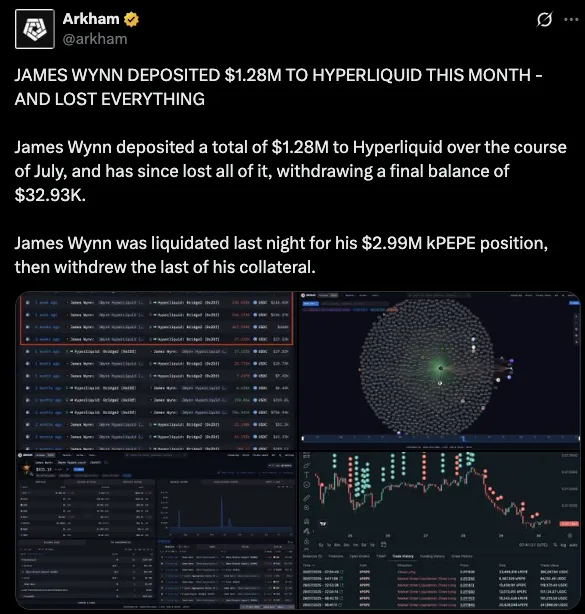

James Wynn, a well-known trader on the crypto exchange Hyperliquid, suffered devastating losses this month. Over the course of July, Wynn deposited $1.28 million to defend his leveraged positions amid market instability. Despite his efforts, nearly the entire amount was wiped out, with only $32,930 withdrawn after his final liquidation.

James downfall was tied to several high-risk trades, especially in blue-chip cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). His major losses began following a severe market dip and were further worsened by a 27-minute API and order book outage on Hyperliquid. During this time, James positions faced extreme volatility, leading to multiple forced liquidations.

Source: Tweet

Following his losses in BTC and ETH trades, James shifted focus to the meme token PEPE. This, however, resulted in more pain. His $2.99 million leveraged PEPE position was liquidated in a final blow. Before exiting, he endured nine partial liquidations on the same trade.

On-chain analysis from Arkham Intelligence showed James constant activity throughout July, regularly moving funds between exchanges. Hyperliquid remained his primary platform. He later transferred his remaining $32K in USDC to Binance, a major centralized exchange.

Wynn is also active on decentralized platforms. He frequently trades through 1inch and is known to promote meme tokens on Telegram channels. His trading style includes taking bold, high-risk positions and sharing them openly on social media.

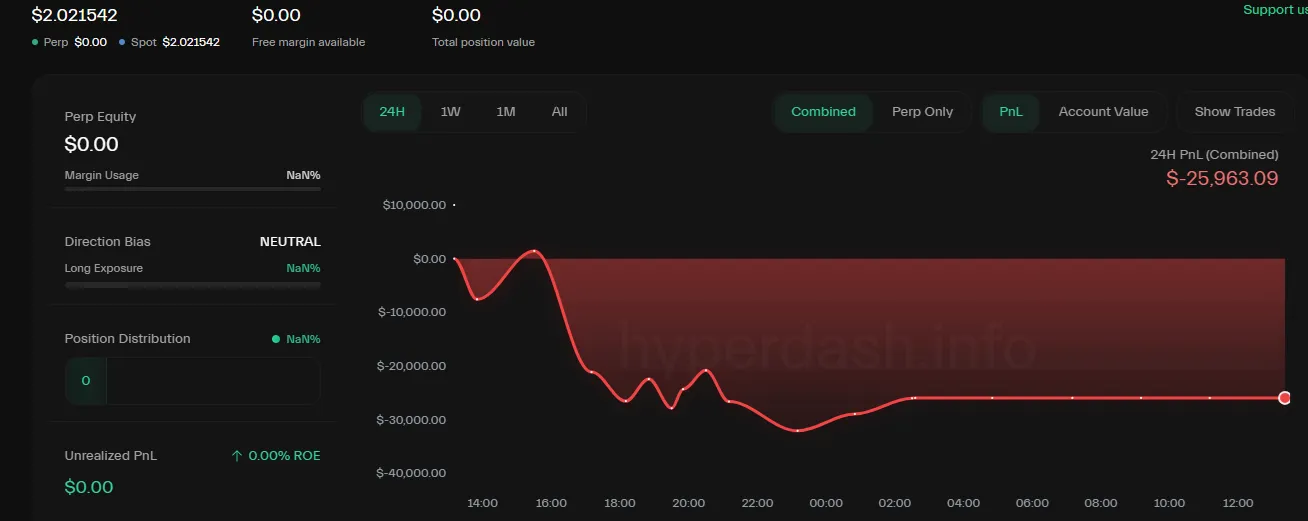

Source: Hyperliquid

Nevertheless, despite suffering the enormous losses, Wynn still trades the meme tokens and is vocal on the Internet. The collapse of his operations is highly monitored in the crypto world as a lesson on leveraging too much during times of instability.

This episode reminds us of the risks involved in fierce trading, particularly, the time when the market is not stable. The response of Wynn demonstrates the dangers that traders take in doubling down rather than quitting during the first time.

The PEPE price had a substantial decline this week, falling by 16.93 to 0.00001123. At the start of the week, the meme coin was trading at around $0.0000137 and was under sustained selling pressure.

The price, however, would plunge and will close at its lowest in a week despite some intraday rebound.

Hyperliquid (HYPE) also fell within the same time, albeit to a lower degree. After seven days, its price had fallen by 2.1% to stand at 42.60. HYPE was very promising in the initial stages where the price was traded in the neighborhood of $44.78 but failed to gather further steam.

Following a recent high of slightly above $45, the asset has retreated and is trading around the $43 level ahead of the day-end just under the $42.51 mark.

Annah Mugoiri is an emerging voice in the crypto content space With More than 5 years of experience, with a growing passion for blockchain technology and digital finance. She possesses a sharp grasp of market dynamics and the broader cryptocurrency landscape, skillfully simplifying complex topics like Bitcoin, altcoins, DeFi, and NFTs into reader-friendly, engaging articles. Annah combines in-depth research with a clear and concise writing style that appeals to both beginners and seasoned crypto investors. Dedicated to monitoring price trends, project launches, and regulatory changes, she keeps her audience updated on the rapidly evolving crypto scene. Annah is a firm believer in blockchain’s transformative power to foster innovation and expand financial access worldwide.