Chainlink (LINK) has shed approximately 30% since its peak in early December, now stabilizing near a critical support level. The daily chart reveals a bearish head-and-shoulders pattern, often signaling a trend reversal.

Blockchain analytics platform Lookonchain highlights a notable whale activity: a significant deposit of 250,000 LINK (worth $5.37 million) into Binance and OKX. Historically, such deposits have often preceded sell-offs. From December 14 to 18, this same whale withdrew 595,000 LINK (approximately $17.31 million) from Binance at an average price of $29.10.

Currently, the whale faces an unrealized loss of around $4.5 million, which could increase selling pressure as they may seek to minimize losses.

Data from Coinglass reveals a 9% decline in LINK's open interest, bringing it down to $570 million.

Meanwhile, recent outflows have seen approximately $60 million worth of LINK withdrawn from exchanges, indicating a shift in market sentiment.

Coinglass data reveals a substantial liquidation of long positions across various timeframes, particularly within the 12-hour and 24-hour periods. This trend often suggests bearish market sentiment or a decline in prices, as long positions are usually liquidated during price drops.

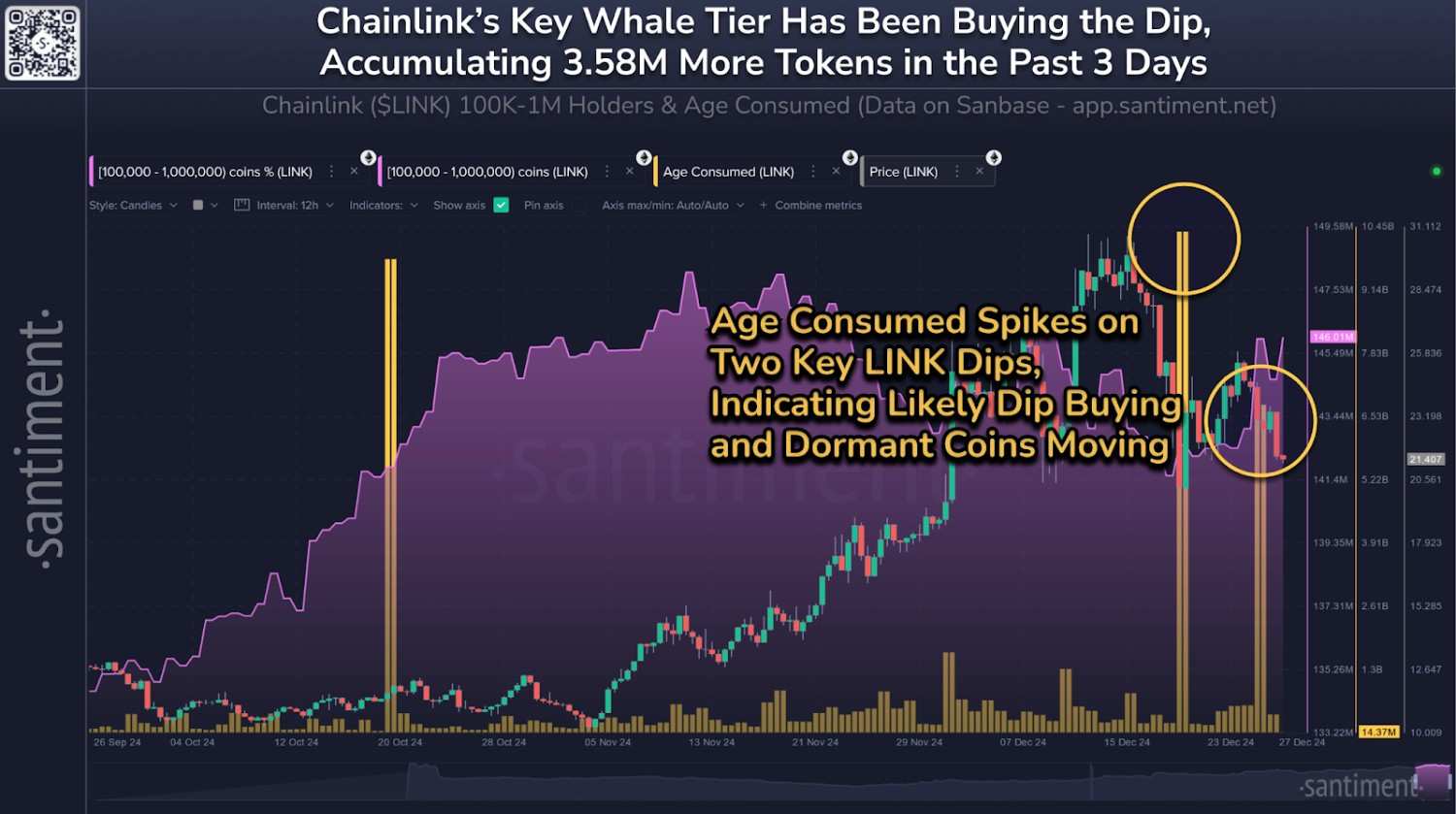

On the other hand, blockchain analytics firm Santiment reports that key whale addresses holding between 1 million and 10 million LINK have capitalized on the price dip. Over the last three days, these whales have accumulated 3.58 million LINK, valued at approximately $76.9 million. This accumulation reflects strong confidence in a potential recovery, suggesting some long-term players view the current levels as an opportunity

What’s Next for LINK?

The immediate outlook for LINK hinges on the $21 support level. A decisive breakdown below this level could pave the way for a swift decline to $18, with further downside risk toward $15–$16 in a worst-case scenario.

Conversely, defending the $21 level could spark a recovery, pushing LINK toward $25. A sustained move above $28 would invalidate the bearish setup, potentially setting the stage for a retest of $30 and reigniting bullish momentum.

In conclusion, while short-term bearish pressure remains due to whale activity and broader market trends, strategic accumulation by key players suggests long-term confidence in LINK’s recovery. Traders should closely monitor the $21 support level for clues about the next major price move.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.