Solana’s price has recently recovered following a significant dip, while other cryptocurrencies strive to stabilize. Once the favored token for DeFi traders and meme coin enthusiasts, Solana’s ecosystem now leads in decentralized finance, thanks to its speed and cost-efficiency.

Solana’s ecosystem is gaining traction among institutional investors. Major firms like VanEck and Bitwise have applied for Solana spot ETFs, following the blockchain’s successful $173 million funding round. This surge in attention highlights the network’s potential for innovative projects expected in the coming year.

Solana’s price is hovering around $175, with potential dips to $170-$160. However, an uptick in trading volume and institutional interest suggests bullish momentum. If SOL sustains support levels and breaks above $200, analysts predict it could rally to $400.

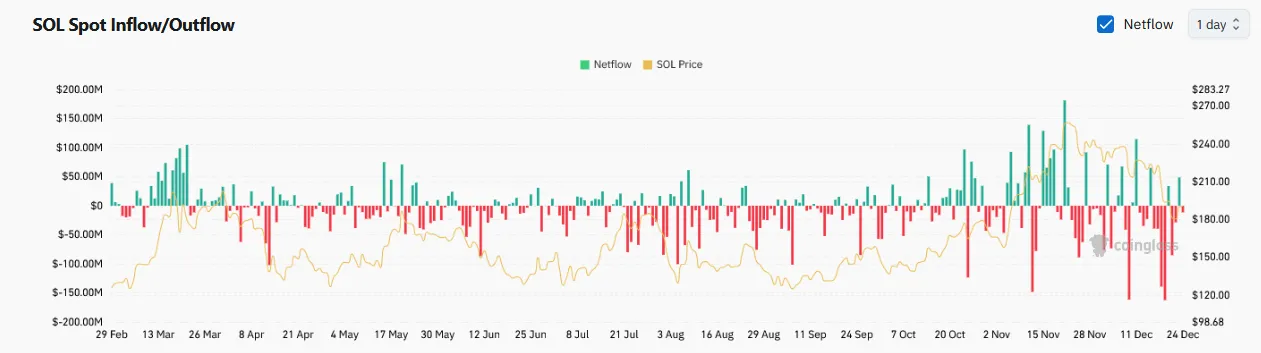

Spot market inflows have increased, while outflows have steadily declined. This trend, coupled with improving broader market conditions, hints at a possible price stabilization or upward movement for SOL.

Key metrics, including a total value locked (TVL) of 43.79 million SOL, reflect robust network activity and user confidence. Despite fluctuations in USD valuation, the bullish TVL underscores Solana’s growing dominance in the crypto market.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

2 months ago

Latest cryptocurrency news