Two addresses that joined the private placement round of pump.fun’s PUMP token price have made a huge combined profit of $39.65 million in just one week. Their quick sell-offs have caught the attention of many in the world of crypto.

A recent post of EmberCN has shared the details on their X handle explaining the whole data.

Source: X

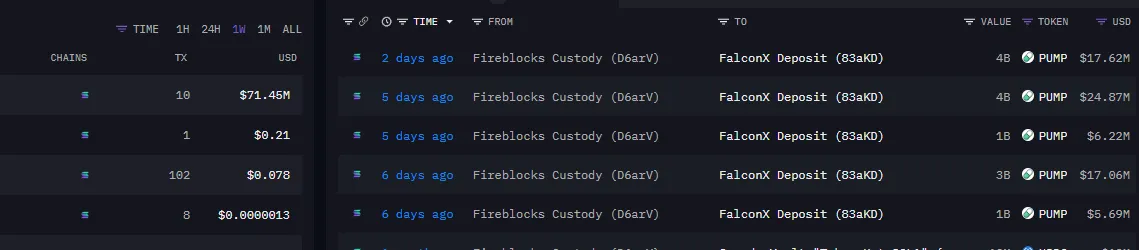

The first address called D6arV1F6dfF5xHjLNhoyTMA78KT7yDA2dGPd1cwpLazd, spent 100m USDC to buy 25 billion PUMP token price. These were bought without any lock-up and at the same price as public investors.

Source: Arkham

Last week the address sent 13 billion tokens to FalconX which later moved them to centralised exchanges. By selling at an average price of $0.0055 the address earned a profit of $19.5 million.

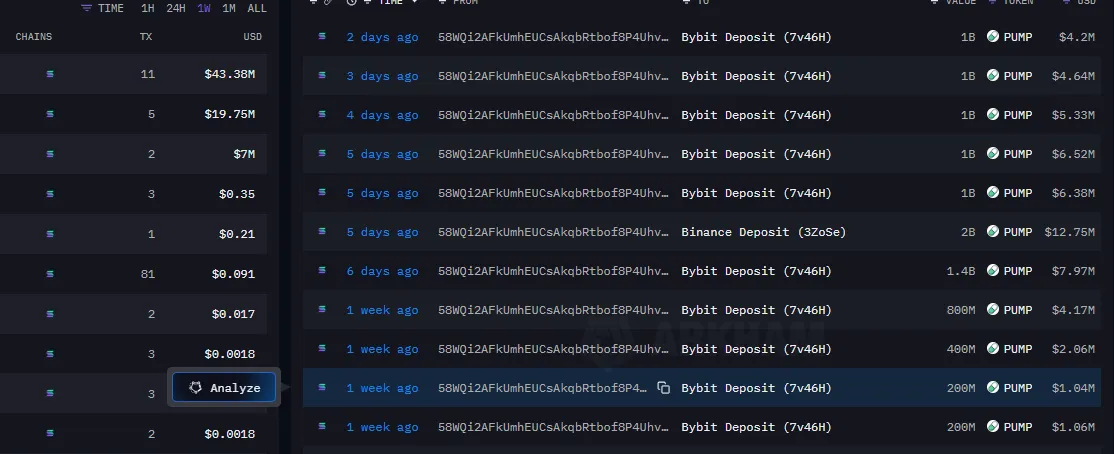

The second address 58WQi2AFkUmhEUCsAkqbRtbof8P4Uhv8r1ohLAogv33E used 50m USDC to buy 12.5 billion PUMP token price. This investor transferred all the tokens directly to centralised exchanges last week.

Source: Arkham

At an average price of $0.0056 the total profit made was around $20.15m.

Together these two addresses sold 25.5 billion tokens which is worth nearly $141 million within just one week. The data was shared by EmberCN, a blockchain monitoring platform that tracks movement and large transactions.

It raises a big question in the crypto community about the fairness of such private sell. While early investors get easy profits with no holding period, public buyers often enter later at higher risk.

When large investors sell off their tokens without any restriction it often leads to a sudden drop in the price. Similar pattern was seen in this case, PUMP token price dropped over 6% in a day with current trading price at $0.004288 and $1.51B in market cap.

Source: CoinMarketCap

This not only shakes the market in the short term but also weakens trust among long-term investors.

That’s why many people believe that future token launches should come with stricter rules to protect everyday investors and maintain stability.

These quick exits by private investors with no lock-up period raised concerns about fairness in token launches. While early participants make fast profits, public buyers are left dealing with price drops and market risks.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.

4 months ago

😀😃😄😁😆🤣😂🤣