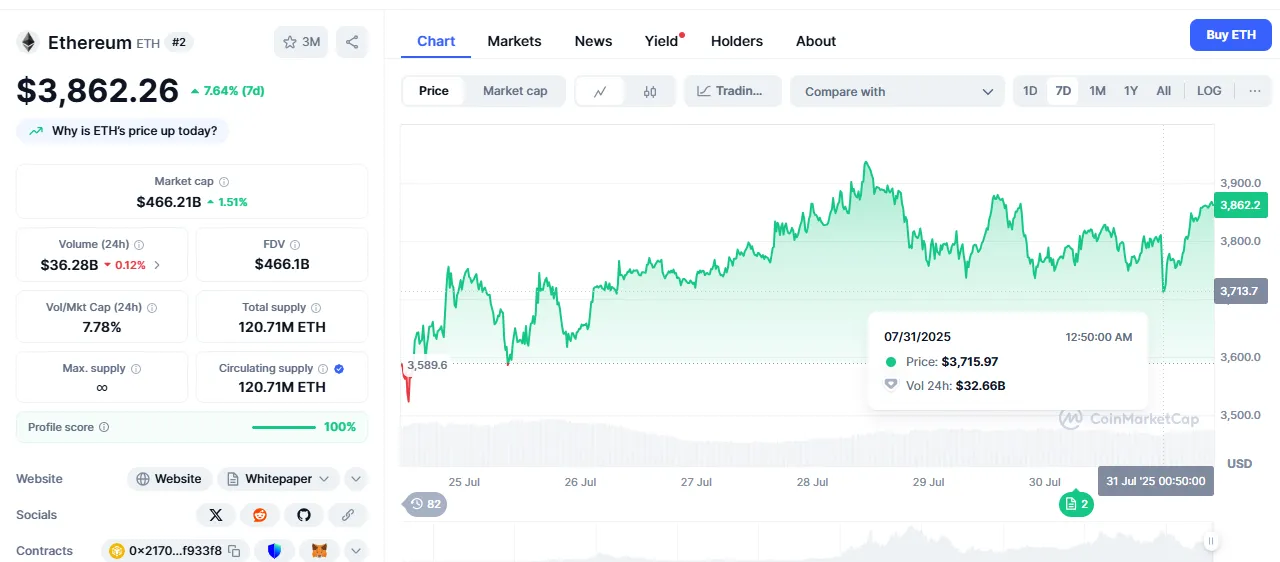

Ethereum

Currently trading at: $3,862.26

At the time of announcement: $3715.97

Price fall by: $146.29

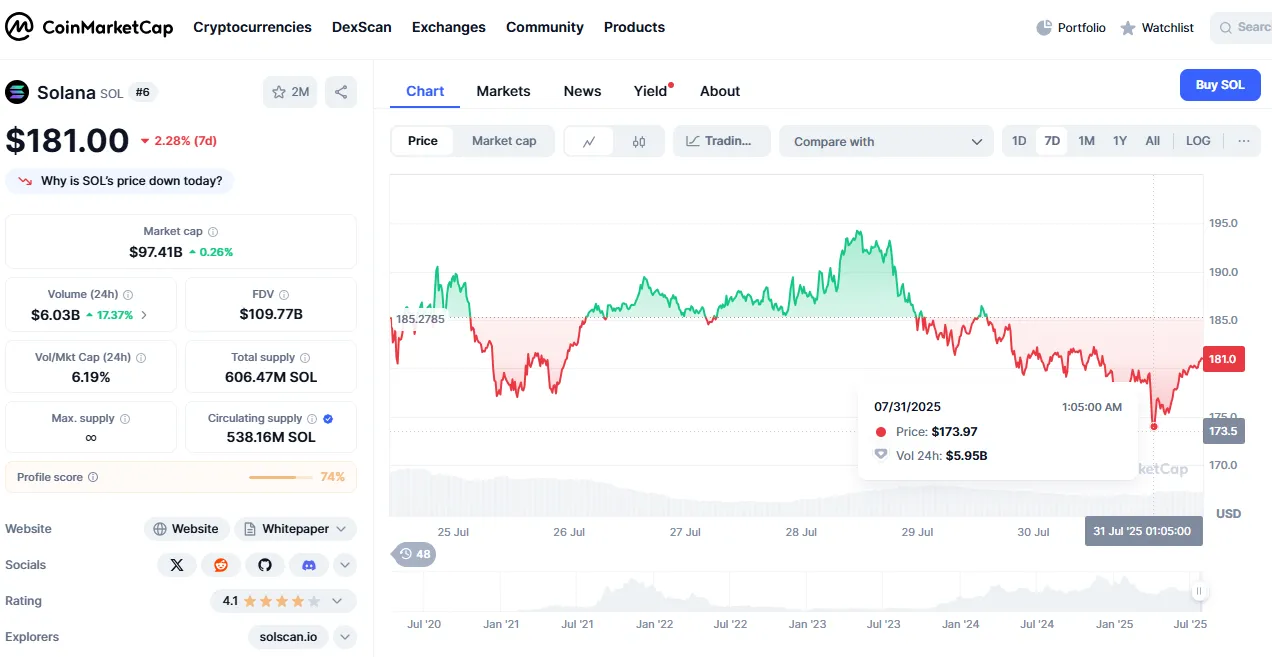

Solana

Currently trading at: $181.00

At the time of announcement: $173.97

Price fall by: $7.03

The data clearly shows that whatever the decision of the political leaders the market will show a small downfall but attain its value aggressively.

President Trump tariff news shook crypto briefly, but Bitcoin bounced back fast. This shows that despite political shocks, Bitcoin still holds strong as a trusted choice for many investors.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.