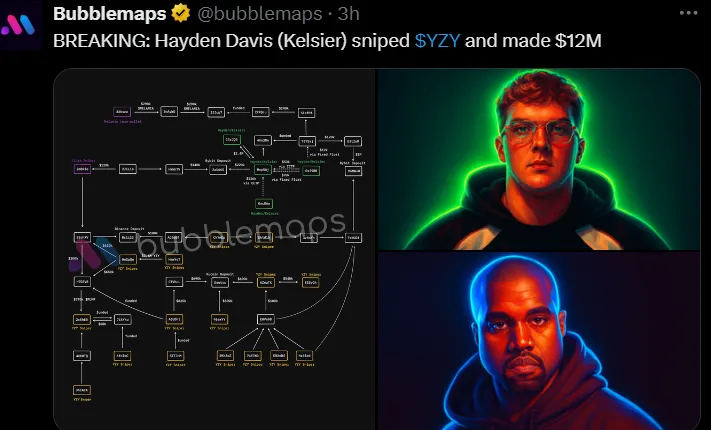

The crypto market woke up to a storm after reports of a $YZY Coin Price Crash. Bubblemaps blockchain watchers revealed that Hayden Davis, known for past token controversies, allegedly hijacked the token launch using many wallets.

The move created nearly $12 million in instant profit. But instead of excitement, the news triggered doubt, heavy selling, and a sudden 22% fall in value.

The Money token went live on August 21, 2025. Just a day earlier, $57 million of Davis’ frozen assets were released. Soon after, a group of addresses linked to him started getting funds from exchanges. At exactly 1:54 AM UTC, barely one minute after the official launch post, buys were placed.

According to the Hayden Davis crypto news today, Bubblemaps report says at least 14 wallets were prepared in advance. These wallets had similar deposit trails, transfers, and past links with other projects like LIBRA and MELANIA. All paths led back to him, raising strong suspicion of insider timing and price crash trigger.

Market reaction was fast. After the Bubblemaps post, fear spread quickly. Many traders felt insiders had an unfair advantage. According to CoinMarketCap the $YZY Coin Price Crash was about 22% in just one day.

Price: around $0.5468

Volume: $41.8M, showing panic trades

RSI: 20.6, deeply oversold

MACD: still negative, sellers in control

This sell-off made headlines in the YZY money price news today. Speculative traders left quickly, pulling liquidity away from the token.

Another reason was the leveraged bets, The decline wasn’t only about Davis. According to Lookonchain, wallet 0x68c0 tried three leveraged longs within one hour. Each failed, burning about $160K. These repeated mistakes increased volatility and pushed confidence even lower.

Right now, the project faces a trust issue more than a technical one. Short term, analysts expect movement between $0.50 and $0.55, with possible dips toward $0.45 if fear grows.

Next 7 Days: sideways or weaker, pressure remains

Next 1–4 Weeks: if liquidity support or buybacks arrive, recovery toward $0.70–$0.75 could be possible

Risk: without strong communication, token may slide below $0.40

The $YZY Coin Price Crash shows how fragile trust can be in digital assets. From the Hayden Davis crypto scam, to leveraged trading mistakes, all evidence pointed to a market quickly losing faith.

If the token does recover, it hinges not only on charts but how clear the team is at confronting community doubts. For now, the scam remains a reminder that transparency is the only way forward in the market, and keeping an eye on the latest crypto news may avoid high investing risks.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.