Pump.fun saw two early institutional investors offload a combined 25.5 billion tokens last week, netting a total profit of approximately $39.65 million. The sales, valued at around $141 million, were carried out by two addresses that participated in the project’s private placement round using USDC. These moves come amid growing attention on token activity and early investor behavior.

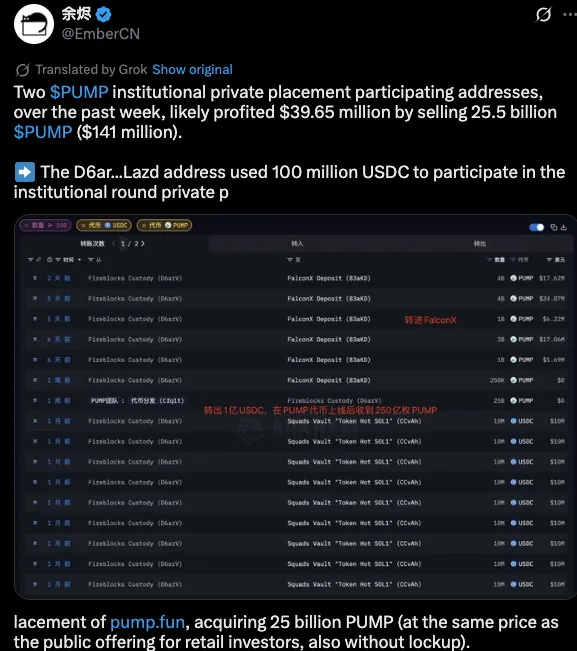

The address D6ar...Lazd invested 100 million USDC in the institutional private placement of PUMP's, acquiring 25 billion tokens. This purchase was made at the same price available to the public, with no lock-up period.

Source: X

Over the past week, the wallet transferred 13 billion to FalconX, which is believed to have facilitated distribution across multiple centralized exchanges. The average sale price of $0.0055 brought the wallet a reported profit of $19.5 million.

Another wallet, known as 58WQ...v33E, joined the private placement with a 50 million USDC investment. This wallet secured 12.5 billion tokens, which were entirely moved to centralized exchanges within the last seven days. At an average sale price of $0.0056, the address is estimated to have earned a profit of $20.15 million.

Both wallets took advantage of early access and immediate liquidity. Their significant profits underscore the influence of institutional participation on market dynamics and token flow.

At the time of writing, the Pump.fun price is trading at $0.004412, with 5% decrease over the past 24-hours following a brief consolidation phase. The fund had increased its price before that, reaching near the $0.006 resistance from the level of resistance has confronted his steady sale pressure.

There are early signs of the possible upside momentum on the technical indicators. The Relative Strength Index (RSI) stands at 42.68 and bounces off of the oversold level. Such transformation implies decreased selling pressure and change of sentiment.

The histogram print on MACD was small as bullish bars implied that there might be a change in momentum. Nevertheless, this was not certain yet since both, the MACD line and signal line were negative.

An upside target of $0.01 was projected from current levels. This marked a possible 128% move from the $0.004341 base. Intermediate resistance levels were marked at $0.006 and $0.008, providing key hurdles for buyers.

On the downside, $0.0022 remained a crucial support level. A breakdown below this point could trigger a steep decline.

In conclusion, volatility has been brought about by heavy institutional selling as well as attracting attention in the market. Provided that the momentum is gained, will regain essential levels. Nonetheless, the price action might falter in case the hectic exiting persists. The $0.01 target is still achievable but needs a bullish validation.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.