Cardano (ADA) price has shown a notable decline over the past 24 hours, reflecting broader weakness in the cryptocurrency market. After gaining over 20% in July’s bullish trend, ADA has now fallen below key support levels. This pullback aligns with losses seen in major assets such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Despite the downturn, technical indicators on the weekly chart show ADA still holds bullish momentum. Analysts observe that Cardano is mirroring a previous cycle but with slower movement. Renewed investor interest may push for a breakout if current support holds and broader market sentiment improves.

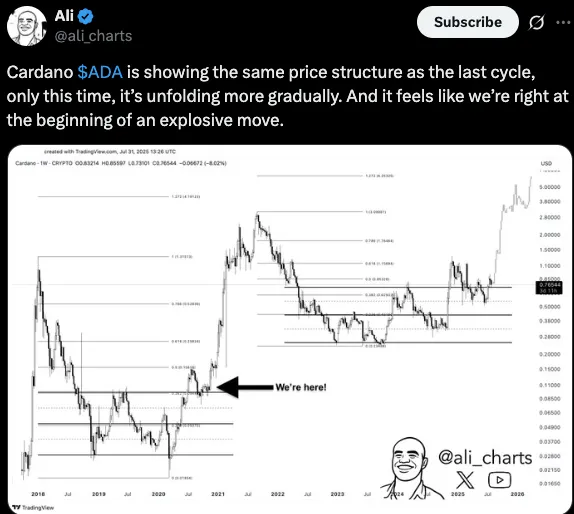

Cardano price appears to be mirroring a familiar price pattern last seen in a previous market cycle. However, this time the pattern is playing out with more caution and slower momentum.

According to market analyst Ali, this slower buildup might be setting the stage for a potential breakout. His latest chart analysis suggests the cryptocurrency could be on the cusp of a strong upward move.

Source, tweet

The comparison between the current structure and the past cycle reveals striking similarities. In the last cycle, ADA experienced a steep rise following a long consolidation phase. The current market behavior reflects a similar consolidation, but the pace is more measured.

The chart pinpoints Cardano’s current position as nearly identical to its pre-rally stage in the previous cycle. If the pattern repeats, it could signal the beginning of a significant bullish phase.

Ali emphasized that the technical structure is nearly identical to that of early 2020. Back then, Cardano rallied sharply after weeks of sideways movement.

The chart includes Fibonacci retracement levels and historical data to support the analysis. The historical comparison supports the possibility of an explosive upward price move.

While the market remains unpredictable, patterns like this often attract the attention of traders and long-term holders. Market watchers will closely observe whether Cardano can replicate its past performance.

The ADA price continued to face selling pressure as bearish momentum remained intact on the 4-hour chart.

Also at time of writing ADA price is trading at near $0.722 with an 8% decline in the last 24-hours and within a descending channel, indicating the ongoing bearish pressure.

The bottom line of this channel is likely pointing to the point where the price may touch the support of $0.70 should the direction be maintained.

Source: Tradingview

The indicators of weakness are technical. The RSI (Relative Strength Index) currently stands at 28.70, which places it squarely in the oversold realm, and this means that the asset is possibly undervalued but not turning around. The MACD is still in bearish mode, and the signal line is above the MACD line, and the histogram bars are going below in red affirming the downward momentum.

A breakdown of the substantial support level of $0.700 will break the pathway to an increase in losses, potentially as far as $0.670.

Conversely, in the event that the bulls once again assume control and ADA rises above the upper boundary of the descending channel, the next major resistance is at $0.750. A continued upward motion beyond that extent may propel a revisit of the $0.800 hurdle.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.