The crypto world is buzzing with excitement—Lagrange ($LA), the utility token powering the decentralized cryptographic engine behind DeepProve, is officially making its market debut. Binance Alpha has gone on to confirm the listing as of June 4, 2025, followed by the confirmation from Bybit, one question is loud and clear in every investor's mind-worthy of answer: Will LA generate huge returns post-listing or will early profit-taking steal the gains, similar to Bondex, which has dumped by 80% post-listing?

Let's go through the listing of the token, understand the distribution model, and discuss price predictions over the medium and long term in an attempt to attain some kind of intuitive sense of the possible direction in which $LA will go.

Not just another utility token, $LA serves Lagrange's cryptographic proving engine for decentralized activities across interoperable blockchains-the most prominent being DeepProve. Users pay in $LA for zero-knowledge proof generation, and provers are subsidized to keep the network going.

Further, trading, staking, and delegation can be done by token holders as well, thereby aligning the interests of the token holders with the growth of the ecosystem. This has thus received a high-utility token economy that rewards all participants, along with enhancing network security and decentralization.

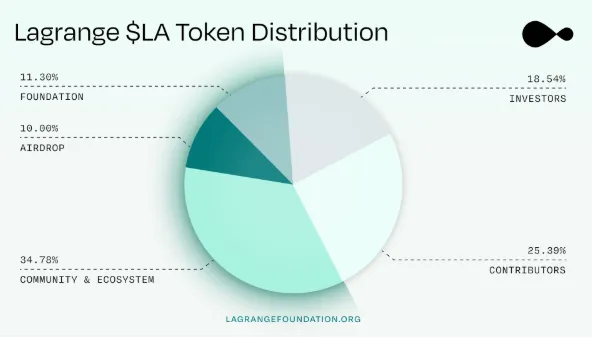

Tokenomics play an important role in long-term sustenance of a crypto project. Lagrange offers a fair model. Among the 1 billion $LA tokens issued:

34.78% is assigned to the Community & Ecosystem to promote adoption and development.

25.39% is rewarded to Contributors for active building activities.

18.54% is allocated for Investors who back the venture in early stages.

11.30% is retained by the Foundation to maintain operational stability.

10.00% goes to Airdrops to ensure well-rounded exposure.

Large allocations emphasize the long-term sustainability of the chain and keeping users engaged in technical development.

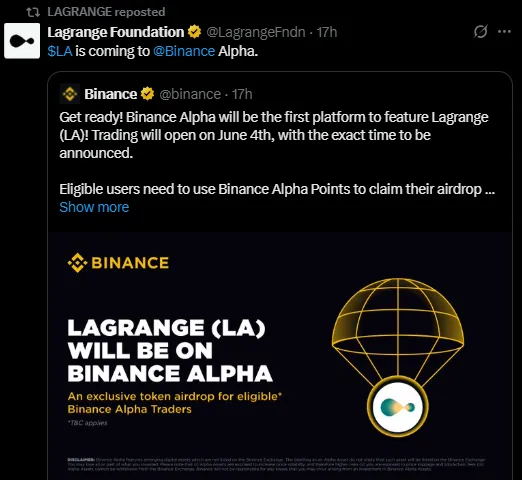

According to the official announcement, Lagrange ($LA) deposits commenced on Binance Alpha on June 3 at 10 AM UTC, with spot trading scheduled to be opened on June 4 at 12 PM UTC. Meanwhile, Bybit also confirmed that it would soon be live on its Spot trading platform.

Users of Binance Alpha who qualify will be able to redeem Alpha Points in an exclusive airdrop with full rules and claim instructions outlined on the official event page. These back-to-back listings on top-tier exchanges are expected to bring immediate liquidity and wide exposure.

Such high-profile exchange listings usually provide immediate price volatility. They do, however, open up opportunities for a wider token distribution and ecosystem development. So, how will $LA’s price react in the short and long term?

Since the price always moves first, action within the first two hours of listing has been more turbulent. Sellers could include their dropping beneficiaries, early investors were also booking profits. In this way, depending on short-term price action, anywhere could be from $0.08 to $0.15 between:

Initial market sentiment

Exchange liquidity

Ecosystem engagement levels

Broader crypto market trends

However, thanks to strategic allocation and strong community incentives, a quick stabilization is expected.

Past the hype generated by the listing, Lagrange's long-term value lies primarily in adoption, building utility, and interoperability under the LayerZero omnichain ecosystem. If the project is able to deliver on its roadmap and bring a number of key partnerships, $LA might well be one of the main utility tokens in the decentralized proving space.

Under ideal conditions, we expect a range of $0.35 to $1.20 over the next 6 to 24 months; this should be propelled by:

An increase in zk-proof application demand across DeFi and compliance

Growth for the Lagrange Prover Network

Cross-chain integrations facilitated by LayerZero and others

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.