Ethereum was trading at $4,278.72 as of Monday, an increase of 1.53% in the past 24 hours, with a market cap of $516.47 billion. Its daily trade volume of over $35.95 billion signifies strong buying interest.

According to Lookonchain data, one of the early Ethereum ICO participants who bought 20,000 Ethereums in 2014 at $6,200 sold 2,300 ETH at $9.91 million.

The investor keeps 1,623 Ethereums valued at $6.99 million, a move that is either strategic diversification or a partial profit-taking move.

Lookonchain report on old wallet transfer.

Analysts observe that this kind of big transfers by old wallets can temporarily affect Ethereums price sentiment in spite of the profound liquidity of Ethereum.

The volume of Altcoin trading in the billions of dollars daily is probably not having a direct influence on price, but the psychological influence is still enormous to traders in the market.

Glassnode statistics indicate that the Ethereums MVRV ratio is lower than market top levels, which means that there is still potential for the asset to appreciate before it becomes extremely overvalued.

Ethereum MVRV Extreme Values : Source : glassnode

Additionally, the Altcoin net capital change has recently exceeded that of Bitcoin, which analysts consider to be evidence of the fact that the altcoin season is beginning.

Bitcoin Altseason Indicator : Source : glassnode

Furthermore, the addresses with more than 10,000 Ethereums increased to 868,886 (the largest in a year) indicating that large holders are becoming more confident.

Crypto Rover reported this milestone, noting the accumulation pattern of whales and institutions, which frequently precedes large market shifts.

Meanwhile, data from SoSoValue indicates that the Altcoin spot ETFs have had 13 straight weeks of net inflows, and last week it was a total of $326.83 million, with net assets of $23.38 billion.

Moreover, TedPillows reports that a mysterious institution has recently bought $212 million of ETH, and in a week, it has already accumulated a value of $946.6 million.

Also, CryptoPatel noted that the Strategic ETH Reserve currently has a total of 3.03 million ETH with a value of $12.83 billion in 64 holders.

Such inflows indicate an ongoing institutional demand and are consistent with the forecast of Rekt Fencer, who predicts the possible ETH price increase to $15,000, which is due to corporate buying, ETF development, and positive regulations.

According to TedPillows, ETH price reclaimed the $4,000 level with little to no resistance to the all-time high, and the next big level should be $4,800 as long as the bullish momentum persists.

ETHUSD 5-Day Chart | Source: X

Chart projections show that, unless there is a major fall in the price of Bitcoin, Ethereum may reach a new ATH by next week.

Open interest increased by 3.36% to $203.08 billion, and the Fear & Greed Index is at 69, which implies a current state of Greed.

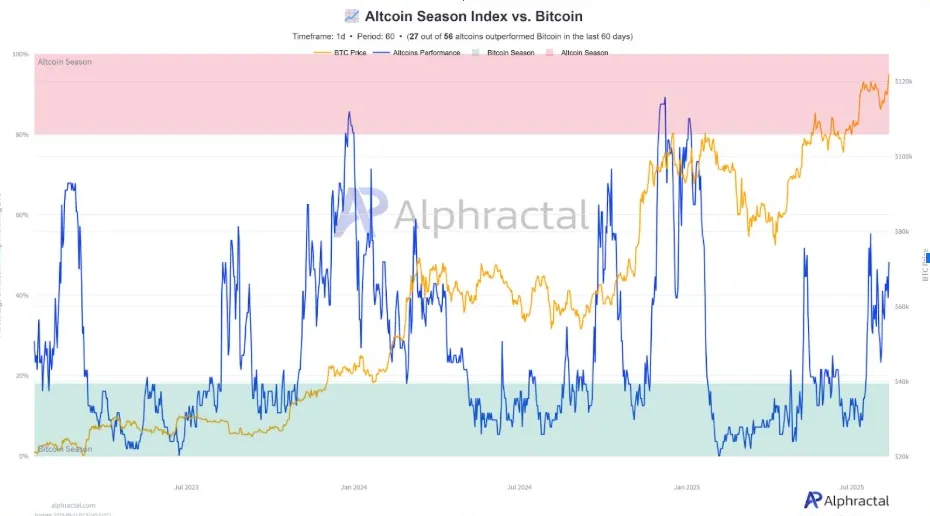

The Ethereum rally is consistent with the market in general with Alphapractal Altcoin Season Index indicating 27 of 56 altcoins beating Bitcoin over the past 60 days.

Altcoin Season Index vs. Bitcoin: Source: Alphractal

Joao Wedson added that smart money generally flows out of BTC into ETH and then into top-cap, mid-cap, and low-cap altcoins, and the current cycle may continue until November.

Meanwhile, Ethereum dominates real-world assets with 319 issuers, a total value of $7.08 billion, and a market share of 53.94%, surpassing ZKsync Era ($2.42 billion) and Aptos ($721.4 million) based on rwa.xyz.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.