Over the years, the US Govt. has quietly built up one of the largest BTC holdings in the world. The biggest chunk came recently $13.65 billion worth of Bitcoin was seized from the Bitfinex hackers.

Before that, $8.26 billion was taken from ‘Individual X’ connected to the Silk Road case in 2020, and another $1.17 billion from James Zhong, a known Silk Road hacker.

Source: Wu Blockchain

These massive seizures show just how much US Government Bitcoin is sitting untouched in official wallets, collected over years through law enforcement and criminal investigations.

According to data from Arkham Intelligence, the US Govt. currently holds at least 198,000 of this digital asset, worth about $23.5 billion. These coins are stored in wallets run by different departments, like the FBI, DOJ, DEA, and the US Marshals Service.

Source: Arkham

Interestingly, none of this currencies has moved in the last four months, which means no major sales have taken place.

This large stash of US Government Bitcoin has sparked a lot of public interest, especially because of what might happen if the govt. decides to sell even a small part of it.

On July 17, Senator Cynthia Lummis shared a post saying she was “alarmed” that the nation might have sold over 80% of its BTC, leaving just 29,000 BTC behind. She called it a huge mistake that could hurt the country’s digital future.

But this wasn’t entirely true. Arkham quickly responded, saying the 28,988 BTC she mentioned was just from the US Marshals Service. Other agencies still hold large amounts of US Government Bitcoin, and none of the known wallets have moved coins recently. In short there was no big sell-off.

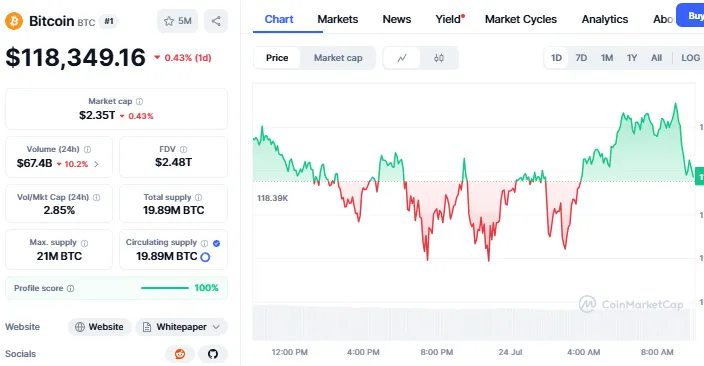

Even though the United States hasn’t sold any BTC during this US Government Bitcoin holdings buzz, just the rumor caused a little panic in the market. The price dipped for a short time, but once Arkham cleared things up, prices bounced back. Right now, It is trading around $118,349.

Source: CoinMarketCap

As long as the US Government Bitcoin stash stays untouched, investors' confidence will persist. But if they ever decide to sell a large chunk all at once, it could cause the price to drop fast.

Experts suggest that if sales happen, they should be slow and steady to avoid crashing the market.

The US is retaining its this digital asset, but the UK is having different thoughts. The British Govt. is developing a strategy to auction more than 5 billion pounds of the confiscated BTC to facilitate the battle of a swelling budget deficit. The biggest share of this money was related to criminal cases, e.g., 61,000 coins, seized in a Chinese scam in 2018.

Now that it's price has gone up, the UK’s crypto stash is worth more than £5.4 billion. A special framework is being created to help the government store and sell the coins safely. It's regarded as a fast source of raising money during difficult times.

The controversy surrounding US Government Bitcoin brings up a great question: will crypto be held as a strategic asset or sold to shore up national coffers? Currently, the US is holding on, but the UK is set to sell. Either way, those choices will have a big influence on where the digital asset will fit in the financial future of the world.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.

6 months ago

🙃🙃🙃🙃🙃🙃🙃

2 months ago

Good