SBI Holdings has officially filed to launch a new XRP ETF, making a bold move in Japan's regulated financial market. The proposal includes two new exchange-traded funds—one is a gold-crypto mix with over 51% in gold and the rest in Bitcoin and XRP, while the other is a pure crypto exchange-traded funds. John Squire, an influencer, shared the filing details over X (formerly Twitter).

Source: X

If approved, this would be the first-ever regulated XRP ETF in Japan, signaling a big shift for local investors.

This move shows SBI’s strong support for Ripple. The company already works closely with Ripple on blockchain payments across Asia and now wants to increase altcoin adoption among institutions. The SBI XRP ETF is part of the company’s Q2 2025 growth plan and could lead to more crypto ETFs news from Japan, a country often seen as cautious in financial regulation.

The SBI Holdings XRP ETF could offer a safer, more trusted way for Japanese investors to gain crypto exposure, especially in altcoin. If accepted, it may open the door for other companies to file similar products. Currently, SEC has approved no XRP ETF, even though firms like Grayscale, ProShares, WisdomTree, 21Shares, Bitwise, and CoinShares are already waiting in line.

SBI Holdings is not stopping with ETFs. The company also announced plans to expand into the stablecoin market. It aims to support Ripple’s RLUSD, a USD-backed stablecoin launching soon. In addition, it is teaming up with Circle to bring USDC into Japan. These stablecoins are expected to help with faster and cheaper payments between Japan and the U.S.

However, Japan’s financial rules currently limit crypto transfers to under ¥1 million. This is slowing down adoption. To fix this, the company is talking with regulators to ease the restrictions. The company believes these stablecoins can boost Japan’s global crypto standing.

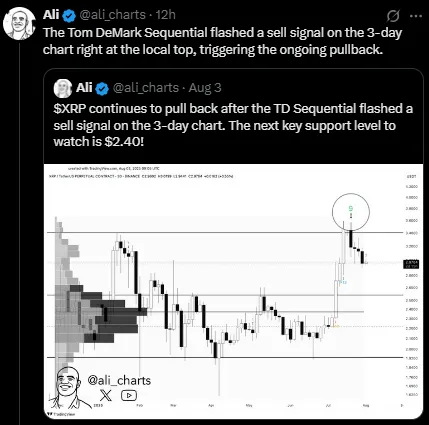

Even after this big news, its price dropped over 5% and is now trading at $2.93. This week alone, it fell from $3.10 to $2.75. The fall is linked to a sell signal on 3-day chart, identified by Tom DeMark’s Sequential tool, and major whales selling over 720 million altcoins, according to Ali Martinez.

Source: X

Technical charts show $2.80 as a weak support and real stability expected only near $2.48. Despite the dip, analysts say the price may still rise to $5 or even $10, depending on two big events this month: the SEC decision on pending ETF filings and the end of the Ripple vs SEC case. Many in the community are watching these developments closely for signs of a bounce.

This Ripple vs SEC news will likely shape the price direction. If the court ruling goes in Ripple’s favor, the altcoin could see a major rally. Investors are keeping an eye on this crucial moment in SEC news and broader crypto ETFs news.

Japan may soon approve its first XRP ETF, thanks to SBI Holdings’ bold move. While its price is down, all eyes are on the Ripple vs SEC case, which could decide whether it hits $10 or falls further. SBI’s actions prove that Asia isn’t waking up—it’s already moving.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before investing in cryptocurrencies.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.