Binance, the largest cryptocurrency exchange in the world, sent shockwaves through the market following its recent announcement. Starting April 16, 2025, Binance will be delisting 14 struggling token pairs, causing severe price plunges and a rally of bearish sentiment among crypto traders and investors.

The impacted tokens are well-known names like BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT, and VIDT. These spot trading pairs will be delisted following Binance's due diligence and "Vote to Delist" procedure.

Binance explained that the move came after a careful review of the feasibility and platform compatibility of each project. The primary considerations are:

Development team's commitment and activity

Liquidity, volume, and community activity

Compliance with regulatory requirements and requests for due diligence

History of unethical or negligent behavior

Ownership or tokenomics changes

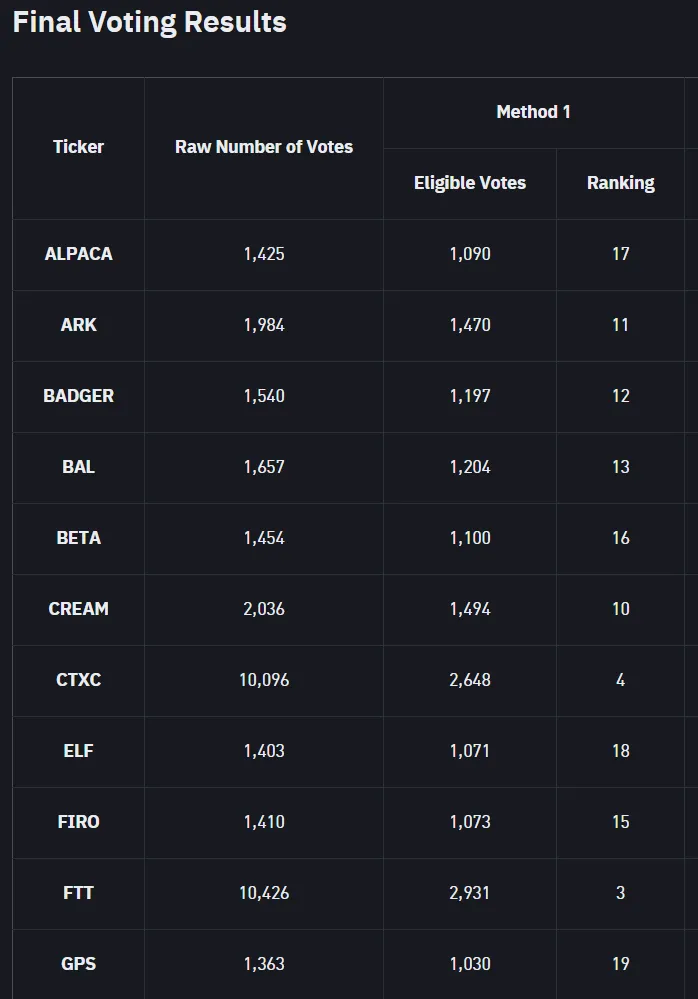

A total of 103,942 votes were registered during the Vote to Delist campaign, of which 93,680 votes were valid after excluding fraudulent accounts. Tokens such as TROY (4,985 votes) and SNT (3,533 votes) had strong support from the community for delisting.

Interestingly, even though it was third on the delisting vote with more than 10,000 votes, FTT (FTX Token) escaped the chopping block, which led to community backlash and questioning Binance's consistency.

Binance explained that:

Spot trading for the delisted tokens will be stopped on April 16 at 03:00 UTC

Trading Bots services will also end at the same time

Binance Spot Copy Trading will remove the tokens one day in advance on April 15 at 03:00 UTC

Users are highly recommended to terminate their bots and copy portfolios well in advance to prevent forced liquidations or unsolicited asset conversions.

The news instantly caused a panic sell-off, with most tokens suffering double-digit declines in hours:

BADGER fell 18.70% to $0.8702

Balancer (BAL) fell 22.69%, now at $0.7880

BETA declined 55.90% to $0.0074

CREAM suffered the largest decline, falling 59.46% to trade at $1.59

CTXC fell 27.80%, FIRO by 54%, and PROS by 60.45%

Other significant losers included HARD (-59%), NULS (-48.3%), UFT (-46.15%), and VIDT (-37.11%).

These abrupt corrections have fueled fear of ongoing bear momentum as delistings limit exposure and market access to these assets.

Historically, when a large exchange such as Binance delists tokens, it usually indicates worsening fundamentals or stagnation. This limits liquidity and drastically reduces investor confidence, which usually leads to:

Decreased market participation

Lower long-term price support

Higher volatility for remaining holders

Although some of the impacted projects will move liquidity to decentralized exchanges (DEXs) or smaller platforms, the loss of Binance exposure is a significant blow to their market relevance.

The community is especially vocal regarding the non-delisting of FTT, despite it being high on the delist voting. This disparity has led to speculation regarding selective transparency and potential favoritism in Binance's decision-making process.

The case is a reminder of earlier instances when oversight by regulators has conflicted with exchange operations and underscores the importance of having more transparent, predictable listing standards.

As April 16 approaches, investors who own the impacted tokens should do the following:

Exit positions or move tokens to other wallets or exchanges

Cancel all open Trading Bots and Copy Trading positions

Stay up to date on project news or recovery initiatives

The Binance delisting action highlights the gamble involved in token listings on centralized exchanges. With regulatory heat and quality assurance on the rise, more coins could be axed in the next round of reviews.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.