After two years of its quiet development, Dolomite (DOLO) finally made its awaited launch on April 24, 2025; however, instead of a sustained rally, the newly launched token was quickly pumped and dumped into volatility, prompting early investors and traders to scramble.

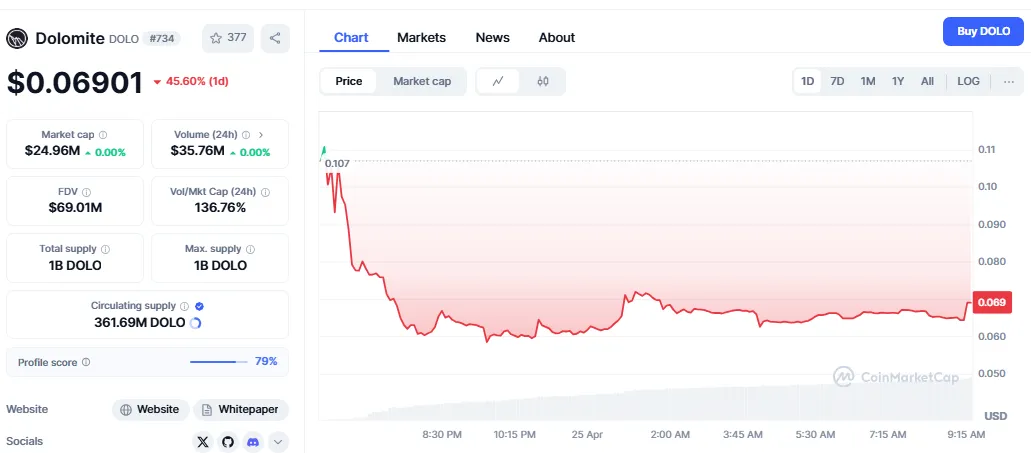

Presently at $0.06901, the price has crashed down by 45.60% over the past 24 hours after hitting an all-time high of $0.1269 merely 16 hours ago.

DOLO crashed heavily as a direct outcome of an eventful marketing selloff big time, with the early backers and speculative buyers selling aggressively to take profits in the peak of hype. The downward movement to $0.05822, followed by a slight recovery, was a manifestation of market uncertainty and weak fundamental backing at this initial stage.

Despite this sell-off, throughout these 24 hours, the token had a trading volume of $35.76 million, clearly more than its market cap of $24.96 million-more of a speculative interest and high-frequency trading activity.

With only 36% of the total 1 billion tokens currently in circulation, further unlocks of tokens will exert additional downward pressure. Investors should keep watch for any future vesting schedules and unlock events, as it is these that usually trigger some short-term selling unless engaged user adoption, protocol growth, or community traction can counter this.

From price behavior and volume dynamics, currently, Dolomite is anticipated to be traded in a volatile short-term range ($0.062-to-$0.080), as the coin attempts to establish a stronger support price base.

Support Zone: $0.058-to-$0.062

Immediate Resistance: $0.080

Bullish Target: $0.085-to-$0.095, assuming momentum build-up

Bearish: An upside should potentially finish below $0.058, which can mean further declines.

In the coming days, whether or not DOLO holds above the $0.062 mark will determine if these tokens will stabilize or continue to trend downward.

To gain back investors' trust, Dolomite must provide a clear utility, adoption of the protocol, and a smooth development timeline. It has a grim future as an eternally short story unless community interventions or sustainable growth are done to bail it out on legitimate staking or inherent utility value.

On the flip side, assuming the Dolomite team effectively promotes the project and garners the requisite developer and community support, they might witness a gradual recovery in the mid-term, truly between the $0.085-$0.095 region.

Source: CoinMarketCap

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.