In a shocking turn of events, a wallet linked to Justin Sun allegedly triggered one of the wildest market swings seen this year.

Hours ago, the wallet address, tied to Sun for years, dropped $16 million USDC into Hyperliquid.

Within minutes, the funds were used to buy 15.2 million XPL on Hyperliquid, completely wiping out the order book.

That single move sent the price of XPL on Hyperliquid soaring from $0.60 to $1.80, a jump of more than 200% in under two minutes.

For retail traders, the event was a disaster. For Sun, if it was indeed him, it was a masterclass in whale games.

The aggressive buy forced massive liquidations across the platform.

Another wallet lost a $7 million short position.

In total, more than $16.6 million in shorts were wiped out during the spike.

As the price peaked at approximately $1.80, the whale began offloading positions at $1.55 to $1.60.

Source: X (previously Twitter)

This tactic achieved a rapid profit ranging between $14m and $16m in less than an hour.

Even after cashing out, the wallet maintains 15m XPL bags worth approximately $10m at prevailing prices.

The mess left behind was colossal. In 24 hours:

Daily perpetual trading volume on XPL on Hyperliquid reached $161m, an increase of over 311%.

Open interest plummeted by over 70% as short positions were squeezed out.

Exchange fees jumped to $7.7m for a day, the highest on record.

Funding rates reversed from being heavily negative to wildly positive, punishing short traders some more.

But even with the huge pump, the token was not able to maintain its gains. Only a few hours later, XPL on Hyperliquid had plummeted back down to the same level of $0.60 where it began, leaving behind trails of liquidations and confusion.

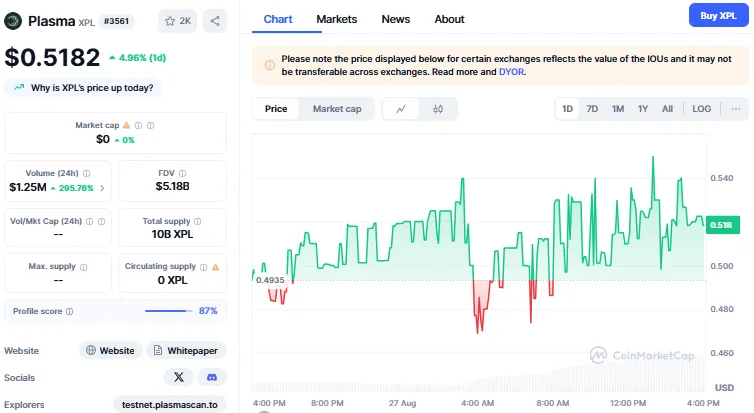

Source: CoinMarketCap

The coin is now trading at $0.5182 with an increase of 4%. Looking at the details, the coin does seem to be a little suspicious of being a legit crypto token.

For regular traders, the pump and dump that came out of nowhere was pure carnage. Many who attempted to short or ride the rally were decimated. The thin book liquidity allowed a whale to move the price violently, and the retail players had to bear the brunt.

Meanwhile, to Justin Sun, if the wallet belongs to him, the incident was a payday. The market manipulation might appear to be a whale minigame, but for small investors, it is a harsh reminder: liquidity reigns supreme, and following hype is lethal.

Hyperliquid responded by saying that “all systems are normal,” but the community is left shaken. Rumors are already circulating that $WLFI could be the next target for whale games.

The key lesson from this event is clear. Thin books can kill, and XPL on Hyperliquid just proved it in dramatic fashion. On-chain data tells the story: whales play for profit, and retail traders are often left holding the bag.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.