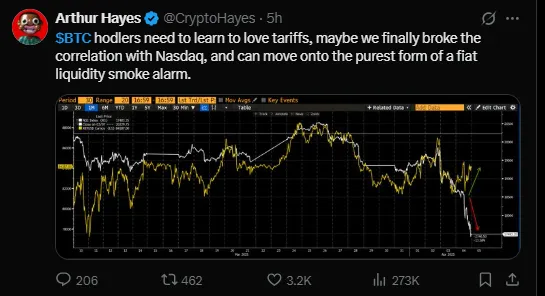

Bitcoin has been rocking strong the past few days, hitting the $84,000 level earlier Friday after China charged the cryptocurrency a 34% tariff on U. S. imports. As U. S. stock markets fell to 11-month lows, crypto investors are wondering just when Bitcoin will finally start to move away from traditional stocks like the Nasdaq.

U. S. Federal Reserve chair Jerome Powell addressed growing economic concerns on April 4, warning that President Donald Trump’s “reciprocal tariffs” could lead to higher inflation and slowing economic growth. Powell’s cautious tone added fuel to the stock market’s fall.

After the risk-off mood, Bitcoin and other altcoins have been holding steady. The surprising divergence has prompted skepticism from analysts and retail investors alike. Equity was rocked by macro headlines, but crypto assets remained strong and even took in new capital.

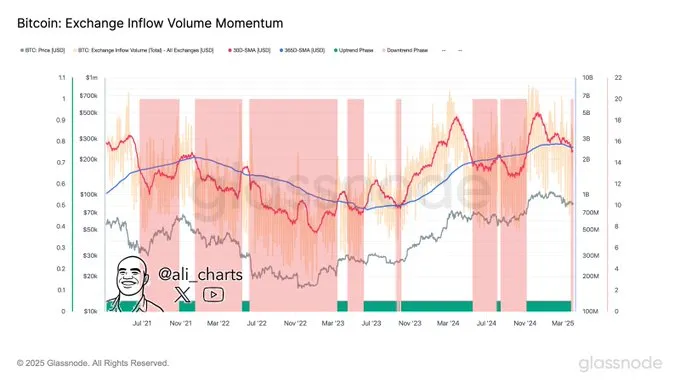

On-chain analytics firm Glassnode said capital inflows into the crypto industry were 350% higher in two weeks, growing from $1.82 billion to $8.20 billion. That same day $3.25 trillion was pulled from the US stock market, while crypto markets rose $5.4 billion, so something was feeding people the desire to shift to elsewhere.

> “Hodlers need to learn to love tariffs, ” says Arthur Hayes. “Maybe we finally broken the correlation with the Nasdaq. ”

On the daily chart, the price is forming a falling wedge pattern, a classic bullish reversal pattern. If macroeconomic indicators start to lower, such as CPI and Core PCE in 2nd Q2025 (as early data from Trueflation shows) then BTC may fall back to key resistance levels.

Short-term targets remain clear:

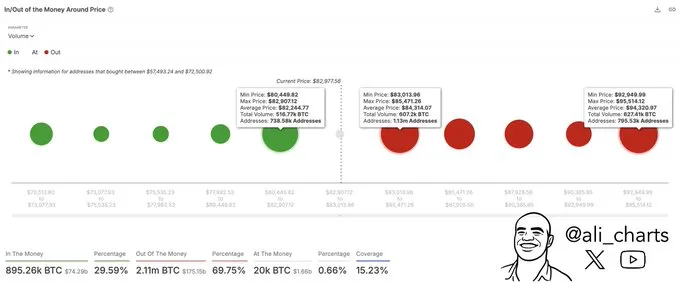

- Support: $80,450

- Resistance: $85,470, followed by $92,950

According to IntoTheBlock, if this stock breaks above $85K, then the bullish momentum will be significantly reversed and above that, $90, 570, short-term holder realized price.

Interesting that Glassnode mentions the slowdown in exchange-related BTC activity, a signal used as a bullish indicator, but at the same time, the surge in capital inflows suggests a more complicated picture—that investors are buying and holding off-exchange, waiting for the next macro momentum.

As one might expect, this may reflect a greater consensus that Bitcoin can act as a hedge against fiat instability and geopolitical risk, particularly if inflation remains stuck and interest rates remain high for longer.

If the price hold above the $85,000 barrier in the coming weeks (and macro conditions continue to be favorable), a bull rally may come to fruition by May 2025. The convergence of the bullish wedge pattern, additional inflows, lower inflation, and institutional accumulation may finally lead to the prospect of BTC going above $92,950 and possibly to retrace to $100K.

Source: TradingView

The latest U. S. -China tariff row may have set off a new chapter for Bitcoin: one that begins to move outside of the traditional markets. As Wall Street scrambles for safety, BTC may perhaps be the lucky winner. The coming weeks will be interesting, but one thing is for sure: Bitcoin isn’t just following the Nasdaq anymore.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.