The current Bitcoin Fear & Greed Index stands at an "Extreme Greed" level, with a score of 90. This high score signals strong investor confidence but also indicates potential overextension in the market. Such extreme sentiment often precedes significant price swings, hinting that traders should remain cautious as a correction may be looming.

On November 19, Russian President Vladimir Putin approved a new decree permitting Moscow to deploy nuclear weapons against non-nuclear states if they receive support from nuclear allies. According to reports, Putin stated, “Any attack by a nation within a military alliance will be viewed as an attack by the entire bloc.” Adding to geopolitical tensions, the Ukrainian armed forces launched their first strike on Russian soil using an ATACMS missile, as reported by RBC Ukraine, citing a military official. This escalation has contributed to unease in financial markets, including crypto, leading to selloffs and increased volatility.

Market sentiment and on-chain indicators for Bitcoin are hinting at a possible 10% price correction, which could push BTC down to the $80,000 level. This follows a period of strong market activity but comes amid caution as potential volatility looms.

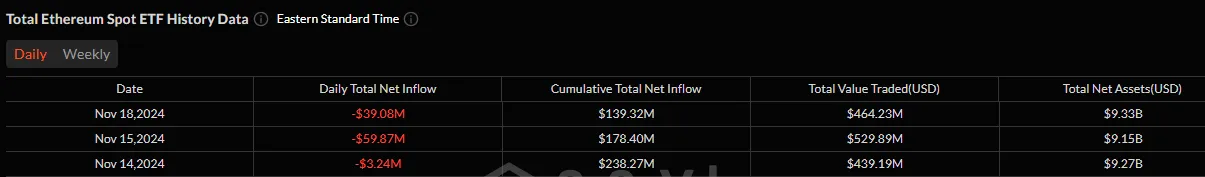

In the three days leading up to November 18, Ethereum ETFs recorded outflows totaling $39.08 million. This substantial withdrawal indicates that the recent surge in crypto market enthusiasm might be short-lived, raising questions about the sustainability of the current momentum.

Bitcoin's Relative Strength Index (RSI) has climbed past the 70-mark, indicating that BTC is in overbought territory. This often serves as an early warning of a potential price correction, suggesting that traders should prepare for possible volatility ahead.

A wave of selloffs by Bitcoin miners following the recent price surge is underway. This movement, fueled by profit-taking due to underwhelming quarterly earnings from BTC mining companies, could impede Bitcoin's expected climb toward the $100,000 mark. Ongoing miner selloffs may further contribute to downward pressure on BTC prices.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

1 month ago

Cryptocurrency security updates

1 month ago

(select convert(int,CHAR(65)))

1 month ago

''""

1 month ago

'"

1 month ago

JyI=

1 month ago

@@qIRoZ

1 month ago

\

1 month ago

1'"

1 month ago

W3rdyl4B