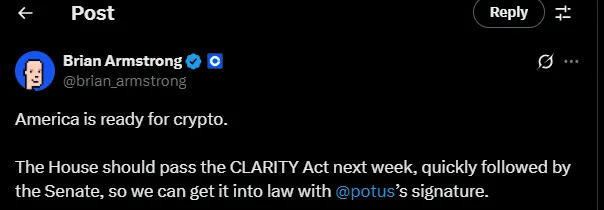

Brian Armstrong, the co-founder and CEO of Coinbase, is optimistic that the upcoming bill named CLARITY Act will pass the House and the Senate quickly for being signed by the president to be enacted as law for more clearing regulations in the crypto market. It is not only wished by the pioneer leader but from every key influencer of the Digital asset.

Source: X

The CLARITY Act, more specifically The Digital Market Clarity Bill, is a cross-party initiative introduced in May, 2025 to establish clear guidelines for the virtual asset industry. The CLARITY Act intends to clear air over Digital asset’s role as a security or commodity by separating responsibilities between the CFTC and SEC, like Bitcoin would be standardized as a commodity, whereas investment type tokens will be governed by SEC.

The Bill also includes rules for virtual money exchanges, stablecoins dealers, by protecting developers and Blockchain platforms from exaggerated norms. Putting together, it's a major step by the US government to make Crypto regulations more predictable and comprehensible.

The U.S. House designated the week as "Crypto Week” to speed-up the pushing of the state’s three major acts to shape the face of Digital Assets regulations.

First one is the Genius Act, which is already in its second phase after being passed by the senate preceding month. It includes regulations for Stablecoins, their reserve, registration and transparency.

Second, the CLARITY Act, defining CFTC and SEC roles in the regulation of the digital assets for long anticipated lucidity in market’s infrastructure.

And Finally, the anti CBDC Act, supported by market advocates designed to stop the use of centre-issued digital currencies for retail use over data privacy issues.

Backed by house leaders and Crypto-favoured President Trump's effort hinting towards a major change in the law book in upcoming days.

The Crypto industry has welcomed the Bills with open hands, appreciating them for presenting legal support and opportunistic innovation which was long anticipated. Key organisations and Crypto influencers define the bills as a step of the U.S. approaching the World leader class in the following era.

However the division in reactions can be seen in Washington. The SEC officeholders and several Democrats look at the bills as legal constraints for regulatory authorities and a scale back for investor protections. The variety of opinions showing the need of strong consumer protections with the fueling innovations.

After the House Vote, The CLARITY Bill will be headed towards the Senate, where policy leaders review and revise if necessary. The Genius, which already passed through the Senate, is seen as a compatible merger for CLARITY Act as both the Bills share the same era with a slight difference. The consolidation of both the digital Assets regulation Bills (Genius is specific for Stable Coins i.e. also a type of digital asset) is highly feasible. But let’s see because the act still needs votes from both assemblies and the president's signature to come into force.

Although the U.S. is making progress on the certainty and regulatory framework of Crypto Market with its CLARITY and the GENIUS Acts, it is still lagging behind. The EU’s MiCA has already set the crypto rules giving Europe an early advantage. If Bills passed then they will be helpful for the states to compete on the global levels. Buy latency may keep them behind other leaders like the EU, UK and Singapore.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.