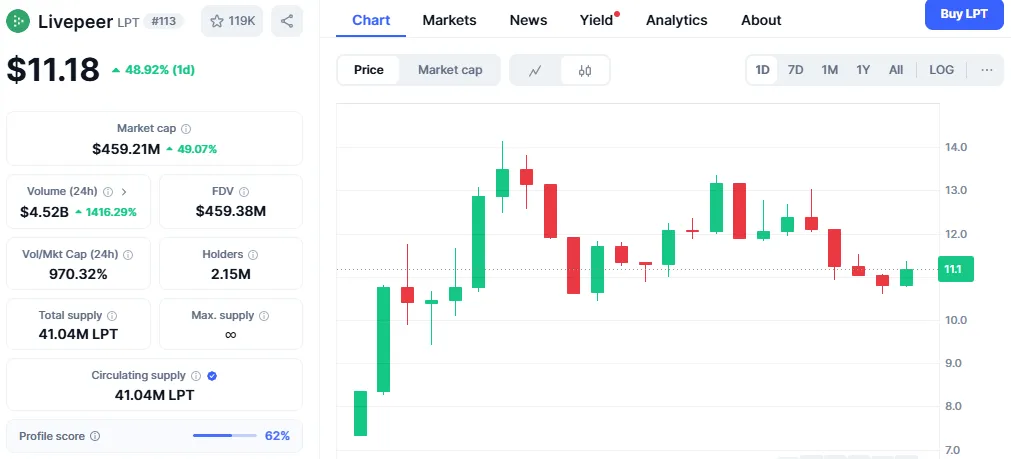

LPT, the native token of Livepeer, decentralized video infrastructure - has recently made an appearance following a parabolic price rise. The price rose to incredible highs of around $14.20, after listing on the major Korean exchange, Upbit, marking an increase of 220% from lows of about $5. The sharp rise in 24-hour volume, which shot past $4.4 billion, further confirms growing investor enthusiasm.

Source: CoinMarketCap

The question presented, however, even with LPT hitting resistances in the upper areas and becoming rather indecisive in form on the daily charts, is this once again a sustainable rally or a setup for a short correction?

Such an exchange listing in South Korea's foremost cryptocurrency market definitely increased the token's exposure and liquidity. LPT then saw a 1400% surge in trading volumes, triggering a popular bullish sentiment.

Being one of those catalysts for price appreciation in crypto markets whereby traders rush to seize early liquidity and visibility of the asset, rapid rallies may eventually dissipate due to profit-taking, especially when technical tools endorse an overbought condition.

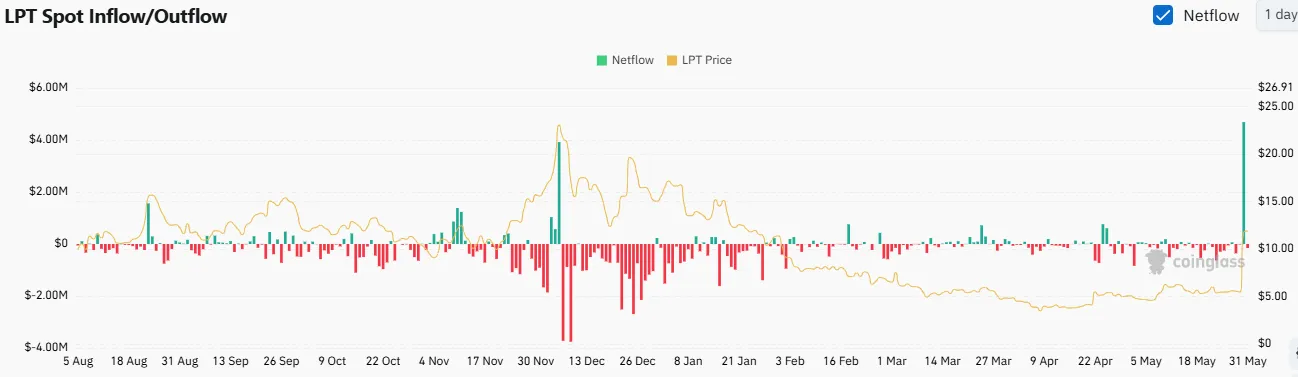

As per Coinglass, While the LPT price has soared, on-chain data paints the cautious picture. Exchange inflows have increased, with more than 4.69 million LPT now on exchanges-the highest since December 2024. It is usually indicative of selling pressure, as investors move tokens to exchanges to book profits.

A Doji candle, forming on a daily time frame, adds to the concerns as it shows market indecision. This candlestick usually warns of potential trend reversals, especially after a strong bullish candle, indicating that the bulls and bears are entering a tug-of-war at current price levels.

Long-term technicals look encouraging with short-term caution. The Weekly MACD changed to bullish after being tremendously bearish, especially, since early 2024. At the same time, the RSI jumped higher than 80, which is usually indicative of strong upward momentum and maybe the beginning of a new bull run.

Source: TradingView

In past instances, Livepeer has made a strong bounce from important support levels, particularly near $3.25. This latest rally seems to confirm the breakout from this long consolidation zone and suggests momentum could be sustained if resistance levels are overcome.

Currently, prices face resistance in the $14.50-$15 range, where strong support had once flipped into a strong resistance in the first quarter of 2024. A mute bull who would combine to take out this level would next prefer the neckline of the V-shaped recovery above $21 also representing a complete recovery from previous losses, thereby signifying a full-scale bull run.

If the LPT cannot break through convincingly, the price might instead head back toward $10, an area of psychological and historical support. The presumption of strong sell-offs in the broader market could see $6.50 come into view for a deeper correction.

While the recent listings breathed new life into LPT, long-term sustainability rests on holding investor interest and injecting capital into moments of exchange. If the bullish sentiment remains in place with high volume, the $15 price point could be broken to start another rally toward the new ATH above $40. But until then, cautious optimism is recommended as the market turns to decide where to go next.

The next few candles will answer questions about whether Livepeer will fly to new heights or if this is the calm before a deeper drop.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.