Belgrade, Serbia, December 24th, 2025, Chainwire

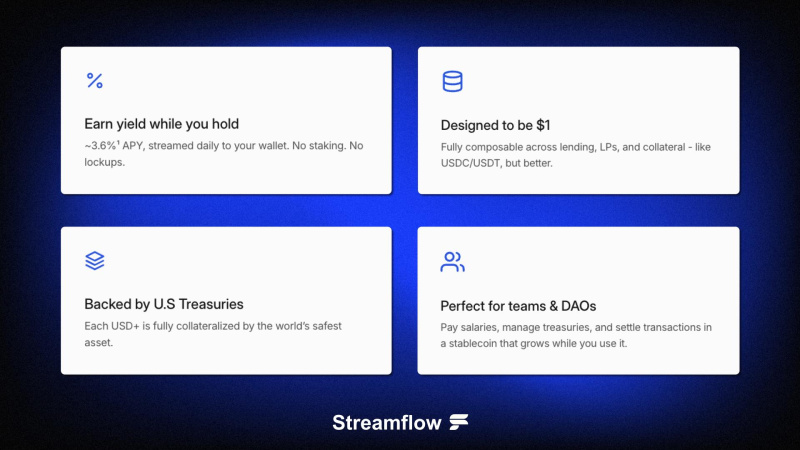

Streamflow announces USD+, a U.S. Treasury-backed stablecoin built on Solana that distributes daily yield directly to holders’ wallets. Designed for Web3 companies with treasuries and crypto-native investors managing idle capital, USD+ enables users to earn yield on stable balances without any staking or lockups.

USD+ is backed by short-term U.S. Treasury Bills and is powered by M0’s universal stablecoin platform, where reserves are held by licensed custodians and independently verified. Rather than yield being retained by centralized issuers, USD+ is designed to pass Treasury bill yield on-chain to holders, daily, as additional tokens.

The product has been publicly announced and is coming soon, with a waitlist now open for early access.

A New Model for Stablecoin Yield

Most widely used stablecoins today are backed by yield-generating assets such as Treasury bills, but the interest is typically retained by the issuers (such as USDC). USD+ introduces an alternative approach: a stablecoin designed to distribute that yield directly to holders.

By holding USD+ in a Solana wallet, users are expected to earn a variable yield of approximately ~3.6% APY at the time of writing, distributed daily on-chain, without requiring staking or lockups. The yield rate is variable and will change over time based on market conditions and prevailing U.S. interest rates. USD+ is designed to maintain a $1 peg while remaining fully composable across the Solana DeFi ecosystem.

USD+ is powered by M0’s stablecoin infrastructure, where issuers lock verified collateral through the M0 Protocol to mint asset-backed stablecoins. U.S. Treasury holdings are transparently tracked and continuously monitored by validators to ensure full backing.

Built for Onchain Treasuries

USD+ is designed with Web3 treasuries and crypto-native capital managers in mind. Potential use cases include:

Once live, users will be able to swap assets such as USDC, USDT, or onramp fiat into USD+ directly through Streamflow’s interface, using popular Solana wallets. Fiat on-ramps are expected to support multiple currencies.

Unlike rebasing stablecoins, USD+ is designed to remain composable across lending markets, liquidity pools, and on-chain applications. This allows users to earn yield while still retaining the flexibility expected from a modern stable asset. As adoption grows, USD+ is intended to integrate across the Solana ecosystem, enabling broader use in lending, liquidity provision, and payments.

USD+ is expected to launch soon, with early access prioritized for users on the waitlist. Interested users can join the waitlist to be among the first to access a Treasury-backed, daily yield-bearing stablecoin built for Solana.

About Streamflow: The Team Behind USD+

USD+ is being developed by Streamflow, a team best known in the Solana ecosystem for token management infrastructure (vesting, airdrops, token staking, recurring payments and related tooling), supporting tokens throughout their entire lifecycle, from fundraising and TGE to long-term ecosystem incentivizing. With a peak TVL of ~$2.5 billion, over 1.3 million users, and 26,000+ projects powered, Streamflow delivers on-chain transparency and customization with full support for Solana.

Streamflow’s broader ecosystem also includes the $STREAM token, associated with the project’s governance and platform incentives. That said, a stablecoin introduces additional layers (custody, verification, integrations) that go beyond typical on-chain tooling, so the rollout and transparency practices will matter.

USD+ Website: https://usd-plus.com/

Streamflow Website: https://streamflow.finance/

Streamflow App: https://app.streamflow.finance/

$STREAM Website: https://streamflow.foundation/

Twitter / X: https://x.com/streamflow_fi

Other links: https://linktr.ee/streamflow