Bitcoin is experiencing downward pressure in price once again, moving from around $110,000 to just above $107,000 since yesterday. With a daily decline of 2.4%, traders are starting to ask an important question across markets; why Bitcoin is falling today?

There are several layers to the answer, but it starts with an important failure at the Bitcoin resistance $110,000. This eventually led to extreme long position liquidation waves, and value began pushing lower.

Thus, let’s look at some of the main reasons behind why Bitcoin is falling today.

It has consistently faced the $110K resistance since the start of its rally in late May. This level matches a prior multi-week high and holds significance both psychologically and technically.

According to TradingView technical data, the rejection occurred near a key Fibonacci extension and resistance trendline. Momentum indicators like RSI (54.99) and MACD showed weakening strength just before the reversal.

Source: Ali Martinez X

“It must hold $108,300 to maintain bullish momentum. If it loses this level, it could drop to $107,000 or lower,” said analyst Ali Martinez on X.

That prediction came true within hours, as this currency reversed sharply to current levels.

One of the most powerful drivers of the current drop is the liquidation spiral in its derivatives market. According to data by CoinGlass, over $323 million worth of long positions were liquidated within 24 hours.

This Bitcoin latest news explains why the Bitcoin price drop started to become aggressive after the initial price rejection

Volume data supports this caution:

Trading volume declined by 2.42% in 24 hours.

The global market cap dropped by 2.38%, indicating a broader selloff.

The combination of resistance failure, liquidations, and cooling sentiment all point toward a short-term consolidation or correction phase.

According to the chart from TradingView 1D timeframe, BITSTAMP:

Source: TradingView

RSI is at 54.99, which means it isn’t overbought or oversold — but momentum is starting to weaken.

MACD shows early bearish signs — the trend is losing steam as the red bars appear, which usually hints at a possible down move.

It is facing resistance near $110,000, where it keeps getting rejected.

If it drops below $106K with strong selling, prices could fall further to $104.8K or even $102K, where the next strong support lies.

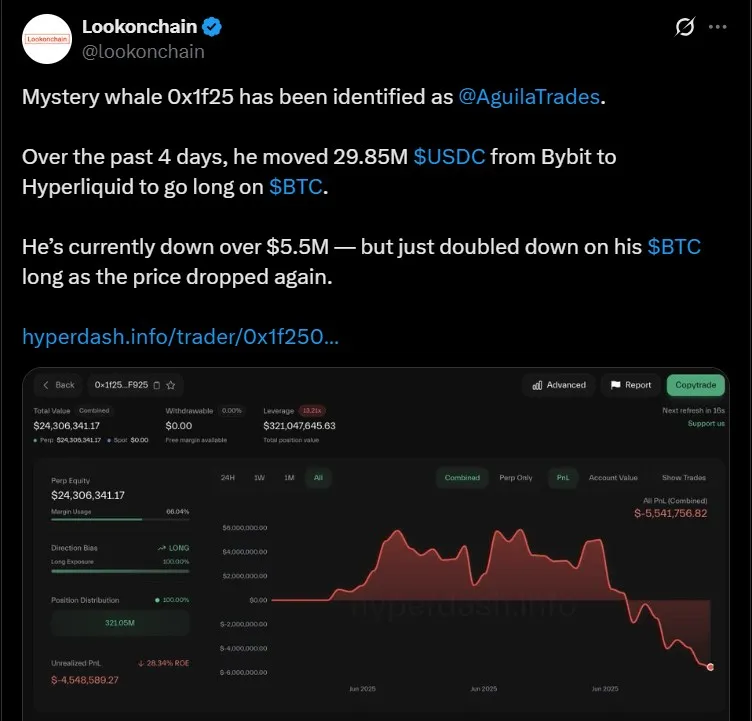

Interestingly, despite the current drop, some institutional signals remain bullish. Blockchain data from Lookonchain reveals that a whale wallet linked to AguilaTrades moved $29.85 million in USDC from Bybit to Hyperliquid to go long on this crypto king — just before the drop.

Source: Lookonchain

Meanwhile, its ETF activity remains strong: Net inflows of 1,413 BTC in the past 24 hours

This contrast between short-term traders exiting and institutions buying the dip may suggest a fundamental floor forming around $106K–$104K.

To sum it up, Bitcoin is falling today due to a classic combination of resistance rejection, long liquidations, fading sentiment, and cooling momentum. However, strong ETF inflows and whale accumulation show that long-term conviction remains intact.

If you’re asking how much will it fall, the answer lies in how it behaves around $106K. A strong defense here may stabilize the market. A breakdown? We may be heading toward a deeper reset.

Stay tuned. This zone could decide whether its next move is back toward ATH or down into correction territory.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.